Amazon dominates teens’ online shopping habits

To teenage shoppers, there is nothing quite like Amazon (AMZN).

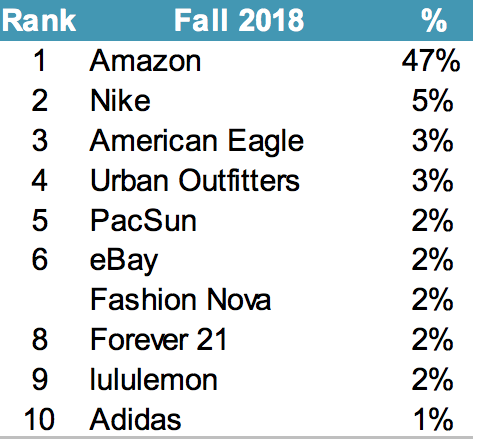

Nearly half of 8,500 teens (47%) surveyed by Piper Jaffray named Amazon their favorite shopping website. The share is up three percentage points from 44% this spring and leads other competitors by a wide margin. The second “most preferred shopping website” is Nike.com at 5%.

More teenagers are using Prime membership, too, according to the survey. Prime adoption is at 74%, up from 66% last year. This is in line with the rise of Prime membership penetration across American households. Piper Jaffray estimates that a little over 80 million households are Prime users, up from a high of 70 million in the spring. Another research firm, Consumer Intelligence Research Partners, has estimated that Amazon Prime reached 97 million U.S. members in September.

Piper Jaffray’s report also broke down the popularity of Amazon based on household income. It found that the Seattle retail giant is the favorite among teens from upper-income families (with an average income of $101,900), it also saw strong growth in the $41,000-$68,000 household income bracket. Piper Jaffray says this may be a sign that Amazon’s efforts to convert lower-income consumers is working.

How Amazon is drawing the next generation

Amazon has good incentives to lure the young Gen Z group, who are native digital shoppers and will make up the majority of the consumer market by 2030. Savvy about its users’ life cycles, Amazon offers Prime programs dedicated to teens, college students and new parents.

Amazon has made significant efforts to attract future consumers. The Prime Student program, launched in 2010, offers free shipping and access to streaming video at a discounted rate.

To facilitate shopping on its site, Amazon Prime allows teens to set up their own logins independent of their parents’ accounts and parents can choose to review their items before allowing the purchase. Teens can send purchase requests to parents, including messages like “Everyone in my school has this.”

It has also partnered with popular brands among teens. Nike, for example, became a partner seller on Amazon last summer. Snapchat users can shop on Amazon easily, too. As of last month, some Snapchat users are able to point its camera at an item or barcode and buy it from Amazon. Snapchat is the second-most used social media among teens after Instagram, according to the Piper Jaffray survey.

Amazon is scheduled to report its third-quarter earnings aftermarket on Oct. 25.

Krystal Hu covers e-commerce for Yahoo Finance. Follow her on Twitter.

Read more:

Some Amazon employees say they will make less after the raise

Amazon bought Whole Foods a year ago. Here’s what has changed

Yahoo Finance

Yahoo Finance