Akamai (AKAM) Beats Q3 Earnings Estimates on Top-Line Growth

Akamai Technologies, Inc. AKAM reported relatively healthy third-quarter 2022 results with year-year-year growth in revenues despite a challenging macroeconomic environment and adverse currency translation effects. Both the bottom line and top line beat the Zacks Consensus Estimate on solid demand trends.

Quarter Details

GAAP net income in the reported quarter was $108.2 million or 68 cents per share compared with $178.9 million or $1.08 per share in the year-ago quarter. The decline in GAAP earnings despite top-line growth was primarily attributable to higher operating expenses. Non-GAAP net income in the quarter was $200 million or $1.26 per share compared with $238.9 million or $1.45 per share a year ago. Non-GAAP earnings surpassed the Zacks Consensus Estimate by 3 cents.

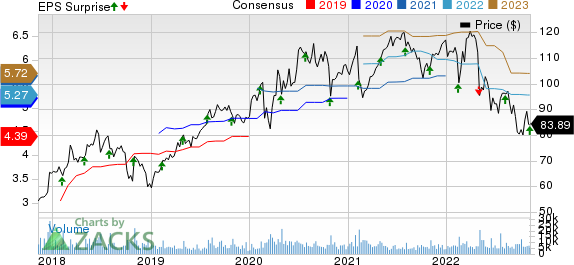

Akamai Technologies, Inc. Price, Consensus and EPS Surprise

Akamai Technologies, Inc. price-consensus-eps-surprise-chart | Akamai Technologies, Inc. Quote

Revenues of $881.9 million increased 2.5% year over year and beat the consensus estimate of $875 million. Growth in the Security and Compute businesses primarily contributed to the top line, which collectively improved 23% year over year. Region-wise, U.S. revenues were $461.1 million, up 2.7% year over year. International revenues were $420.8 million, up 2.3%.

By product groups, Security Technology Group revenues were $379.5 million, up 13.4% year over year, driven by growth in the application security business and solid performance from Guardicore. Revenues from Delivery aggregated $393.2 million, down 14.9% owing to non-renewals by some customers and continued deceleration in traffic growth among the largest customers. Compute revenues increased 71.5% year over year to $109.1 million, led by incremental contribution from the Linode acquisition and the addition of improved enterprise capabilities to the compute platform.

Non-GAAP operating margin contracted to 28% from 32% in the prior year. Adjusted EBITDA declined to $368.5 million from $396 million a year ago for a margin of 42%, down from 46%.

Cash Flow & Liquidity

In the first nine months of 2022, Akamai generated $933.2 million in cash from operating activities compared with $1,017.7 million in the prior-year period. As of Sep 30, 2022, the company had $457.8 million in cash and cash equivalents with $681.4 million of operating liabilities. During the reported quarter, Akamai repurchased 1.8 million shares for $163 million at an average price of $90.93 per share.

Guidance

For the fourth quarter of 2022, Akamai expects revenues between $890 million and $915 million with incremental contribution from Linode. It expects a non-GAAP operating margin of 27%. Non-GAAP earnings are envisioned in the range of $1.23-$1.30 per share.

For 2022, Akamai has narrowed its earlier revenue guidance and expects revenues between $3,580 million and $3,600 million, down from $3,570 million and $3,610 million expected earlier due to uncertain market conditions and challenging macroeconomic conditions. It expects a non-GAAP operating margin of 28%. Non-GAAP earnings are expected in the range of $5.23-$5.30 per share, down from earlier expectations of $5.19-$5.37.

Zacks Rank & Stocks to Consider

Akamai currently has a Zacks Rank #3 (Hold).

A better-ranked stock in the broader industry is Sierra Wireless, Inc. SWIR, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sierra Wireless has a long-term earnings growth expectation of 15% and delivered an earnings surprise of 229.9%, on average, in the trailing four quarters. Over the past year, the stock has gained 57.3%. Earnings estimates for the current year have moved up 1025% since November 2021. Sierra Wireless continues to launch innovative products for business-critical operations that require high security and optimum 5G performance.

Aviat Networks, Inc. AVNW carries a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has been revised 23.5% upward since November 2021.

Aviat Networks pulled off a trailing four-quarter earnings surprise of 9.7%, on average. It has soared 137.6% in the past two years.

Comtech Telecommunications Corp. CMTL, sporting a Zacks Rank #1, is another key pick. Headquartered in Melville, NY, the company is a leading global provider of next-generation 911 emergency systems and secure wireless communications technologies to commercial and government customers.

Comtech’s key satellite earth station modems incorporate forward error correction and bandwidth compression technologies, which enable its customers to optimize their satellite networks by either reducing their satellite transponder lease costs or increasing data throughput. It holds leadership positions in the market for high-throughput modems used in cellular backhaul.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sierra Wireless, Inc. (SWIR) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Aviat Networks, Inc. (AVNW) : Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance