Amplify Energy (NYSE:AMPY) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Amplify Energy Corp. (NYSE:AMPY) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Amplify Energy

What Is Amplify Energy's Net Debt?

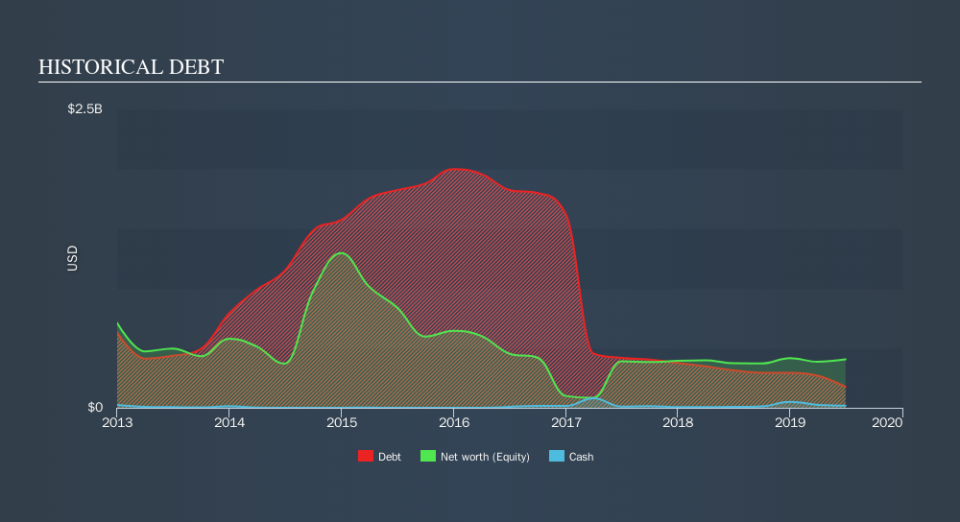

As you can see below, Amplify Energy had US$175.0m of debt at June 2019, down from US$314.0m a year prior. However, it does have US$18.7m in cash offsetting this, leading to net debt of about US$156.3m.

How Strong Is Amplify Energy's Balance Sheet?

We can see from the most recent balance sheet that Amplify Energy had liabilities of US$60.8m falling due within a year, and liabilities of US$256.8m due beyond that. On the other hand, it had cash of US$18.7m and US$22.8m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$276.1m.

When you consider that this deficiency exceeds the company's US$267.1m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Looking at its net debt to EBITDA of 1.1 and interest cover of 4.9 times, it seems to us that Amplify Energy is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. We also note that Amplify Energy improved its EBIT from a last year's loss to a positive US$91m. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Amplify Energy will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. In the last year, Amplify Energy's free cash flow amounted to 45% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Amplify Energy's level of total liabilities was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. For example, its net debt to EBITDA is relatively strong. When we consider all the factors discussed, it seems to us that Amplify Energy is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. Over time, share prices tend to follow earnings per share, so if you're interested in Amplify Energy, you may well want to click here to check an interactive graph of its earnings per share history.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance