Alliant Energy (LNT) Q2 Earnings Top Estimates, Sales Rise Y/Y

Alliant Energy Corporation LNT reported second-quarter 2022 operating earnings of 63 cents, beating the Zacks Consensus Estimate of 58 cents by 8.6%. Earnings also improved 10.5% from the year-ago figure.

Revenues

Second-quarter revenues were $943 million, improving 15.4% year over year. The year-over-year improvement was primarily due to strong contributions from its Electric and Gas operations.

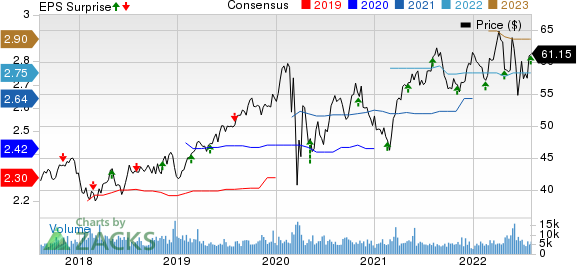

Alliant Energy Corporation Price, Consensus and EPS Surprise

Alliant Energy Corporation price-consensus-eps-surprise-chart | Alliant Energy Corporation Quote

Operational Highlights

For the second quarter, the company’s retail electric and gas utility customers grew 0.8% and 0.6% year over year, respectively. Electric volumes improved 1.8% year over year due to the strong power sales volume to residential and commercial customers. Gas volumes sold and transported in the reported quarter improved 1.1% year over year due to an improvement in sales volume to all customer groups, except for transportation.

Total operating expenses were $731 million for the reported quarter, up 14.1% from $641 million in the year-ago period. The rise was due to the higher cost of electric transmission services and increased production of fuel, and purchased power expenses.

Operating income was $212 million, up 20.4% from $176 million in the year-ago quarter.

Interest expenses were $78 million, 13.1% higher than the prior-year quarter.

Financial Update

Cash and cash equivalents were $19 million as of Jun 30, 2022, up from $39 million on Dec 31, 2021.

Long-term debt (excluding the current portion) was $6,981 million as of Jun 30, 2022, higher than $6,735 million as of Dec 31, 2021.

For the first half of 2022, cash flow from operating activities was $300 million compared with $207 million in the year-ago period.

Guidance

Alliant Energy reiterated its 2022 earnings guidance at $2.67-$2.81 per share. The guidance takes into account normal temperature in its service territories, stable economic conditions, the proper execution of cost controls and a few other factors.

Alliant Energy’s 2022 earnings per share expectation indicates an improvement from the 2021 reported figure of $2.63. The midpoint of the 2022 earnings guidance is $2.74, a tad lower than the Zacks Consensus Estimate of $2.75 per share for the same period.

Zacks Rank

Currently, Alliant Energy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

NextEra Energy, Inc. NEE reported second-quarter 2022 adjusted earnings of 81 cents per share, which beat the Zacks Consensus Estimate of 75 cents by 8%.

The Zacks Consensus Estimate for NextEra Energy’s 2022 earnings has gone up 2.1% in the past 60 days. NEE’s long-term (three to five years) earnings growth is pegged at 9.3%.

WEC Energy Group WEC delivered second-quarter 2022 earnings per share (EPS) of 91 cents, which beat the Zacks Consensus Estimate of 86 cents by 5.8%.

The Zacks Consensus Estimate for WEC Energy’s 2022 earnings has gone up 0.3% in the past 60 days. WEC’s long-term earnings growth is pegged at 6.1%. The WEC stock has gained 9.5% over the past six months.

American Electric Power Company, Inc. AEP reported second-quarter 2022 operating earnings per share of $1.20, which beat the Zacks Consensus Estimate of $1.18 by 1.7%.

The Zacks Consensus Estimate for American Electric Power’s 2022 earnings has gone up 0.6% in the past 60 days. AEP’s long-term earnings growth is pegged at 6.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance