Air Canada (TSX:AC) Stock: How to Make Money From the Dip

Air Canada (TSX:AC) stock has dipped 19% in the last week after rising 17% in the prior three weeks. The stock’s rally and fall are in the $14-$20 price range, around which it has been juggling since the pandemic-driven lockdown in April. This volatility in the stock is due to the updates.

Air Canada stock sensitive to news

In the recent update, AC was preparing to start flights to the U.S. when the border restrictions ease, but an international traveler flying on its flight was confirmed COVID-19 positive. Moreover, the fears of the second wave of COVID-19 are building up. It is unclear if the Justin Trudeau government will extend border restrictions or ease them despite risks.

The COVID-19 case comes just days after AC canceled and consolidated hundreds of flights for which it couldn’t fill half the seats. To add to the uncertainty, AC was also the North American airline with the highest number of refund complaints.

Such incidents fade investors’ hope of AC returning to flying internationally anytime soon. Another reason is that the general public owns 65% of AC’s shares, because of which, the stock is sensitive to news. Institutional investors generally don’t buy and sell as frequently as retail investors.

The long-term bait

Some analysts say that AC will reward those who have patience. I believe that’s just long-term bait. The next three years are crucial for the airline, as it is piling up debt. The one thing I fear is the $3.2 billion worth of debt coming due next year.

If the airline is unable to generate at least $4-$5 billion in revenue next year, it might default on the debt repayments. It can repay this debt with its $9.1 billion liquidity, but that would be like committing suicide when it is burning $17 million cash daily. AC managed to refinance $1.42 billion worth of its debt for a longer term, which comes as a temporary relief. All these activities are just delaying its bankruptcy.

AC needs to generate revenue, and for that, it needs international travel. If the travel demand doesn’t recover significantly in three years, its liquidity will exhaust, and all that would be left is debt. So, the statement that AC could reward long-term investors comes with a risk of the stock going $0. Hence, no hedge fund has AC in its portfolio.

Betting on Air Canada stock in the short term

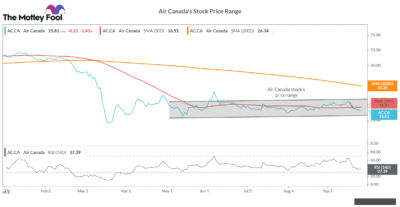

If you want to invest in Air Canada, then invest in the short term. Don’t hesitate to sell the stock if the airline’s losses continue to widen. When playing a short-term card, you should be vigilant of the technical indicators. If you look at the above chart, AC stock is moving along its price range of $14-$20.

The stock largely trades below its 50-day simple moving average (SMA). But when there is positive news, the sentiment improves, and it has some buyers, pushing the stock above its 50-day SMA. This is a short time frame that lasts not more than a week or two. Traders generally buy the share near the $14 price and sell it when it approaches near $20, representing a 40% upside. Even if they buy at $15 and sell at $19, it represents a 27% upside.

Investor corner

While the short-term returns look attractive, it is more of a gamble, where you run the risk of making a loss. The trader should learn to let go, even if it’s a loss, instead of holding onto the stock with hopes of a revival. Even Warren Buffett has sold his airline stocks at a loss, as he knew that he can recoup these losses by investing in other profitable ventures, rather than sticking to the loss-making industry.

Instead of blocking your money in a stock like AC, which has a cloudy future, invest in profitable stocks like Descartes Systems or dividend stocks like Enbridge, which has a dividend yield of 8%.

The post Air Canada (TSX:AC) Stock: How to Make Money From the Dip appeared first on The Motley Fool Canada.

More reading

CERB Alternatives Are Here! Here’s How You Can Get CRA Cash Benefits for More Than 26 Weeks

How to Earn Big TFSA Income That the Canada Revenue Agency Can't Tax

Fool contributor Puja Tayal has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Enbridge.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2020

Yahoo Finance

Yahoo Finance