Amphenol (APH) to Report Q3 Earnings: What's in the Cards?

Amphenol APH is set to report third-quarter 2019 results on Oct 23.

The company projects adjusted earnings between 86 cents and 88 cents per share. The Zacks Consensus Estimate for earnings stayed at 87 cents over the past 30 days.

Notably, the company’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average positive surprise being 3.1%.

Moreover, third-quarter sales are expected between $1.960 billion and $2 billion. During the second-quarter earnings call, management slashed 2019 guidance on global economic uncertainties and geopolitical tensions related to the U.S.-China trade war.

Amphenol expects demand for its solutions to be moderate across communications equipment, automotive and industrial end markets in second-half 2019. Management stated that uncertainty across the communications equipment market over China demand, following U.S. restrictions on sales to Huawei, is a major headwind.

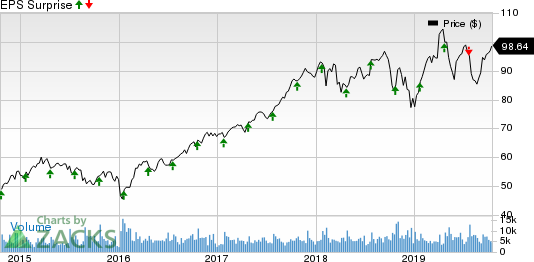

Amphenol Corporation Price and EPS Surprise

Amphenol Corporation price-eps-surprise | Amphenol Corporation Quote

The consensus mark for third-quarter revenues currently stands at $1.99 billion, indicating a decline of 6.7% from the figure reported in the year-ago quarter.

Factors to Consider

Amphenol’s diversified end market, which lowers exposure to volatility in any industry, is likely to have benefited the company’s performance in the third quarter. Moreover, a strong defense spending environment, which is positively impacting the military end market, is likely to have contributed to the top line.

In fact, Amphenol’s buyouts of CONEC, Kopek, Bernd Richter, GJM Group, CTI, Ardent, All Sensors, SSI Controls, Aorora and Charles Industries have not only strengthened its portfolio but also expanded the consumer base. This is likely to have aided the upcoming quarterly results.

Notably, Amphenol projects third-quarter sales from the industrial end market to be better than the second-quarter results (sales were down 3%, and 8% excluding the contribution from acquisitions) on contributions from CONEC and Bernd Richter acquisitions.

We also believe that the company’s leading position in the interconnect and sensors markets is likely to have positively impacted industrial end-market sales.

However, the uncertain macroeconomic environment due to the U.S.-China trade war, the sluggish automotive market in Europe and Asia and continued weakness in mobile devices end market is likely to get reflected in the company’s top-line performance in the to-be-reported quarter.

What Our Model Says

According to the Zacks model, a company with a positive Earnings ESP and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates.

Amphenol has an Earnings ESP of 0.00% and a Zacks Rank #3, which makes surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few other companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat in their upcoming releases:

Commvault Systems CVLT has an Earnings ESP of +2.66% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Facebook FB has an Earnings ESP of +5.01% and a Zacks Rank #3.

Avnet AVT has an Earnings ESP of +2.68% and a Zacks Rank #3.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Facebook, Inc. (FB) : Free Stock Analysis Report

CommVault Systems, Inc. (CVLT) : Free Stock Analysis Report

Amphenol Corporation (APH) : Free Stock Analysis Report

Avnet, Inc. (AVT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance