AMERISAFE (AMSF) Stock Down Slightly Despite Q2 Earnings Beat

Shares of AMERISAFE, Inc.'s AMSF have dipped 0.3% since second-quarter 2022 results were reported on Jul 28. The quarterly results suffered due to lower net investment income, an elevated expense level and softer underwriting results. Nevertheless, the downside was partly offset by higher net premiums earned and a significant increase in fee and other income.

Q2 Update

AMERISAFE reported second-quarter 2022 earnings per share (EPS) of 68 cents, which beat the Zacks Consensus Estimate by 15.3%. The figure was higher than our estimate of 62 cents per share. However, the bottom line plunged 34.6% year over year.

Operating revenues of AMERISAFE amounted to $77 million, flat year over year in the quarter under review. The top line outpaced the consensus mark by 8.5% and came above our estimate of $72.1 million.

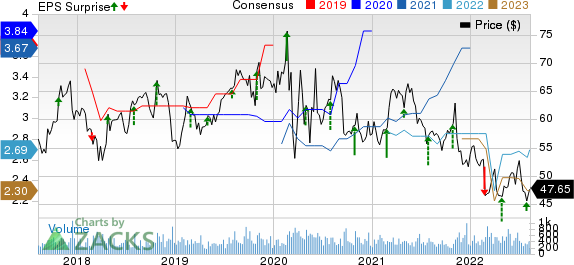

AMERISAFE, Inc. Price, Consensus and EPS Surprise

AMERISAFE, Inc. price-consensus-eps-surprise-chart | AMERISAFE, Inc. Quote

Net premiums earned of $70.3 million inched up 0.6% year over year in the second quarter. The figure was higher than the Zacks Consensus Estimate of $64 million and our estimate of $62.8 million.

Net investment income slid 3.6% year over year to $6.5 million due to reduced investment yields on fixed-income securities and moderately lower average invested assets. The figure was higher than the Zacks Consensus Estimate of $6.4 million but lower than our estimate of $6.7 million.

Fee and other income of $0.1 million soared 82.4% year over year in the quarter under review.

AMERISAFE reported a pre-tax underwriting profit of $9.4 million in the second quarter, which dropped 47.7% year over year.

Total expenses of $60.9 million escalated 17.2% year over year, mainly due to an increase in loss and loss adjustment expenses incurred, and underwriting and other operating costs. The figure was higher than our estimate of $54.7 million.

Net combined ratio deteriorated 1,230 basis points (bps) year over year to 86.7% during the quarter under review. The figure was lower than the Zacks Consensus Estimate of 88% and our estimate of 87.2%.

Financial Update (as of Jun 30, 2022)

AMERISAFE exited the second quarter with cash and cash equivalents of $85.3 million, which climbed 20.6% from the 2021-end level.

Total assets of $1.4 billion slipped 1.5% from the figure at 2021 end.

Shareholders' equity declined 3.6% from the 2021-end level to $385 million.

During the six months ended Jun 30, 2022, net cash provided by operating activities decreased 3.9% from the prior-year comparable period’s level to $25 million.

Book value per share came in at $19.95, down 17.5% year over year.

Return on average equity deteriorated 1,450 bps year over year to 6.3% in the second quarter.

Share Repurchases and Dividend Update

AMERISAFE bought back shares worth $3.6 million in the second quarter. As of Jun 30, 2022, an amount of $19.3 million was left under the authorized share buyback program.

On Jul 26, 2022, its board of directors approved a quarterly cash dividend of 31 cents per share. The dividend will be paid out on Sep 23, 2022, to its shareholders of record as of Sep 9.

Net Investment Income Outlook

As returns on AMERISAFE’s investment portfolio continues to show an uptick, net investment income is anticipated to rise in the third and the fourth quarter of 2022.

Zacks Rank

AMERISAFE currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Some Other Insurers

Of the insurance industry players that have reported second-quarter results so far, the bottom-line results of RLI Corp. RLI, Chubb Limited CB and AXIS Capital Holdings Limited AXS beat the respective Zacks Consensus Estimate.

RLI’s operating earnings of $1.49 per share beat the Zacks Consensus Estimate by 6.1% and improved 36.7% from the prior-year quarter's figure. Operating revenues of RLI were $301.3 million, up 16.9% year over year. The top line outpaced the Zacks Consensus Estimate of $276 million by 0.9%. RLI’s underwriting income of $56 million increased 53%, primarily due to the strong performance of the Property and Surety segments.

Chubb reported second-quarter 2022 core operating income of $2.40 per share, which outpaced the Zacks Consensus Estimate by about 17%. The bottom line improved 16% from the year-ago quarter's level. Net premiums written of CB improved 7.9% year over year to $10.3 billion in the quarter. CB’s adjusted net investment income was a record $950 million, up 0.5%.

AXIS Capital posted second-quarter 2022 operating income of $1.74 per share, beating the Zacks Consensus Estimate by about 13%. However, the bottom line decreased 13% year over year. AXS’ total operating revenues of $1.4 billion beat the Zacks Consensus Estimate by 5.5%. The top line rose 7.8% year over year on higher net premiums earned. The combined ratio of AXS deteriorated 280 bps to 93.4.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

AMERISAFE, Inc. (AMSF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance