Al Gore Sells Credicorp and Adds 3 New Holdings

Al Gore (Trades, Portfolio), co-founder of Generation Investment Management, has released his portfolio for the first quarter of 2020. Gore sold out of his holding in Credicorp Ltd. (NYSE:BAP), bought into Palo Alto Networks Inc. (NYSE:PANW), Gartner Inc. (NYSE:IT) and Trimble Inc. (NASDAQ:TRMB), and added to his existing holding of Becton, Dickinson and Co. (NYSE:BDX).

Generation is an investment management company based out of London that is dedicated to "long-term investing, integrated sustainability research, and client alignment." The company was founded in 2004 by Gore and David Blood. The firm focuses on a long-term investment perspective, focusing on sustainability within markets with companies that strategically manage their economic, social and environmental performances; a systematic view of global challenges considering all inputs, costs and externalities; and believing that sustainable development is economically transformative.

Portfolio overview

The portfolio contains 41 stocks, with six new holdings. It is valued at $14.09 billion and has seen a 25% turnover rate. Top holdings in the portfolio include Alphabet Inc. (NASDAQ:GOOG) (8.25%), Charles Schwab Corp. (NYSE:SCHW) (7.73%), Baxter International Inc. (NYSE:BAX) (5.86%), Cognizant Technology Solutions Corp. (NASDAQ:CTSH) (5.28%) and Dentsply Sirona Inc. (NASDAQ:XRAY) (5.12%).

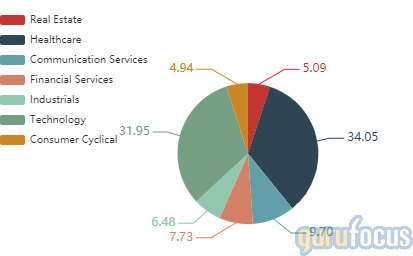

By weight, the top three sectors represented are health care (34.05%), technology (31.95%) and communication services (9.70%).

Credicorp

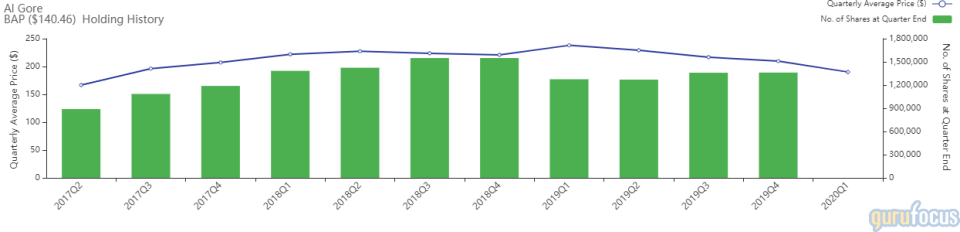

The first quarter saw the sale of the entirety of the investment in Credicorp. Around 1.36 million shares were sold at an average price of $190.24. Overall, the sale had a -1.86% impact on the equity portfolio.

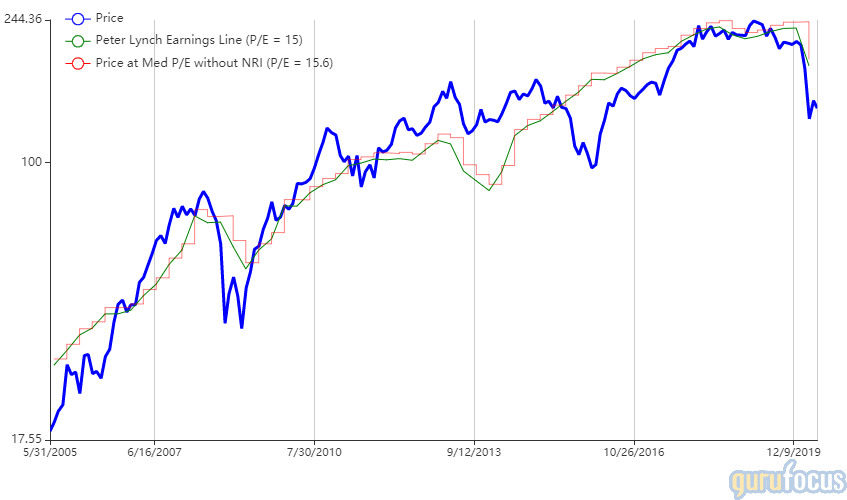

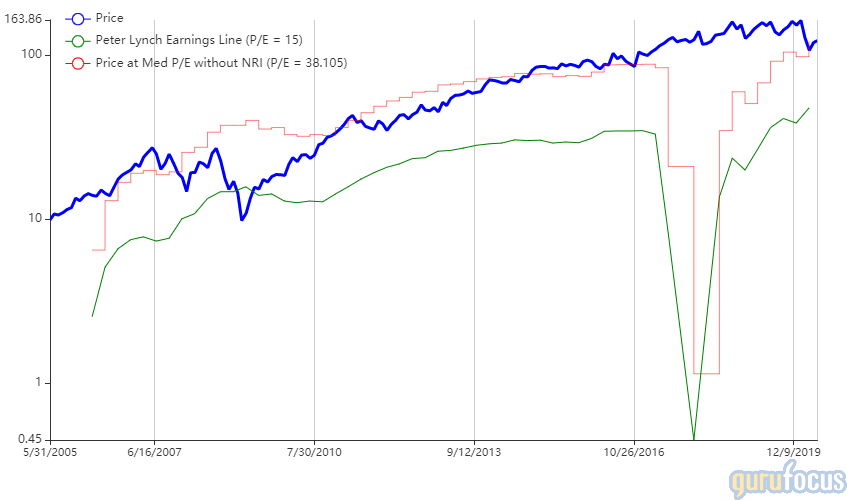

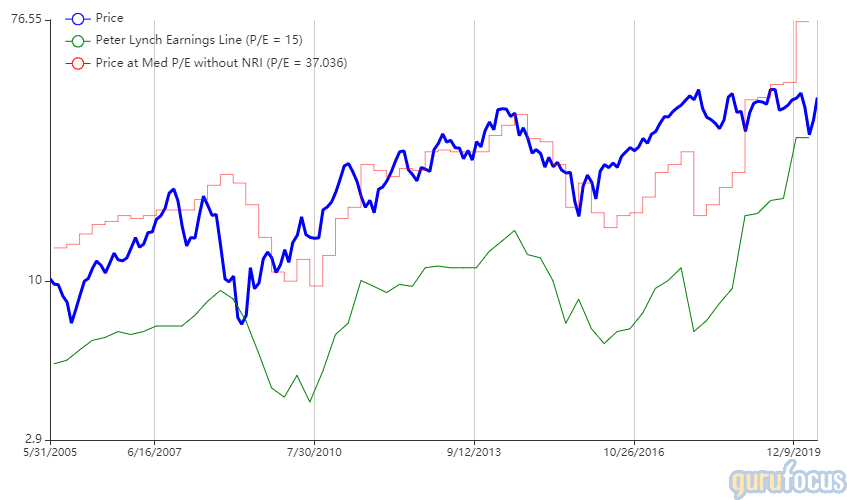

Credicorp is a Peru-based financial holding company. It operates in the fields of universal banking, microfinance, insurance and pensions and investment banking and wealth management. As of May 27, the company was trading at $142.08 per share with a market cap of $11.27 billion. The Peter Lynch chart suggests the stock was undervalued at the end of 2019.

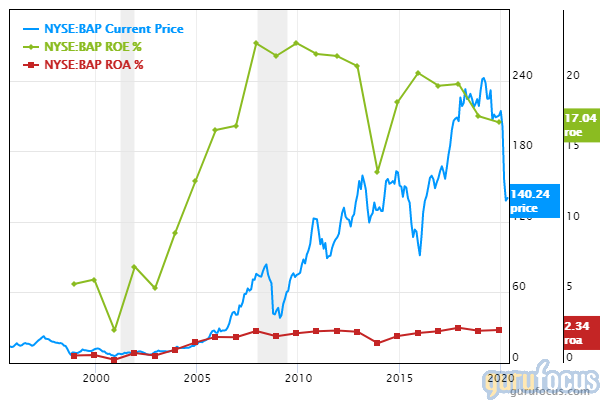

GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rank of 4 out of 10. The company has a cash-to-debt ratio of 1.05, which places it lower than 51.29% of the banking industry. However, a return on equity of 13.94% and a return on assets of 1.84% places it above 84.52% of the industry.

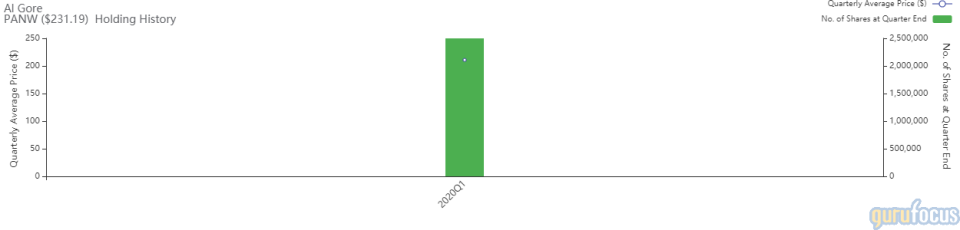

Palo Alto Networks

A new holding was created with the purchase of 2.49 million shares of Palo Alto Networks. The shares were purchased at an average price of $210.86 during the quarter. The purchase represents an overall 2.91% impact on the portfolio.

The American multinational cybersecurity company is based in California. Core offerings include firewalls and cloud-based services. As of May 27, the stock was trading at $231.19 per share with a market cap of $22.10 billion.

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rank of 3 out of 10. The company has a cash-to-debt ratio of 1.73, which is lower than 53.87% of the industry, but an Altman Z-Score of 3.01 indicates it safe from bankruptcy.

Gartner

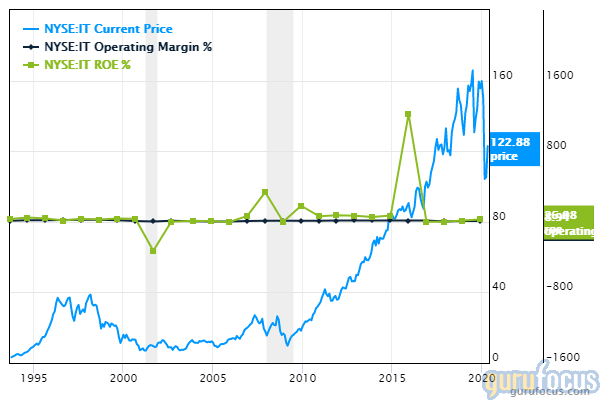

Another new purchase saw the addition of 3.98 million shares of Gartner to the portfolio. During the quarter, the shares saw an average price of $137.88 per share. The addition represented a 2.81% impact on the portfolio overall.

The global research and advisory company provides information, advice and tools for leaders in IT, finance, HR, customer service and support, communications, legal and compliance, marketing, sales and supply chain functions. As of May 27, the stock was trading at $122.46 per share with a market cap of $10.90 billion. The Peter Lynch chart suggests that the stock was trading above its intrinsic value at the end of 2019.

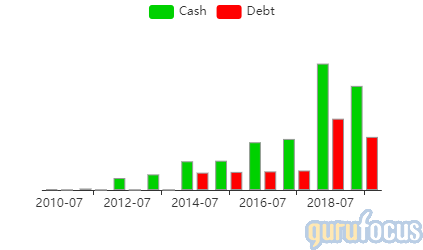

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 6 out of 10. A cash-to-debt ratio of 0.08 and an equity-to-asset ratio of 0.13 place the company lower than 89.59% of the industry. A high operating margin of 10.58% and a return on equity of 31.47% contributes to the high profitability rank.

Trimble

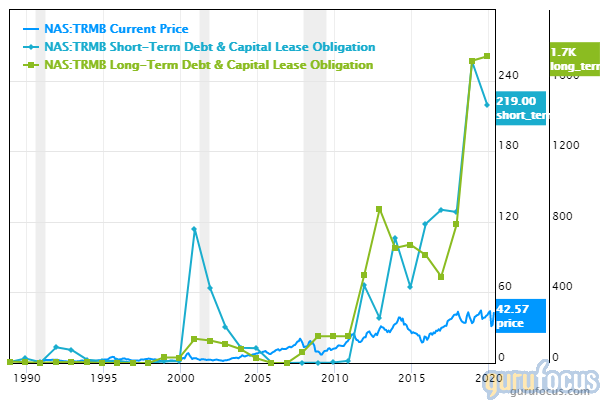

The third new addiition to the portfolio was the purchase of 11.32 million shares of Trimble. The shares were purchased at an average price of $39.31 during the quarter. The purchase had a 2.56% impact on the portfolio and is the first time the stock has been in the portfolio since 2016.

The SaaS technology company operates out of California. It services global industries in the agriculture, building and construction, natural resources and utilities, governments and transportation industries. As of May 27, the stock was trading at $42.16 per share with a market cap of $10.57 billion. The Peter Lynch chart suggests the company is trading slightly above its intrinsic value.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 4 out of 10. While the company has a cash-to-debt ratio of 0.1, which is lower than 94% of the industry, an operating margin of 12.72% places it higher than 83.44% of the industry.

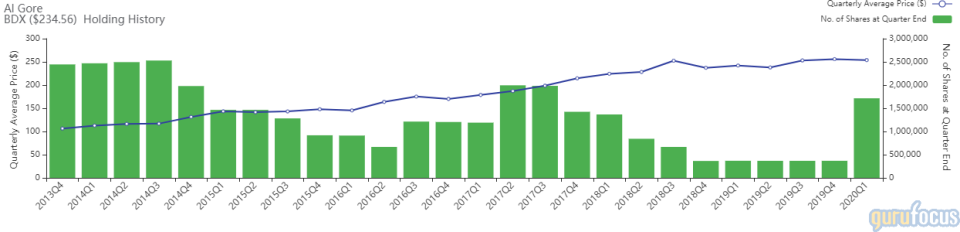

Becton, Dickinson and Co.

Representing a 365.95% growth, the portfolio saw the addition of 1.34 million shares of Becton, Dickinson and Co. The shares were purchased at an average price of $253.86. Overall, the purchase represented a 2.20% impact on the equity portfolio.

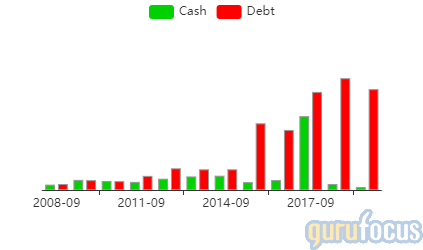

Commonly known as BD, the American medical technology company manufactures and sells medical devices, instrument systems and reagents. BD also provides consulting and analytics services in certain geographies. As of May 27, the stock was trading at $234.45 per share with a market cap of $67.72 billion. The Peter Lynch chart suggests the company was trading well above its intrinsic value at the end of 2019.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 3 out of 10. A low price-earnings ratio of 70.65 and cash-to-debt ratio of 0.11 lead to the low financial strength and valuation ranks. An operating margin of 11.8% places the company higher than 70.05% of the industry.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Richard Snow Buys Into Tyson and Reduces Dow in 1st Quarter

Leon Cooperman Sells Fiserv and United Airlines During 1st Quarter

Steve Mandel Buys Into 3 New Holdings in 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance