Alberta's minimum wage now highest among provinces

No one turned into a pumpkin, but there was some magic when the clock struck midnight in Alberta today.

As the calendar turned over to Oct. 1, tens of thousands of workers in the province got a raise.

The province's minimum wage rose to $12.20 an hour, the highest rate among the provinces. Across Canada, only the Northwest Territories at $12.50 and Nunavut at $13 have higher minimum wages.

Michelle Hunter, one of about 60,000 Albertans who received a pay bump, works full time in the gift shop of a Calgary casino. She made $12 an hour before the provincial minimum went up.

It's a small raise to be sure, but Hunter says that every cent counts for the bottom line of her household, which includes her daughter and her boyfriend. This week, the family is wrestling with how to keep the lights on.

"Our electricity bill we just got is really high and we were thinking of paying the whole thing and it leaves us close to nothing."

Food or power, it's just one of many difficult choices Hunter says she has to make, "not being able to go out and buy my daughter school clothes and things that she wants and needs."

Hunter's partner Russell Boysis didn't get a raise this month. He already makes $15 an hour working at a local community centre. However, Boysis can only work part time, after being injured in a car accident.

Boysis receives as much as $1,000 a month from the province's AISH program (Assured Income for the Severely Handicapped), but he says that total goes down the more he and Hunter earn.

'Bills start adding up'

In total, the family's monthly income hovers around $3,000, an amount Boysis says rarely covers all of their costs.

"The bills start adding up and really by the end of the month we don't have any money left for anything."

This year's pay bump is just a first step on the way to meeting the provincial NDP's commitment to implement a minimum wage of $15 an hour by 2018.

But some warn that those gains for Alberta's low income workers comes at a steep price. The Canadian Federation of Independent businesses says that one in four of its members will be forced to cut jobs following the wage hike.

Amber Ruddy, the group's Alberta director, says that raising the minimum wage during a prolonged recession makes little sense for small businesses or the provincial economy.

"The timing couldn't be worse. What can we do to support small business owners now, because the real minimum wage is zero if people are being laid off because of this policy."

Ruddy says that the boost in minimum wage is just one of a number of challenges small businesses in Alberta are facing as the province's economy continues to suffer under the yoke of low oil prices.

"We have a carbon tax coming down January 1st, $15 minimum wage, the Canada Pension Plan premiums are being hiked, business owners can't get a break and they would expect the government to listen to their concerns and act."

For her part, Premier Rachel Notley says her government remains committed to rolling out both the looming carbon tax and future bumps to the minimum wage, rejecting the notion that either policy will be a drag on the provincial economy.

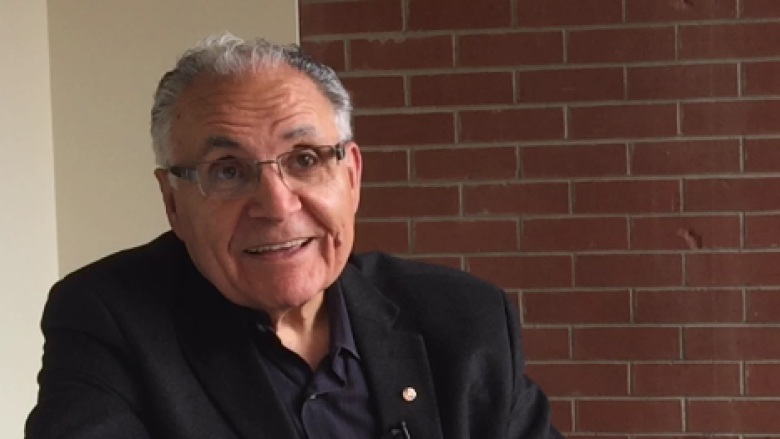

Franco Savoia agrees. The executive director of the poverty reduction group Vibrant Communities Calgary insists that higher minimum wages are actually good for the local economy.

"Those people will spend this money here, it's not that they are going to Mexico with it or Hawaii. They are going to spend it in this community."

Savoia argues that communities across Canada should be moving away from the notion of a minimum wage and begin focussing on paying a living wage.

In Calgary, Savoia says, a living wage would be around $18.25 an hour, significantly higher than even the $15 minimum that the province has committed to.

No province has yet to commit to paying a living wage to all workers but minimum wages went up in a number of jurisdictions across Canada today.

In Saskatchewan, the minimum wage edged up to $10.72 an hour and in Ontario it saw a bump to $11.40, the second highest provincial rate.

Savoia says that despite the increases, neither of those pay rates is high enough to live on in those jurisdictions and should be raised much higher.

"Ultimately our position is there is no one who is working full time that should have to go to the food bank to get food."

'Paycheque to paycheque'

But that is precisely what Deanna Poirier has had to do to make ends meet.

Poirier, who makes $17 an hour as a receptionist at a Calgary hair salon, says that despite making far more than the minimum wage she has had to visit the food bank during lean months.

"I pretty much live paycheque to paycheque, like from one paycheque would be rent and then the paycheque after would be bills and what is most important at that time is what I would pay."

Poirier shares a small two-bedroom basement suite with her two teenage boys. She would like to move into a three-bedroom but can't afford the increase in rent, so she sleeps on the couch so her sons can have their own rooms.

The single mother says that implementing a living wage might boost her income just enough to help her avoid the food bank and find a larger place to live.

"You are constantly worrying about how am I going to make this work, or that work, or you end up paying less on one bill so that you can pay this one to catch up on areas."

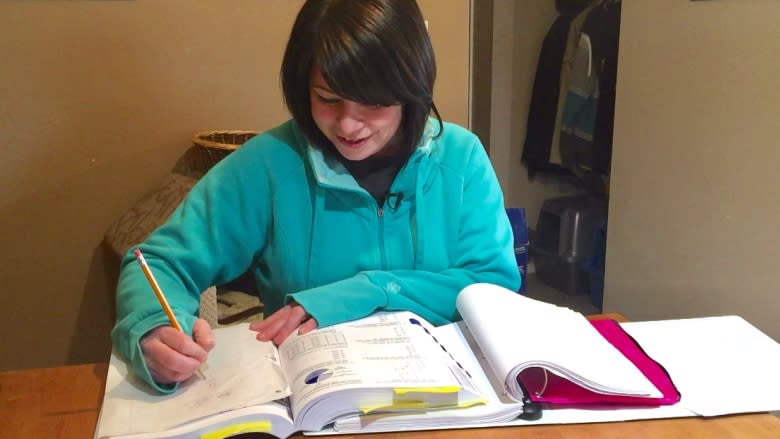

Poirier spends her evenings studying to take her high school equivalency exam so that she can find a better-paying job, one that would allow her to spend less time stressing about making ends meet and more time with her family.

"We would be able to go out and do things more as a family, or you know just have those little luxuries like vacations and stuff like that."

Yahoo Finance

Yahoo Finance