AIG Inks Deal to Sell Validus Re, Eyes Portfolio Repositioning

American International Group, Inc. AIG recently inked a definitive deal to divest Validus Re, AlphaCat and the Talbot Treaty reinsurance unit to property, casualty and specialty reinsurance provider, RenaissanceRe Holdings Ltd. RNR. Subject to regulatory nod and other customary closing conditions, the transaction is likely to be completed in the fourth quarter of 2023.

The three units that are likely to be divested form part of the Validus Holdings’ buyout that AIG completed nearly five years back (in July 2018). However, Talbot Underwriting and Western World, which were also bought as part of the Validus Holdings acquisition and presently account for around $1.6 billion of total gross premiums written of AIG, are not part of the recently disclosed divestiture deal.

The consideration price for the latest transaction stands at $2.985 billion, which will be paid by RNR partly in cash amounting to $2.735 billion and the leftover balance will be paid through its common shares. To this effect, concurrent with the latest transaction announcement, RenaissanceRe announced an underwritten public offering of 6,300,000 common shares and the proceeds derived from the offering will be leveraged to finance a part of the cash consideration of the divestiture deal.

Additionally, any capital worth more than $2.1 billion of Validus Re’s shareholders’ equity can be retained by AIG. Further, the balance sheet transfer of Validus Re to RenaissanceRe is expected to create future capital synergies of roughly $400 million to AIG.

Conclusively, the total value of the divestiture deal is forecast to cross $4.5 billion. Consequent to the transaction closure, AIG estimates to incur substantial investments in the DaVinci Reinsurance and Fontana Re managed funds businesses of RNR as an effort to strengthen ties between the two companies.

The latest move seems to be a win-win situation for both parties involved in the transaction. For AIG, the divestiture deal is likely to intensify focus on the General Insurance unit, minimize volatility in its portfolio, boost cash liquidity and enable it to accelerate capital deployment. Also, investments in RNR’s businesses are expected to help AIG in tapping the growth prospects of a low-risk reinsurance market.

As an example of benefits to RenaissancRe, the recent move is anticipated to enhance the scale of its global property and casualty reinsurance business as well as boost profitability.

AIG had also resorted to divestitures in the past with an endeavor to increase focus on the General Insurance business. It has a deal in place with American Financial Group, Inc. AFG to sell another unit that was part of the Validus Holdings acquisition - Crop Risk Services. The agreement valued at $240 million is likely to be completed in the third quarter of 2023.

To complement the same endeavor, AIG also sold a 9.9% equity stake in its Life & Retirement Business to one of the world’s leading investment firms Blackstone BX in November 2021. The General Insurance business resorts to prudent underwriting and expense management efforts along with devising an extensive reinsurance strategy that aids in portfolio repositioning. The unit is usually the most significant contributor to AIG’s overall top line.

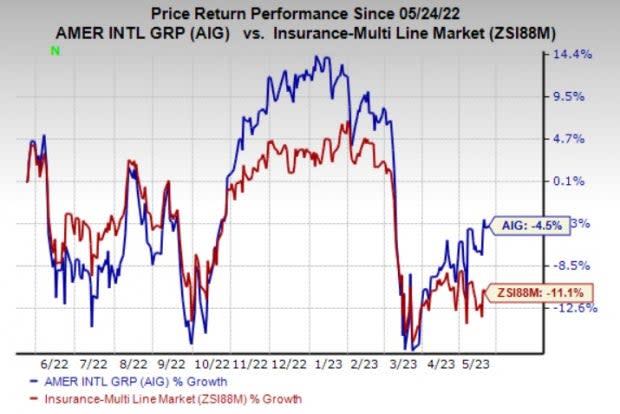

Shares of American International have declined 4.5% over a year, compared with the industry’s decline of 11.1%.

Image Source: Zacks Investment Research

AIG currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blackstone Inc. (BX) : Free Stock Analysis Report

American International Group, Inc. (AIG) : Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance