Akamai (AKAM) Earnings and Revenues Beat Estimates in Q4

Akamai Technologies Inc. AKAM delivered non-GAAP fourth-quarter 2018 earnings of $1.07 per share beating the Zacks Consensus Estimate by 7 cents. The figure also surged 51% from the year-ago quarter and came ahead of management’s guided range of 97 cents to $1.03 per share.

Better-than-expected year-over-year growth can be attributed to robust increase in revenues, lower tax rate and favorable impact of the cost reduction initiatives.

Revenues of $713 million outpaced the Zacks Consensus Estimate of $704 million and increased 8% from the year-ago quarter (up 10% adjusted for foreign exchange). Further, revenues surpassed management’s guided range of $692 million and $709 million.

The top line benefited from robust performance ofcloud security business, growth in Media and Carrier Division, strong seasonal traffic and operational efficiency.

Excluding Internet Platform Customers, revenues increased 10% year over year (up 11% adjusted for foreign exchange) to $670 million. Revenues from Internet Platform Customers were $43 million, down 14% year over year.

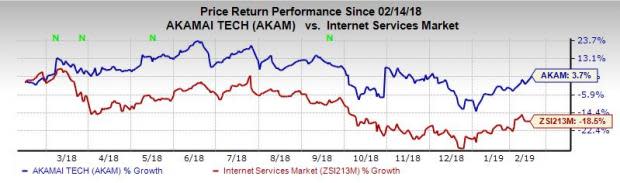

Akamai has returned 3.7% year over year, against the industry’s decline of 18.4%.

Robust Cloud Security Solutions Growth

Cloud Security Solutions (26% of total revenues) revenues were $185 million, surging almost 36% year over year (up 38% adjusted for foreign exchange). Solid growth was driven by strong demand for Kona Site Defender, Bot Manager and Prolexic Solutions. The traction gained by Enterprise Application Access and Enterprise Threat Protector also aided growth.

Akamai recently closed the buyout of Janrain in an all-cash transaction. The company’s focus on enhancing its security solutions portfolio amid growing data traffic is in sync with the latest agreement.

Management remains optimistic over the growing influence of its security solutions during the reported quarter among media customers, in particular.

Notably, Akamai is one of the largest cloud security providers. It exited the quarter at a run-rate of around $750 million for security business.

Segment Details

Web Division (almost 54% of total revenues) revenues increased 9% year over year (up 10% adjusted for foreign exchange) to $385 million. Solid cloud security solutions growth as well as strong performance from Image Manager, mPulse and Digital Performance Management solutions drove growth.

Media and Carrier Division (46% of total revenues) revenues of $328 million increased 8% (up 9% adjusted for foreign exchange) from the year-ago quarter. Akamai stated that growth was primarily aided by initiatives to improve traffic growth across many global media accounts.

Traffic growth was especially strong in OTT and gaming sectors. Management also remains elated on the recent record download of Epic Games’ new game, Fortnite.

U.S. revenues were $434 million (60.1% of total revenues), up 2% year over year. International revenues (39.1% of total revenues) were $279 million, up 20% year over year (up 23% adjusted for foreign exchange) primarily driven by robust growth in Asia Pacific and EMEA region.

Management stated that foreign exchange volatility negatively impacted revenues by $8 million from the year-ago quarter. Further, the foreign exchange movement affected revenues by $3 million sequentially.

Operating Details

Adjusted EBITDA margin of 42%, registered an expansion of 500 basis points (bps) on a year-over-year basis. This can primarily be attributed to higher revenues and improving operational efficiency.

Non-GAAP cash gross margin expanded nearly two points from the year-ago quarter to 79%. Non-GAAP operating margin expanded 100 bps from the year-ago quarter to 28%.

Balance Sheet & Cash Flow

As of Dec 31, 2018, Akamai’s cash and cash equivalents (and marketable securities) were $1.89 billion as compared with $1.80 billion recorded at the end of the previous quarter.

The company generated cash flow from operations of $286.2 million as compared with $310.5 million in the previous quarter.

In the quarter under review, Akamai repurchased around 1.9 million shares for $124 million. Further, the company had 163 million shares outstanding as of Dec 31, 2018.

Fiscal 2018 Highlights

Akamai delivered non-GAAP fiscal 2018 earnings of $3.62 per share, up 38% year over year.

Revenues of $2.714 billion in fiscal 2018 increased 9% year over year. Excluding Internet Platform Customers, revenues increased 11% to $2.540 million. Revenues from Internet Platform Customers were $175 million, down 14% year over year.

Guidance

For first-quarter 2019, Akamai envisions revenues between $690 million and $704 million. Management anticipates unfavorable foreign exchange and seasonal summer traffic care to impact revenues. The Zacks Consensus Estimate is pegged at $709.4 million.

Non-GAAP cash gross margin is expected to be roughly 78%.

Non-GAAP operating expenses are projected between $252 million and $256 million. Adjusted EBITDA margin is anticipated to be in the range of 41-42%. Non-GAAP operating margin is projected to be in the range of 28-29%% for the first quarter.

Non-GAAP earnings are envisioned in the range of $1.00 cents to $1.05 per share. The Zacks Consensus Estimate is pegged at 97 cents.

Akamai provided guidance for 2019. Owing to currency headwinds, the company expects full-year 2019 revenues between $2.81 billion and $2.85 billion. The Zacks Consensus Estimate is pegged at $2.9 billion.

Non-GAAP earnings are projected to be approximately $4.15 per share. The Zacks Consensus Estimate is pegged at $4.02 per share.

Adjusted EBITDA margin is anticipated to be around 41%. Non-GAAP operating margin is projected to be 28%.

Management maintains its plans to achieve non-GAAP operating margin of 30% in 2020.

Zacks Rank & Stocks to Consider

Currently, Akamai carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Symantec Corporation SYMC, salesforce.com, inc. CRM and Twilio Inc. TWLO, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Symantec, salesforce and Twilio have a long-term earnings growth rate of 7.9%, 24.2% and 9%, respectively.

3 Medical Stocks to Buy Now

The greatest discovery in this century of biology is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating revenue, and cures for a variety of deadly diseases are in the pipeline.

So are big potential profits for early investors. Zacks has released an updated Special Report that explains this breakthrough and names the best 3 stocks to ride it.

See them today for free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report

Symantec Corporation (SYMC) : Free Stock Analysis Report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance