How to get (almost) free stuff from banks in Singapore

Everyone loves freebies and discounts! And Singaporeans are no exceptions. You tend to get a warm fuzzy feeling when you are handed something for free or at a cheaper rate.

The banks here certainly know this and they are doing their part to entice you to take up their latest financial products. Here is a quick guide to some of these offers.

Credit card perks

Nowadays, it's pretty common to be offered some free gifts when you get a credit card from a bank. But before you get all excited about a new piece of luggage, don't forget to spend some time to comb through the other perks and promotions that suit your needs.

An important thing to look out for is the annual fee waiver, as this could save you quite a bit of money in the long run. Most of the time, banks would offer an annual fee waiver ranging from one to five years.

Unfortunately, there's also usually a catch for all this generosity. Occasionally, the banks might require you to have a minimum spend of several thousand dollars monthly to qualify for those same freebies and the annual fee. So, be wary!

Credit Cards in Singapore that offer freebies

Take the American Express Platinum card as an example. When you apply for this card, you could either receive a Philips Air Purifier AC4012 that’s worth S$599, or get your hands on a TUMI VAPOR Luggage bag that’s valued at S$825. If it's up to us here at ZUU, we would pick the purifier; it might come in handy the next time the haze strikes again!

Source: American Express

Alternatively, you could apply for an ANZ Optimum credit card and receive a S$100 cash rebate and a 24” luggage bag. That luggage could be useful for a quick weekend getaway to Phuket!

Source: Australia and New Zealand Banking Group Ltd

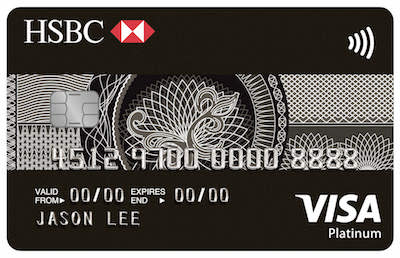

HSBC’s Visa Platinum trumps it all when it comes to giving out freebies – a successful application will make you the proud owner of a Samsonite Black Label Richmond Luggage bag that’s worth a whopping S$950, PLUS, either a cash rebate of S$20 or one of HSBC’S All Day Movie Card which has a value of S$85.

Source: HSBC Bank (Singapore)

Not to be outdone, the Citibank Premiermiles Visa Card comes with a handful of exciting and free privileges for card holders. It provides a complimentary Travel Accident Insurance of up to S$1 million, complimentary Travel Inconvenience Coverage and free access to several airport lounges all over the world twice a year.

Source: Citigroup Inc.

Last but not least, when you apply for the Standard Chartered MANHATTAN World MasterCard (before 31 December 2016), you could pick between getting free Uber Credits worth S$150, or a Caltex StarCash Card with the same exact value, or a straight Cashback amount of S$138. In addition, if you make 3 transactions within 60 days of the card being approved, you do not need to pay for the annual membership fee.

Source: Standard Chartered Bank (Singapore)

All of these cards mentioned above have their credit card fee waivers applied, which would have otherwise cost you between S$180 – S$321.

Personal Loans in Singapore with freebies

Need a personal loan ASAP? Approvals on personal loans these days are almost instantaneous. An in-principal personal loan can be approved in a matter of 60 seconds flat. At least, that’s what Standard Chartered’s CashOne loan is claiming.

Source: Standard Chartered Bank (Singapore)

Should you qualify to take up the loan, you would be able to get up to S$1088 CashBack upon approval. A further S$50 cashback amount is applied on top of that if you apply online.

Citibank’s Ready Credit loan, on the other hand, has no service fee attached to its loan package. You have a 15-day loan return option if you feel that you might not need the funds after all. The bank gives its customers a welcome offer of 4.55% per annum on its interest rate (EIR is at 8.5% per annum).

HSBC’s personal loan meanwhile has the longest loan tenure at 7 years. The processing fee of S$88 is waived. A Premier account holder gets a cashback amount of S$300, while a HSBC Advance customer would get a cashback of S$150. Online applications get an added S$50 in cashbacks. And if you refer a friend, you get S$30 worth of shopping vouchers if you happen to be an existing HSBC customer. But even if you’re not, you still end up with S$20 worth of shopping vouchers for a successful referral.

Home Loans in Singapore with a little something extra

Home loans are usually associated with fee waivers and fixed rates. Take the POSB HDB loan for instance. The bank extends interest rates that are capped with the prevailing CPF Ordinary Account interest rate for the first half of a decade. You’ll be safeguarding yourself from interest rate fluctuations. There’s also no prepayment fee involved in a loan application with the bank.

Source: DBS Bank

ANZ’s property loan in Singapore gives you the chance to save on property assessment fees and legal fees. This applies for a certain period of time and is also subject to the home loan package itself. Here’s another feature you might like – you would be able to enjoy a bonus interest rate of 0.1% per annum on the lowest balance that took place in your account for the month. This is provided you have a minimum of S$50,000 in your Home Loan Current Account for its daily balance.

(By Annette Rowena)

Related Articles

- If you use PayPal, this is what you should know

- Reading the fine print on your home loan: 7 essential clauses not to miss

- Building foundations for wealth

Yahoo Finance

Yahoo Finance