AMC Networks (NASDAQ:AMCX) Misses Q1 Revenue Estimates

Television broadcasting and production company AMC Networks (NASDAQ:AMCX) missed analysts' expectations in Q1 CY2024, with revenue down 16.9% year on year to $596.5 million. It made a non-GAAP profit of $1.16 per share, down from its profit of $2.36 per share in the same quarter last year.

Is now the time to buy AMC Networks? Find out in our full research report.

AMC Networks (AMCX) Q1 CY2024 Highlights:

Revenue: $596.5 million vs analyst estimates of $601.1 million (small miss)

Operating income (GAAP): $110.2 million vs analyst estimates of $130.2 million (15.4% miss)

EPS (non-GAAP): $1.16 vs analyst expectations of $1.65 (29.8% miss)

Gross Margin (GAAP): 54.5%, in line with the same quarter last year

Free Cash Flow of $144.1 million, up 119% from the previous quarter

Company "recently strengthened our balance sheet by completing a series of financing transactions that meaningfully extended our debt maturities"

Market Capitalization: $604.7 million

Chief Executive Officer Kristin Dolan said: "In the first quarter, we continued to execute on our strategic priorities, including the ongoing delivery of healthy free cash flow. As new technologies transform the way media is consumed, we continue to produce great content and make it available to viewers whenever and wherever they want to watch. We recently strengthened our balance sheet by completing a series of financing transactions that meaningfully extended our debt maturities. This creates substantial flexibility for us as we continue to leverage our core strengths and reorient our business around the consumer-driven changes that are happening across the industry."

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Sales Growth

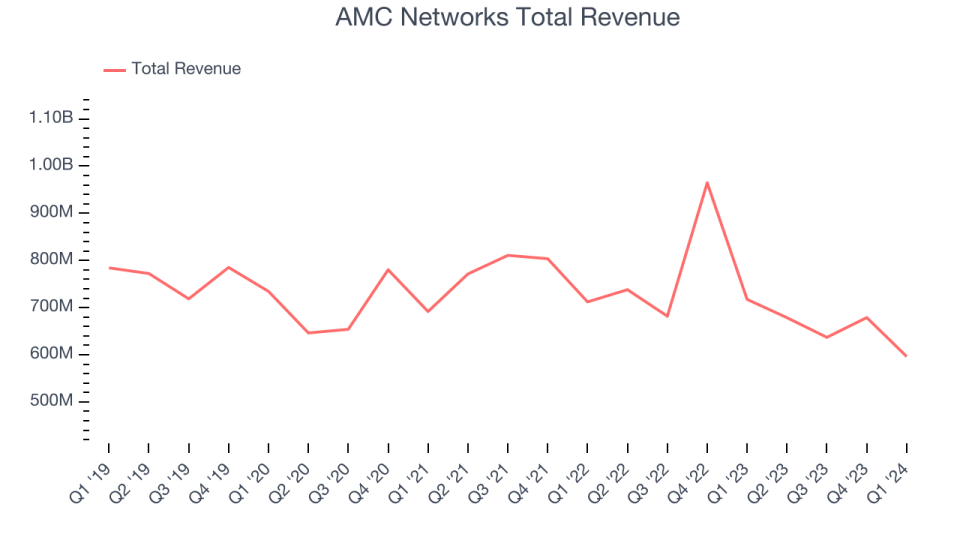

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. AMC Networks's revenue declined over the last five years, dropping 3% annually.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. AMC Networks's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 8.6% over the last two years.

This quarter, AMC Networks missed Wall Street's estimates and reported a rather uninspiring 16.9% year-on-year revenue decline, generating $596.5 million of revenue.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

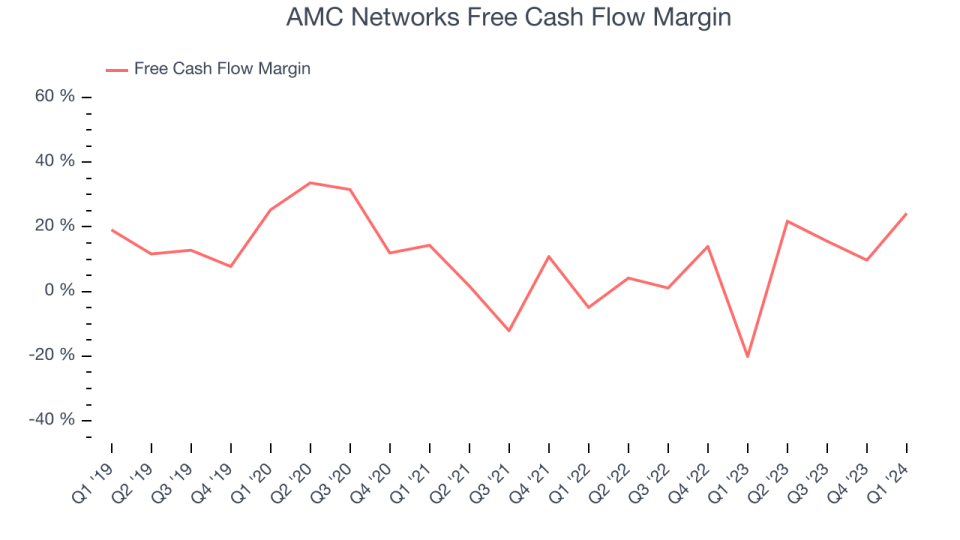

Over the last two years, AMC Networks has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.5%, subpar for a consumer discretionary business.

AMC Networks's free cash flow came in at $144.1 million in Q1, equivalent to a 24.2% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to cash flow positive this quarter.

Key Takeaways from AMC Networks's Q1 Results

The company's operating margin missed and its EPS fell short of Wall Street's estimates. On the other hand, free cash flow beat handily. AMC Networks also strengthened their balance sheet by completing a series of financing transactions to extend debt maturities. Overall, this was a mixed quarter for AMC Networks. The stock is up 1.9% after reporting and currently trades at $14 per share.

So should you invest in AMC Networks right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance