This analyst just went on a 'rant' about how Lloyds' dividend payment is just 'smoke and mirrors' (LLOY)

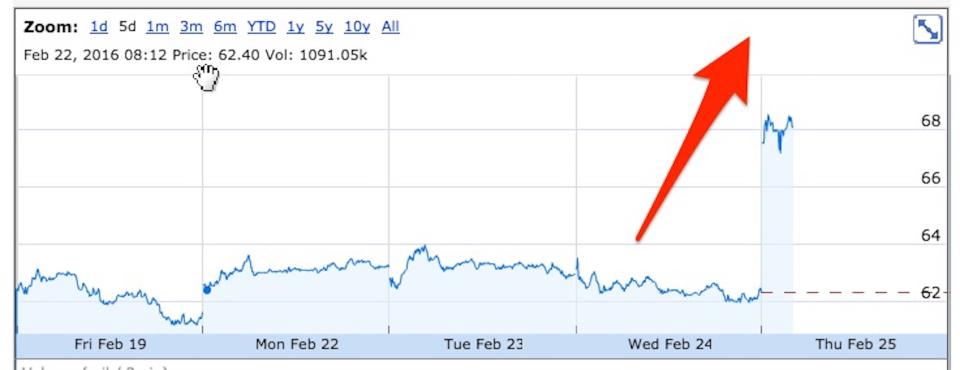

Lloyds shares are rocketing in early trading after the British bank said it would still pay a decent dividend to shareholders despite profits dropping.

The stock price is up nearly 10% and investors can't seem to get enough of the bank stock.

Google Finance

Statutory profit before tax actually dropped to £1.6 billion, from £1.8 billion in 2014 — thanks to a massive £2.1 billion worth of compensation and admin charges related to the misselling of payment protection insurance.

PPI was a form of insurance intended to pay out if consumers failed to make payments on their loans. Many consumers were duped into buying it, or did not know how it worked. PPI was wrongly sold alongside loans, credit cards, and mortgages and banks have been forced to pay out to customers who were wrongly sold the coverage.

However, despite many investors flocking to the stock, which suggests they think the worst is behind Lloyds, Mike van Dulken, Head of Research at Accendo Markets, went on a "rant" this morning about how the Lloyds stock isn't as attractive as people may think (emphasis ours):

Bailed out Lloyds has rewarded and pleased the faithful with its plans for a 0.5p special dividend (politically motivated?) which takes the full year payment to 2.75p and its yield to a respectable 4%. That’s the good news.

Now back to reality, without the smoke ‘n’ mirrors.

Revenues rose by just 1% and net profits fell by a considerable 58%. As usual there is lots of talk about underlying growth, which makes the numbers a quagmire to navigate.

And while we accept removal of TSB to allow analysis of continuing operations following the unit’s sale to the Spaniards, PPI (and litigation in general) has become, in our view, too regular a feature to strip out. Another £2.1bn last quarter is almost equivalent to that booked for the whole of 2014 and almost doubles the full-year charge since October’s nine-month results.

After all, we know that said provisions are here to stay for another two years. Which is well beyond many investors current crisis-induced short-term horizon. And within that time frame, the bank has warned on the impact of a low-interest rate environment (no comment on negative rates) as well as taxes on bank profits.

Furthermore, despite the shares rallying by around 10% they have already encountered a hurdle in falling highs from last July. And after bouncing 21% from recent 2.5yr lows, this may prevent any progress towards the 73.6p level which needs to be regained before there can be any hope of the chancellor’splanned full privatisation of the government’s remaining 9% bailout stake.

Rant over.

NOW WATCH: The Justice Department wants to investigate 50 Cent because he keeps flaunting cash on Instagram

See Also:

SEE ALSO: Lloyds bankers now only get a maximum of £4,600 in bonuses

Yahoo Finance

Yahoo Finance