American International (AIG) Q2 Earnings Miss on Lower NII

American International Group, Inc. AIG reported second-quarter 2022 adjusted operating earnings of $1.19 per share, which missed the Zacks Consensus Estimate by 3.3%. The figure was lower than our estimate of $1.25 per share.

The bottom line of AIG slumped 21.7% year over year in the second quarter due to reduced alternative investment income.

Total revenues of $14.4 billion surged 35.2% year over year and came higher than our estimate of $10.4 billion. The growth can be attributed to higher net realized gains on the Fortitude Refunds withheld embedded derivative and solid underwriting results within the General Insurance segment.

Quarterly Operational Update

Total net investment income (NII) tumbled 29.1% year over year to $2,604 million due to a decline in alternative investment returns and reduced yield enhancements. Nevertheless, the downside was partly offset by increased new money rates stemming from higher interest rates and wider credit spreads. The figure was lower than our estimate of $3,475.7 million.

AIG’s total benefits, losses and expenses of $10.1 billion decreased 3.9% year over year, thanks to lower policyholder benefits and losses incurred and interest expenses. The figure was higher than our estimate of $9,722.8 million.

Adjusted return on common equity came deteriorated 350 basis points (bps) year over year to 7% in the second quarter.

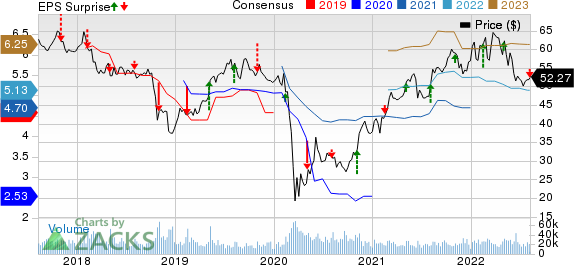

American International Group, Inc. Price, Consensus and EPS Surprise

American International Group, Inc. price-consensus-eps-surprise-chart | American International Group, Inc. Quote

Segmental Performances

General Insurance

The segment reported net premiums written of $6,866 million, which inched up marginally year over year and grew 5% on a constant dollar basis. The improvement came on the back of continuous rate hikes, strong renewal retentions and solid new business production within Property. However, the upside was partly offset by a decline in production in Warranty within Global Personal Insurance. The metric (net premiums written) was lower than our estimate of $7,500 million.

Underwriting income of $799 million soared 73% year over year in the second quarter. The same comprised catastrophe losses (CATs) of $119 million, which compared favorably with CATs of $118 million in the prior-year quarter.

The segment’s combined ratio improved 510 bps year over year to 87.4% in the quarter under review, marking the first time that the metric has been below 90% in the past 15 years. It came lower than the Zacks Consensus Estimate of 92% and our estimate of 92.4%.

Life and Retirement

Premiums of the segment dropped 32% year over year to $1,119 million in the second quarter. The figure was lower than the Zacks Consensus Estimate of $1,680 million and our estimate of $1,596.3 million.

Meanwhile, premiums and deposits of $7,099 million tumbled 21% year over year. Adjusted revenues of the segment amounted to $4,055 million, down nearly 20% year over year due to lower premiums and net investment income. The figure was lower than the Zacks Consensus Estimate of $4,918 million and our estimate of $4,965.7 million.

The segment’s adjusted pre-tax income of $563 million fell nearly 50% year over year in the second quarter, primarily due to lower net investment income as well as accelerated deferred policy acquisition cost (DAC) amortization stemming from declining equity markets, improving interest rates and widening credit spreads. Reduced fee income in Individual Retirement and Group Retirement hampered the segment’s results. The metric (adjusted pre-tax income) was lower than the Zacks Consensus Estimate of $832 million and our estimate of $881 million.

In March 2022, American International filed for an initial public offering (IPO) for the Life and Retirement business in a bid to make it a standalone company. AIG intends to rebrand the holding company of its life and retirement arm, SAFG Retirement Services, Inc., as Corebridge Financial, Inc., upon it becoming a public company. However, as the equity market remained volatile in the last two months of the second quarter of 2022, management decided to put off the launch of the Corebridge Financial IPO.

Financial Position (as of Jun 30, 2022)

American International exited the second quarter with a cash balance of $2,378 million, which declined 13.8% year over year. Total assets of $538.9 billion decreased nearly 10% year over year.

Long-term debt of $22.2 billion dropped 15.2% year over year.

Total equity slumped 30% year over year to $46.8 billion. Debt to capital deteriorated 390 bps year over year to 30.4% at the second-quarter end.

Adjusted book value per share came in at $72.23, up 20.2% year over year.

Share Repurchase & Dividend Update

American International rewarded $2 billion to shareholders, which included $1.7 billion through share buybacks and dividends worth $256 million.

Concurrent with announcing the second-quarter results, the board of directors approved a quarterly cash dividend of 32 cents per common share. The dividend will be paid on Sep 30, 2022, to shareholders of record as of Sep 16.

Zacks Rank

American International carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Insurers

Of the insurance industry players that have reported second-quarter results so far, The Travelers Companies, Inc. TRV, AXIS Capital Holdings Limited AXS and RLI Corporation RLI beat the respective Zacks Consensus Estimate for earnings.

Travelers’ core income of $2.57 per share beat the Zacks Consensus Estimate by 28.5% but decreased 26% year over year. Total revenues of Travelers increased 7% year over year, primarily due to higher premiums and beat the consensus mark by 1.8%. Net written premiums of TRV increased 11% year over year in the second quarter.

AXIS Capital Holdings posted second-quarter 2022 operating income of $1.74 per share, beating the Zacks Consensus Estimate by about 13%. However, the bottom line decreased 13% year over year. AXIS Capital’s total operating revenues of $1.4 billion surpassed the Zacks Consensus Estimate by 5.5%. The top line rose 7.8% year over year on higher net premiums earned. The combined ratio of AXS deteriorated 280 bps to 93.4.

RLI’s operating earnings of $1.49 per share beat the Zacks Consensus Estimate by 6.1% and improved 36.7% from the prior-year quarter. Operating revenues of RLI were $301.3 million, up 16.9% year over year. The top line outpaced the Zacks Consensus Estimate of $276 million by 0.9%. RLI’s underwriting income of $56 million increased 53%, primarily due to the strong performance of the Property and Surety segments.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

American International Group, Inc. (AIG) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance