Amazon earnings, GDP report — What you need to know for the week ahead

The stock market is looking for direction.

This past week, markets had big swings up and down before closing the week mostly unchanged, with the tech-heavy Nasdaq dropping fractionally while the S&P 500 closed right at its 200-day moving average, a level that has been of particular focus for markets over the last several trading sessions.

“The volatility in equity markets continued this week as a long list of domestic and global concerns overshadowed upbeat US economic data and a positive start to Q3 earnings season,” said Gregory Daco, head of U.S. economics at Oxford Economics.

In the week ahead, third quarter earnings season will start to reach a fever pitch with 160 members of the S&P 500 and 10 members of the Dow set to report earnings.

Notable companies reporting earnings include McDonald’s (MCD), 3M (MMM), Caterpillar (CAT), Verizon (VZ), Lockheed Martin (LMT), and Harley-Davidson (HOG) on Tuesday; Microsoft (MSFT), Boeing (BA), UPS (UPS), AT&T (T), Visa (V), Ford (F), AMD (AMD), and Whirlpool (WHR) on Wednesday; Alphabet (GOOGL), Amazon (AMZN), Gilead (GILD), Chipotle (CMG), Merck (MRK), Twitter (TWTR), Altria (MO), Discover Financial (DFS), and Comcast (CMCSA) on Thursday; and Moody’s (MCO), Philips 66 (PSX), Colgate-Palmolive (CL), and Weyerhaeuser (WY) on Friday.

Earnings from Boeing and Caterpillar will be closely watched as both companies have been seen as proxies for the U.S.-China trade conflict. This past week, Caterpillar shares dropped more than 7% and year-to0date the stock has dropped more than 15%.

Amazon, Alphabet, and Microsoft will also be crucial reports from the tech sector, with the Nasdaq this week lagging the Dow and the S&P 500 as Netflix (NFLX) stock failed to hold on to its post-earnings gains and shares fell 4% to close the week.

On the economics side, the highlight will come Friday when investors get their first look at economic growth in the third quarter of this year.

Expectations are the economy grew at an annualized pace of 3.4%, down from the 4.2% pace of growth seen in the second quarter but still capturing an acceleration in the economy’s expansion after tax cuts were passed by the Trump administration in late 2017.

“Data next week are likely to show GDP growth slowing to 3.3% annualized in the third quarter,” Capital Economics said in a note to clients this week. “That would still be well above the economy’s potential growth rate but, looking under the hood, there are reasons to suspect that a sharper slowdown lies ahead.”

No matter what way you cut it up, the week ahead is likely to be very busy. Buckle up.

Economics calendar

Monday: Chicago Fed national activity index, September (0.25 expected; 0.18 previously)

Tuesday: Richmond Fed manufacturing index, October (24 expected; 29 previously)

Wednesday: FHFA house price index, August (+0.3% expected; +0.2% previously); Markit Economics flash manufacturing PMI, October (55.4 expected; 55.6 previously); Markit Economics flash services PMI, October (54 expected; 53.5 previously); New home sales, September (-0.6% expected; +3.5% previously)

Thursday: Initial jobless claims (213,000 expected; 210,000 previously); Durable goods orders, September (-1.4% expected; +4.4% previously); Pending home sales, September (-2.5% previously)

Friday: Third quarter GDP, first estimate (+3.4% annualized pace of growth expected; +4.2% previously); University of Michigan consumer sentiment, October (99 expected; 99 previously)

The housing market is sending troubling signals about the economy

The stock market is saying all is not well in the U.S. economy.

A quick look at the XHB ETF (XHB) which tracks homebuilder stocks and the chart is not good. On 20 of the last 23 trading sessions through Friday, the XHB has declined. Since the beginning of the year the fund is down 24%. Just last week, homebuilder stocks fell 3.5%.

So, what are the homebuilders trying to tell us about the economy?

In a note to clients this week, economists at Bank of America Merrill Lynch led by Michelle Meyer said that, “while housing is no longer a tailwind, its headwinds are blowing very slowly.”

“We are making a number of changes to our housing forecasts which reflect a weaker trajectory of sales, starts and home prices,” the firm said in its note. “The revisions largely reflect the decline in affordability — which is likely to continue to deteriorate with further increases in rates — and a shift toward more negative perceptions regarding housing.”

A major economic story for some time has been the lack of affordable housing in the economy.

In July, Yahoo Finance’s Amanda Fung noted that the housing market had been losing significant momentum with the pace of existing home sales really starting to level off. On Friday, the September data on existing home sales indicated the pace of sales fell 3.4% from August to the lowest level since November 2015.

“A decade’s high mortgage rates are preventing consumers from making quick decisions on home purchases,” said Lawrence Yun, chief economist at the National Association of Realtors. “All the while, affordable home listings remain low, continuing to spur underperforming sales activity across the country.”

And while the cost of housing is a story that continues to make itself felt, the biggest economic shift this year has been higher interest rates. The Federal Reserve has raised interest rates three times this year. Investors expect the central bank to raise rates once more in December and up to four times in 2019, even as the Fed forecasts a slowdown in economic growth as the benefits from the Trump tax cuts fades. Higher rates are not going away.

A major impact of higher rates has been an increase in the 30-year fixed mortgage rate, the mechanism by which many Americans actually experience a change in interest rates. Earlier this month, the 30-year fixed hit 4.9%, the highest since 2011.

So with rates rising, inventory low, and prices high, it is should come as little surprise that most folks see the housing market as one that favors sellers right now.

BAML economists led by the Joe Song wrote in a separate report this week that, “consumers believe the housing market has favored the seller this year.

“When we ask consumers if it is a good time or bad time to sell a house, the majority of respondents have consistently reported it is a good time to sell. Unsurprisingly, that hasn’t been great for prospective home buyers.”

Perhaps even more discouraging for those looking for a pick-up in home sales — and the spending on things like furniture and home improvements — the gap between current sales prices and what folks think they can afford is very wide.

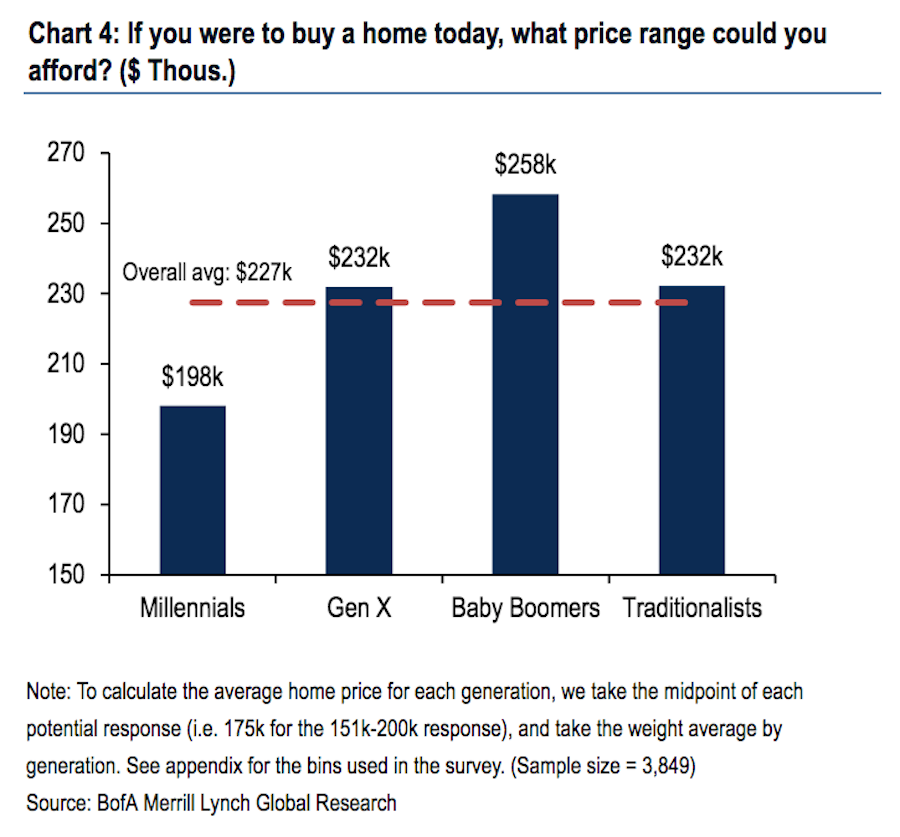

According to BAML, respondents to the firm’s survey of more than 3,800 consumers, respondents think they can afford to a home of $227,000 well below the median sale price of an existing home of $297,000. Millennials are, perhaps not surprisingly, the furthest away on the affordability scale, indicating the ability to afford a $198,000 home against this $297,000 median price.

“With home prices continuing to track higher, albeit more gradually, finding affordable housing will be a greater challenge for millennials and for all prospective homebuyers,” BAML said.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance