Anthem (ANTM) Beats on Q1 Earnings, Raises '18 Guidance

Anthem Inc.’s ANTM first-quarter 2018 adjusted net income per share of $5.41 surpassed the Zacks Consensus Estimate by 12%. The bottom line also rose 15.6% year over year.

Operating revenues of $22.3 billion missed the Zacks Consensus Estimate of $22.5 billion. The top line, however, remained flat year over year.

Quarterly Operational Update

Medical enrollment declined 2.5% year over year to 39.6 million members. This downside was primarily caused by a reduced footprint in the Individual ACA (Affordable Care Act)-compliant marketplace.

Anthem’s benefit expense ratio of 81.5% improved 220 basis points (bps) from the prior-year quarter, driven by the return of the health insurance tax in 2018 and an improved medical cost performance across all its business segments.

SG&A expense ratio of 15.3% deteriorated 100 bps from the year-ago quarter due to return of the health insurance tax in 2018 and the impact of an increased investment spend this year to support growth initiatives.

Segment Update

Commercial & Specialty Business

Operating revenues were $9 billion in the first quarter, down 12% year over year.

Operating gain totaled $1.4 billion, up 8.1% year over year owing to Penn Treaty assessments recorded in the first quarter of 2017 and an improved medical cost performance.

Operating margin was 15.5%, down 280 bps year over year.

Government Business

Operating revenues were $13.3 billion in the first quarter, up 10.3% from the prior-year quarter.

Operating gain was $490.9 million, up 54.1% year over year. The upside reflects the impact of the HealthSun and America's 1st Choice acquisitions as well as organic membership growth in the Medicare business plus retroactive revenue adjustments in the Medicaid business.

Operating margin was 3.7%, contracting 110 bps year over year.

Other

Operating revenues were $13.5 million in the first quarter, up 221.4% from the prior-year period.

The segment reported an operating loss of $31.4 million, narrower than the same of $35.6 million in the prior-year quarter.

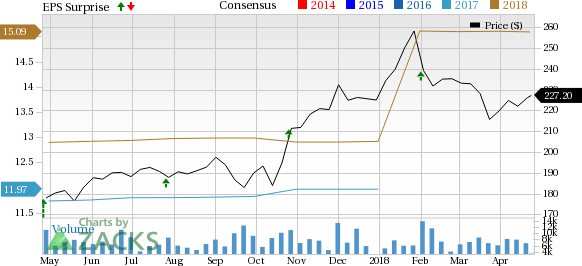

Anthem, Inc. Price, Consensus and EPS Surprise

Anthem, Inc. Price, Consensus and EPS Surprise | Anthem, Inc. Quote

Financial Update

As of Mar 31, 2018, Anthem had cash and cash equivalents of $4.6 billion, up 28% from year-end 2017.

As of Mar 31, 2018, its long-term debt increased 4.2% to $18.1 billion from year-end 2017.

Operating cash outflow was $2.2 billion in the quarter under review, down 18% year over year.

Share Repurchase and Dividend Update

During the reported quarter, Anthem repurchased 1.7 million shares of its common stock for $395 million.

As of Mar 31, 2018, it had approximately $6.8 billion of share repurchase authorization remaining.

During the first quarter, Anthem paid a quarterly dividend of 75 cents per share.

On Apr 24, 2018, the board approved a dividend of 75 cents per share payable Jun 25 to shareholders of record on Jun 8.

Guidance for 2018

Anthem expects adjusted net income to be greater than $15.30 per share, up from the previous projection of more than $15.

Medical membership is now expected in the range of 40.1-40.3 million, up from the previous projection of 40-40.2 million.

Operating revenues are anticipated in the range of $91-$92 billion, more than the earlier forecast of $90.5-$91.5 billion.

Anthem estimates operating cash flow to be more than $4 billion.

Zacks Rank and Performance of Peers

Anthem carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Among other players in the Medical sector having reported first-quarter earnings so far, Novartis AG NVS, UnitedHealth Group Incorporated UNH and Abbott Laboratories ABT surpassed the respective Zacks Consensus Estimate.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Abbott Laboratories (ABT) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance