Alliance Resource (ARLP) Q2 Earnings Lag Estimates, View Cut

Alliance Resource Partners, L.P. ARLP reported second-quarter 2019 operating earnings of 44 per unit, lagging the Zacks Consensus Estimate of 65 cents by 32.3%.

Total Revenues

Total revenues in the reported quarter were $517.1 million, missing the Zacks Consensus Estimate of $524 million by 1.3%. However, the reported revenues reflected year-over-year growth of 0.2%.

The year-over-year improvement in the top line was on account of oil and gas royalties, as well as increased revenues from transportation.

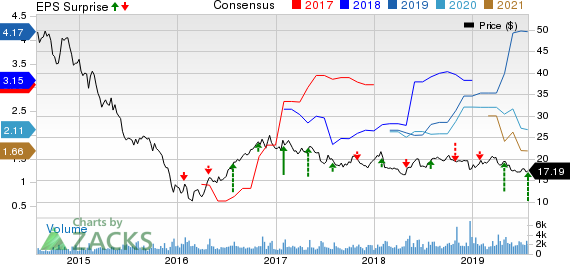

Alliance Resource Partners, L.P. Price, Consensus and EPS Surprise

Alliance Resource Partners, L.P. price-consensus-eps-surprise-chart | Alliance Resource Partners, L.P. Quote

Operational Update

In the reported quarter, Alliance Resource sold 10.216 million tons of coal at an average sales price of $45.16 per ton compared with 10.488 million tons an average sales price of $45.38 in second-quarter 2018.

Total operating expenses in the quarter under review were $448.7 million, increasing 4.9% year over year.

Interest expenses were $10.7 million, increasing 8.1% year over year.

Financial Highlights

Cash and cash equivalents as of Jun 30, 2019 were $55.2 million compared with $244.1 million at the end of 2018.

Long-term debt as of the same date was $467.1 million compared with $564 million at 2018-end.

Cash used in operating activities during the first half of 2019 was $209.8 million compared with $128 million in the comparable year-ago period.

Guidance

Alliance Resource lowered its total 2019 production guidance to the range to 40.8-42.3 million from earlier expectation of 43.5-45 million short tons. The downward revision in coal production view takes into account the decline in demand due to mild weather, reduction in export and strong competition from natural gas.

Net income in 2019 is expected in the range of $432.5-$472.5 million and EBITDA is projected within $625-$665 million.

The company expects 2019 capital expenditure in the range of $345-$375 million.

Zacks Rank

Alliance Resource currently has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Warrior Met Coal Inc. HCC is slated to report second-quarter earnings on Jul 31. The Zacks Consensus Estimate for earnings per share for the to-be-reported quarter is currently pegged at $1.69.

Peabody Energy Corporation BTU is expected to report second-quarter earnings on Jul 31. The Zacks Consensus Estimate for earnings per share is currently pegged at 58 cents.

CONSOL Coal Resources LP CCR is expected to report second-quarter earnings on Aug 6. The Zacks Consensus Estimate for the partnership’s earnings per unit is currently pegged at 53 cents.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Peabody Energy Corporation (BTU) : Free Stock Analysis Report

Alliance Resource Partners, L.P. (ARLP) : Free Stock Analysis Report

Warrior Met Coal Inc. (HCC) : Free Stock Analysis Report

CONSOL Coal Resources LP (CCR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance