Albertsons (ACI) Queued for Q4 Earnings: What's in Store?

Albertsons Companies, Inc. ACI is likely to register an increase in the top line when it reports fourth-quarter fiscal 2022 results on Apr 11 before market open. The Zacks Consensus Estimate for revenues is pegged at $18.16 billion, indicating growth of 4.5% from the prior-year reported figure.

The bottom line of this food and drug retailer in the United States is expected to decline year over year. The Zacks Consensus Estimate for earnings per share for the quarter under discussion has risen by a penny to 69 cents over the past seven days. The figure suggests a decline from the earnings of 75 cents from the year-ago period.

We expect revenues to increase 1.9% year over year to $17,721.8 million and the bottom line to decrease 17.3% to 62 cents a share.

Albertsons Companies has a trailing four-quarter earnings surprise of 17.2%, on average. In the last reported quarter, this Boise, Idaho-based company surpassed the Zacks Consensus Estimate by 29.9%.

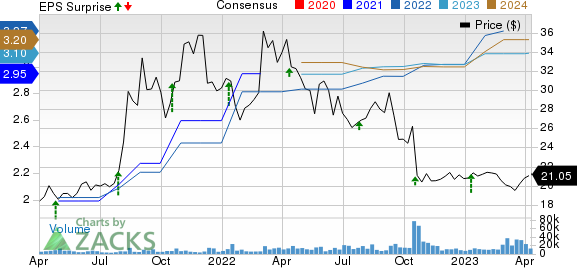

Albertsons Companies, Inc. Price, Consensus and EPS Surprise

Albertsons Companies, Inc. price-consensus-eps-surprise-chart | Albertsons Companies, Inc. Quote

Key Factors to Note

Albertsons Companies' focus on providing efficient in-store services, enhancing digital and omnichannel capabilities and increasing productivity has been contributing to its top line. The company has been enhancing digital payment facilities alongside expanding the availability of online assortments.

Efforts to bolster assortments, especially in the fresh and Own Brands categories, continue to elevate the customer experience. The company's right assortment in each local market, loyalty programs and the ease of checkout through frictionless and contactless payments have been aiding in attracting customers. As part of its digital endeavors, the company has been expanding the Drive Up & Go curbside pickup service and sharpening home delivery capabilities.

The aforementioned factors instill optimism regarding the outcome of the results. However, margins remain an area to watch. The impact of costs associated with digital fulfillment and the supply chain cannot be ruled out. Also, product cost inflation and select promotions might have weighed on margins.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Albertsons Companies this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here. You can see the complete list of today's Zacks #1 Rank stocks here.

Albertsons Companies has an Earnings ESP of +0.82% and a Zacks Rank #2. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

3 More Stocks With the Favorable Combination

Here are three other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

Kroger KR currently has an Earnings ESP of +2.56% and sports a Zacks Rank #1. The company is likely to register a bottom-line decline when it reports first-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $1.41 suggests a decline from the $1.45 reported in the year-ago quarter.

Kroger's top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $45.38 billion, which indicates an improvement of 1.7% from the figure reported in the prior-year quarter. KR has a trailing four-quarter earnings surprise of 9.8%, on average.

Tractor Supply Company TSCO currently has an Earnings ESP of +1.98% and a Zacks Rank of 3. The company is likely to register an increase in the bottom line when it reports first-quarter 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $1.70 suggests an increase of 3% from the year-ago reported number.

Tractor Supply's top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $3.30 billion, which suggests an increase of 9.3% from the prior-year quarter. TSCO has a trailing four-quarter earnings surprise of 5.6%, on average.

AutoZone AZO currently has an Earnings ESP of +0.70% and a Zacks Rank #2. The company is expected to register bottom-line growth when it reports third-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of $30.76 suggests an increase of 6% from the year-ago quarter.

AutoZone's top line is anticipated to rise year over year. The consensus mark for revenues is pegged at $4.09 billion, indicating an increase of 5.9% from the figure reported in the year-ago quarter. AutoZone has a trailing four-quarter earnings surprise of 10.6%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Albertsons Companies, Inc. (ACI) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance