Alibaba to Keep Online-Shopping Crown Even As Jack Ma Exits

Alibaba Group Holding BABA has been one of the best-performing e-commerce stocks so far this year, courtesy of its dominant position in China and expanding cloud business.

This Zacks Rank #1 (Strong Buy) company has been flourishing under the leadership of Chairman Jack Ma. You can see the complete list of today’s Zacks #1 Rank stocks here.

Notably, the company has demonstrated impressive performance on the bourses since it went public. The stock, which was valued at around $94 back in 2014, currently trades close to $178, reflecting a jump of 89.3%.

Further, Alibaba has a remarkable earnings surprise history. It outpaced the Zacks Consensus Estimate in the trailing four quarters, with the average positive earnings surprise being 19.37%.

Currently, Alibaba has a Growth and Momentum Score of B.

One-Year Price Performance

Ma’s Retirement Unlikely to Hurt Momentum

The Chinese behemoth is now on the verge of a transition as Ma stepped down on Sep 10. He has been instrumental in shaping the company’s growth trajectory.

Ma can be credited for making Alibaba the largest online retail platform of China. Further, he helped the company foray into uncharted territories like cloud computing and smart speaker markets with the launch of Alibaba Cloud and Tmall Genie, respectively.

Under Ma’s leadership, the company’s market capital hit $452.34 billion.

Although Jack Ma’s contribution toward Alibaba’s development is unparalleled, we believe his retirement will not have much of an impact on the stock owing to the company’s strong fundamentals.

The company’s robust online retail platform, strengthening cloud computing business and well-performing digital media and entertainment segment are expected to drive growth in the near term. Further, its strategic acquisitions are a key catalyst.

Let’s delve deep to find what makes Alibaba a top-performing stock of 2019.

Dominance in China E-commerce Space

Alibaba holds the dominant position in the online retail market of China, which per a report from Forrester, is anticipated to reach $1.8 trillion by 2022. Further, sales in this market are expected to see a CAGR of 8.5% between 2018 and 2022.

Although global e-commerce giant Amazon AMZN and JD.com JD are trying all means to expand their footprint in China, Alibaba’s direct sale businesses — Tmall Supermarket and Freshippo — have thwarted their efforts.

Further, the company’s latest acquisition of NetEase’s NTES online luxury retail platform, Kaola, is a growth driver. With this buyout, Alibaba aims at expanding foothold in the Chinese e-commerce market.

This has been a major defeat for Amazon as the company was discussing terms about merging its China business with Kaola.

Growing Cloud Business

Alibaba Cloud has been gaining traction in the cloud market for some time now. In the last reported quarter, the company’s cloud computing segment generated revenues of RMB7.8 billion (US$1.1 billion) contributing almost 7% to the total revenues. Further, the figure was up significantly 66% year over year.

The company is experiencing an increase in average spending per customer despite strong competition from AWS, Microsoft’s MSFT Azure and Alphabet’s GOOGL Google Cloud.

Per data from Synergy Research Group, Alibaba continues to outpace the market and expand its market share.

We believe Alibaba’s expanding cloud portfolio is likely to keep aiding top-line growth. The company recently unveiled 10 products, including PolarDB, Alibaba Log Service, Support of “Bring Your Own Key”, SaaS Accelerator, Smart Access Gateway (SAG) Software, Container Registry (ACR) Enterprise Edition and Container Service for Kubernetes.

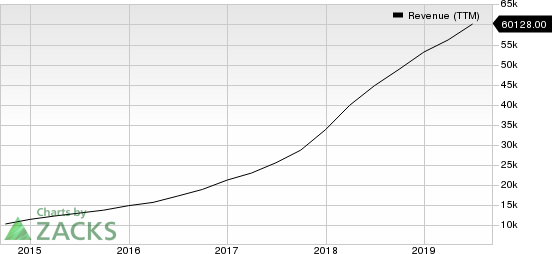

Alibaba Group Holding Limited Revenue (TTM)

Alibaba Group Holding Limited revenue-ttm | Alibaba Group Holding Limited Quote

Conclusion

We believe that e-commerce will remain one of the major growth drivers for Alibaba, thanks to its robust product portfolio, strengthening IoT capabilities and aggressive international expansion strategies.

Further, the company’s strengthening footprint in the international cloud market is encouraging. All these are likely to maintain Alibaba’s solid momentum, making it a prudent choice for investors.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance