Allstate (ALL) Q2 Earnings to Suffer From Catastrophe Loss

Allstate Corp.’s ALL earnings for the second quarter, to be reported on Aug 1, will likely suffer from catastrophe losses sustained in April and May. Nevertheless, investments made in marketing, distribution, telematics, new products and technology business lines should yield results.

Customer growth, one of the company’s priorities, is showing traction. An increase in the number of customers served led to an increase in Allstate brand policies in force driven by auto and other personal lines growth. Esurance policies increased on growth in the homeowners’ line. Allstate Benefits and Square Trade also witnessed policies in force. An increase in the number of customers should lead to premium growth.

Nevertheless, net premium has been declining at Encompass for the past two years. Decline in premium and policies in force in states, with inadequate returns, have impacted the overall top-line trends, to some extent. The business is getting smaller as the company exited unprofitable markets and raised prices. This will shrink top line from the segment and we don’t expect the segment to witness premium growth in the second quarter.

Investment income should show an increase led by strong results from the performance-based portfolio.

The company is expected to incur $489 million loss in the second quarter as a result of weather-related events that occurred in April and May.

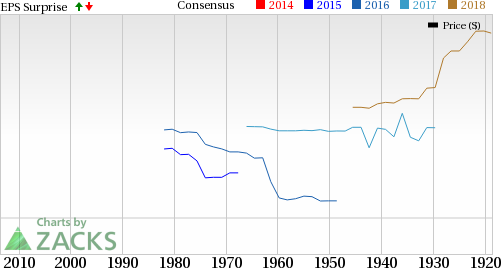

Earnings Surprise History

The company boasts an attractive earnings surprise history, having surpassed estimates in each of the trailing four quarters, with an average positive surprise of 47.42%. This is depicted in the chart below.

The Allstate Corporation Price and EPS Surprise

The Allstate Corporation Price and EPS Surprise | The Allstate Corporation Quote

Here is what our quantitative model predicts:

Our proven model does not conclusively show that Allstate is likely to beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Earnings ESP: Allstate has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Though Allstate currently carries a Zacks Rank #3, its 0.00% ESP makes our surprise prediction difficult.

We caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies that you may consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

XL Group Ltd. XL is expected to report second-quarter earnings results on Jul 31. The company has an Earnings ESP of +6.37% and a Zacks Rank #3.

American Financial Group, Inc. AFG is expected to report second-quarter 2018 results on Aug 1. The company has an Earnings ESP of +1.68% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

NMI Holdings Inc. NMIH has an Earnings ESP of +1.54% and a Zacks Rank #1. The company is expected to report second-quarter earnings results on Aug 1.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

XL Group Ltd. (XL) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

NMI Holdings Inc (NMIH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance