Alaska Air Group's August Load Factor Down, Q3 View Tweaked

Alaska Air Group, Inc. ALK reported moderate traffic results for August. Consolidated traffic, measured in revenue passenger miles (RPMs), increased 3.8% to 4.96 billion.

On a year-over-year basis, consolidated capacity (or available seat miles/ASMs) rose 4.3% to 5.79 billion. However, load factor or percentage of seats filled by passengers decreased 50 basis points to 85.7% as capacity expansion outpaced traffic growth.

In the first eight months of 2018, the carrier generated RPMs of 37.09 billion (up 6.2% year over year) and ASMs of 44.07 billion (up 7.1% year over year). Load factor came in at 84.1% compared with 84.8% in the first eight months of 2017.

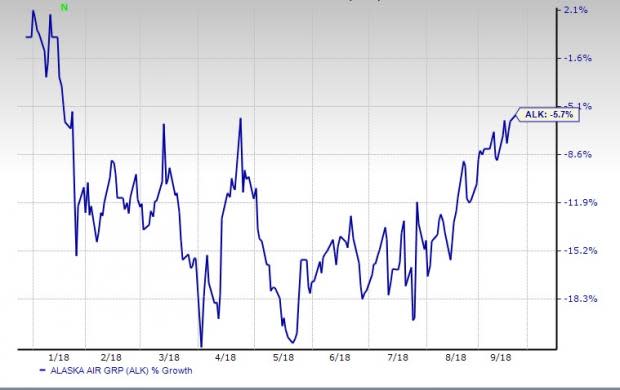

The decline in load factor highlights the fact that Alaska Air Group is suffering from woes related to capacity overexpansion. Apart from high fuel costs, the lack of capacity discipline is responsible for the carrier shedding 5.7% of its value so far this year.

YTD Price Performance

Q3 Projection

Apart from the traffic report, Alaska Air Group revised certain aspects of its guidance for the third quarter of 2018. Reflecting the fuel cost-related concerns, the carrier increased its projection for fuel cost per gallon. The metric is now expected to be $2.32 per gallon, reflecting an increase of 28.9% year over year. The earlier view had anticipated the metric to be $2.30 per gallon.

Non-fuel unit costs are envisioned between 8.36 cents and 8.41 cents, up 4.1% (earlier view had projected the metric in the 8.30-8.35 cents range). Revenue per ASM (a key measure of unit revenues) is projected to either remain flat or decline up to 2% on a year-over-year basis. Previously, the metric was expected to either remain flat or decline up to 3% on a year over year. The company attributed the improved unit revenue projection to a better close-in pricing environment in the July-September period.

Zacks Rank & Stocks to Consider

Alaska Air Group carries a Zacks Rank #5 (Strong Sell).

A few better-ranked stocks in the broader Transportation Sector are SkyWest, Inc. SKYW, Trinity Industries, Inc. TRN and Old Dominion Freight Line, Inc. ODFL, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of SkyWest, Trinity and Old Dominion have rallied more than 47%, 22% and 58%, respectively, in a year’s time.

5 Companies Verge on Apple-Like Run

Did you miss Apple's 9X stock explosion after they launched their iPhone in 2007? Now 2018 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs. A bonus Zacks Special Report names this breakthrough and the 5 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains.

Click to see them right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

Old Dominion Freight Line, Inc. (ODFL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance