Amazon, the Suicide Bomber of Retail (Part Two): Price Cuts, Price Cuts

Amazon (AMZN) has amazing service and a wonderful interface on its web site, but its sales growth wouldn’t be so snappy if it wasn’t slashing prices constantly to grab market share from competing retailers. The result, of course, is rising sales and plunging profits. Oh, and a rising stock price as investors seem only to care for sales growth, as seen in a stock chart.

[More from YCharts.com:Plain Dividend Yield is For Chumps -- We Screen the Aristocrats for Dividend Growth: 10 Income Winners]

[More from YCharts.com:The Earnings-Season Metric to Watch For Clues to 2013 Stock Prices]

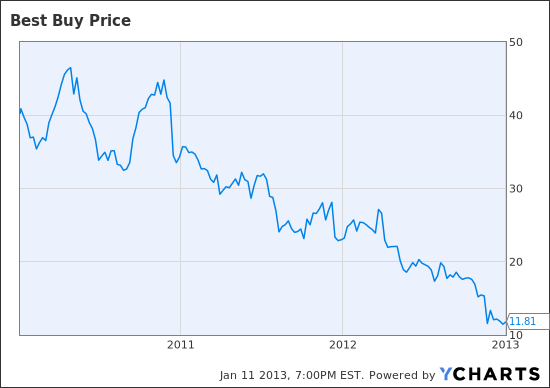

The smart people at William Blair in Chicago, namely analyst Mark Miller, have been calculating the product overlap that Amazon has with various retailers, as YCharts reported in a piece featuring Zumiez (ZUMZ) and Tilly’s (TLYS), and the price difference between Amazon’s offerings and those of other retailers. Not surprisingly, Best Buy (BBY) has a 72% overlap in products with Amazon, Blair estimates, and from 2011 to 2012, Amazon widened its price differential with the big box retailer. Amazon was 11.7% cheaper in 2011, Blair found, and a whopping 16.6% cheaper in 2012 when the firm re-surveyed the retailers. Bad news for Best Buy.

Overall, Blair found, Amazon has been increasing its discounting relative to prices at competing retailers: 17.2% cheaper than Walgreens (WAG); 11.5% cheaper than Williams Sonoma (WSM); 17.7% cheaper than Vitamin Shoppe (VSI); 13.6% cheaper than Target (TGT). The price competition can be devastating to some companies, like Best Buy, and less so to others. The Blair analysts' main interest in the data seems to be to gauge other retailers' vulnerability to Amazon. And that's darned smart. But the data also shows Amazon's seeming desperation to generate sales growth -- it's vulnerable to its own strategy.

The ridiculous and obvious end game is to run every other retailer out of business, but that seems, well, ridiculous. As YCharts asked recently, how does Amazon turn these sales into profits? Until it raises prices, it will continue crushing competitors’ – and its own – bottom line, hence the Suicide Bomber comparison.

Jeff Bailey, The Editor of YCharts, is a former reporter, editor and columnist at the Wall Street Journal and New York Times. He can be reached at editor@ycharts.com.

YCharts is a financial terminal for the web, with advanced stock charts, an innovative stock screener and the largest database of economic data on the web.

Yahoo Finance

Yahoo Finance