AngioDynamics (ANGO) Q1 Earnings Miss, '19 Sales View Up

AngioDynamics Inc. ANGO reported first-quarter fiscal 2019 adjusted earnings of 16 cents per share, which missed the Zacks Consensus Estimate by 2 cents. However, earnings improved 23.1% from the prior-year quarter.

Net sales came in at $85.3 million, which edged past the Zacks Consensus Estimate of $83 million. However, revenues declined 0.1% year over year.

Meanwhile, in the past year, shares of AngioDynamics have rallied 26.4% compared with the industry’s 30.1% rise. However, the current level is higher than the S&P 500 index’s 15.9% growth.

The stock currently carries a Zacks Rank #3 (Hold).

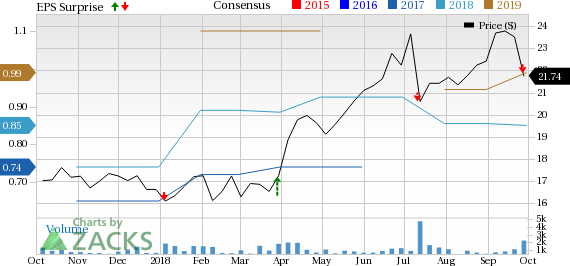

AngioDynamics, Inc. Price, Consensus and EPS Surprise

AngioDynamics, Inc. Price, Consensus and EPS Surprise | AngioDynamics, Inc. Quote

Geographical Analysis

U.S. net revenues in the quarter under review were $67.7 million, down 1.8% at constant currency (cc).

International revenues totaled $17.7 million, up 7.3% at cc. Per management, the company’s NanoKnife saw rising global adoption in the reported quarter.

Segmental Analysis

Vascular Interventions and Therapies (VIT) Business

VIT sales in the quarter grossed $50 million, up marginally from the year-ago quarter’s $49.9 million. Per management, growth in Fluid Management, Angiographic Catheters and AngioVac was offset by declines in the Venous Insufficiency business.

However, AngioVac procedural volume growth remained strong, with procedures increasing 16% year over year.

Vascular Access (VA) Business

Revenues in this segment came in at $23.8 million, which shot up 2.4% on a year-over-year basis. Per management, growth in Ports, Dialysis and Midline products was partially offset by a decline in PICC sales.

Oncology/Surgery Business

Oncology sales fell 6.1% year over year to $11.6 million as NanoKnife disposable growth was more than offset by decreases in sales of Radiofrequency Ablation and Microwave products. Per management, the segment was impacted by the timing of the prior-year Acculis Microwave Ablation system market withdrawal.

Excluding the impact of transition from the company’s Acculis Microwave product to its Solero Microwave product, its Oncology business grew 7.5% year over year.

Margin Analysis

In the quarter under review, gross profit totaled $44.5 million, up 7.9% from the year-ago quarter. Gross margin was 52.1%, up 380 basis points (bps).

Adjusted Operating income totaled $8.9 million, up 15.4% year over year. Adjusted operating margin was 10.4%, up 170 bps year over year.

Guidance

AngioDynamics raised its fiscal 2019 sales guidance and retained its earnings per share view.

The company expects sales within $354-$359 million. The Zacks Consensus Estimate stands at $345 million, below the given range.

Adjusted earnings per share are expected in the range of 82-86 cents. The Zacks Consensus Estimate is pegged at 85 cents, within the guided range.

Wrapping Up

AngioDynamics exited the first quarter of fiscal 2019 on a dull note. However, the company continues to gain from its AngioVac procedures. An uptick in the company’s international business is encouraging. Increased global adoption of NanoKnife in the quarter buoys optimism. Significant expansion in gross margin is another major positive. Management’s focus on raising funds for R&D is also indicative of brighter prospects. Moreover, management is optimistic about the recently announced acquisitions of BioSentry Tract Sealant System and RadiaDyne. Despite a dull topline performance this quarter, a raised sales guidance for fiscal 2019 is encouraging as well.

However, the company’s Oncology business saw a soft quarter. Declines in the Venous Insufficiency business, Microwave Ablation products and PICCs raise concern. In fact, management expects the Venous business to remain soft in the second quarter.

Key Picks

A few better-ranked medical stocks in the broader medical space are athenahealth ATHN, Masimo Corporation MASI and Veeva Systems VEEV.

athenahealth has a long-term expected earnings growth rate of 17.6% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Masimo’s long-term earnings growth rate is projected at 14.8%. The stock carries a Zacks Rank #2 (Buy).

Veeva Systems’ long-term earnings growth rate is estimated at 19.3%. The stock carries a Zacks Rank #1.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

athenahealth, Inc. (ATHN) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance