Alliance Data (ADS) Q4 Earnings Beat, Revenues In Line

Alliance Data Systems Corporation’s ADS operating earnings of $1.21 per share for the fourth quarter of 2021 beat the Zacks Consensus Estimate of 47 cents. The quarterly earnings benefited from continued recovery in consumer spending. However, the bottom line plunged 21% year over year.

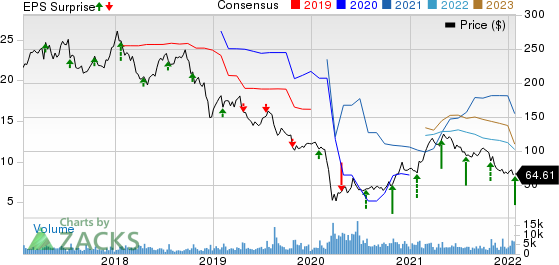

Alliance Data Systems Corporation Price, Consensus and EPS Surprise

Alliance Data Systems Corporation price-consensus-eps-surprise-chart | Alliance Data Systems Corporation Quote

Behind the Headlines

Revenues increased 11% year over year to $855 million, resulting from higher average receivables balances, improved loan yields, and continued improvement in the cost of funds. The top line was almost in line with the consensus estimate.

Credit sales increased 15% to $8.8 billion as consumer spending continues to recover. Average receivables of $16.1 billion were up 2% year over year.

Total interest income increased 7% to $1 billion. Net interest margin expanded 100 basis points to 18.8%.

The delinquency rate of 3.9% improved 50 basis points year over year, while the net loss rate of 4.4% improved 160 basis points from the year-ago period.

Full-Year Highlights

Operating earnings of $15.95 per share beat the Zacks Consensus Estimate of $15.89. and increased nearly fourfold year over year.

Operating revenues of $3.3 billion in 2021 declined 1% year over year and were in line with the consensus estimate.

Credit sales of $29.6 billion increased 20% year over year. Average receivables of $15.7 billion were down 4% year over year.

Financial Update

As of Dec 31, 2021, cash and cash equivalents was $3 billion, up 8.9% from Dec 31, 2020-level.

At quarter-end, the debt level was down 29.2% from 2019-end to about $2 billion.

Tangible book value of $28.09 per share as of Dec 31, 2021 improved 71.9% over 2020 end.

Cash from operations decreased 18.1% year over year to $1.5 billion in 2021. Capital expenditure at Alliance Data increased 55.6% year over year to $84 million in the same period.

Business Update

On Nov 8, 2021, Alliance Data completed the spin-off of its LoyaltyOne segment, consisting of the Canadian AIR MILES Reward Program and Netherlands-based BrandLoyalty businesses.

Dividend Update

The board of directors approved a quarterly dividend of 21 cents to be paid out on Mar 18 to stockholders of record as of Feb 11.

2022 Guidance

Management estimates average receivables growth in the high-single to low-double-digit range from the 2021 level. This expected growth aligns with the achievement of targeted full-year average receivables of $20 billion in 2023.

Total revenue growth is expected to be closely aligned with average receivables growth. The net interest margin is expected to be flat with the 2021 level.

Total expenses are projected to increase, given continued investment in technology modernization, digital advancement, marketing, and product innovation and strong portfolio growth. Management estimates an incremental investment of more than $125 million in digital and product innovation, marketing, and technology enhancements.

The net loss rate is guided in the low-to-mid 5% range.

Zacks Rank

Alliance Data currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Another Player From the Industry

Mastercard’s MA operating earnings per share of $2.35 surpassed the Zacks Consensus Estimate by 7.3% and increased 43.2% year over year. MA’s net revenues of $5,216 million surpassed the Zacks Consensus Estimate of $5,133 million and were also up from $4,120 million a year ago.

Gross dollar volume (represents the aggregated dollar amount of purchases made and cash disbursements obtained with MasterCard-branded cards) rose 23% to $2.1 trillion. MasterCard’s switched transactions, which indicate the number of times a company’s products were used to facilitate transactions, were up 27% year over year to 31,371 million.

Upcoming Releases

Western Union WU will report fourth-quarter 2021 results on Feb 9. The Zacks Consensus Estimate for the fourth quarter is pegged at 53 cents, indicating an increase of 7.8% from the year-ago reported figure.

Western Union beat estimates in two of the three reported quarters of 2021 while missing in one.

Global Payments GPN is set to report fourth-quarter 2021 results on Feb 14. The Zacks Consensus Estimate for the fourth quarter is pegged at $2.12, indicating an increase of 17.8% from the year-ago reported figure.

Global Payments delivered earnings surprise in all the three reported quarters of 2021.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Alliance Data Systems Corporation (ADS) : Free Stock Analysis Report

The Western Union Company (WU) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance