Agnico Eagle (AEM) Tops on Q4 Earnings, Ups Production View

Agnico Eagle Mines Limited AEM reported net income of $35.1 million or 15 cents per share in the fourth quarter of 2017, compared with the year-ago quarter’s net income of $62.7 million or 28 cents.

Barring one-time items, earnings for the quarter were 21 cents per share, which surpassed the Zacks Consensus Estimate of 19 cents.

Agnico Eagle recorded revenues of $565 million in the fourth quarter of 2017, up about 13.2% from $499 million in the year-ago quarter. The figure however, missed the Zacks Consensus Estimate of $566 million.

Full-Year 2017 Results

For 2017, the company posted profits of $243.9 million or $1.05 per share, up 53.6% from a net income of $158.8 million or 70 cents a year ago. Additionally, Agnico Eagle reported revenues of $2.2 billion in 2017, up around 4.9% from $2.1 billion in 2016.

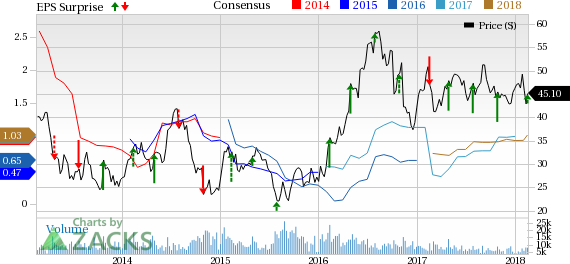

Agnico Eagle Mines Limited Price, Consensus and EPS Surprise

Agnico Eagle Mines Limited Price, Consensus and EPS Surprise | Agnico Eagle Mines Limited Quote

Operational Highlights

Payable gold production in the fourth quarter fell 3.1% year over year to 413,212 ounces from 426,433 ounces in the year-ago quarter.

Total cash costs per ounce for the fourth quarter were $592, up 7.2% from the prior-year quarter figure of $552.

All-in sustaining costs (AISC) was $905 for the fourth quarter, 8.8% higher compared to the prior-year quarter figure of $832. This is mainly due to higher total cash costs and increased sustaining capital spending.

Financial Position

As of Dec 31, 2017, cash and cash equivalents were around $643.9 million, up 17.4% from year-ago quarter.

Long-term debt was $1,371.9 million at the end of 2017, up 27.9% from $1,072.8 million a year ago.

There was no outstanding balance on credit facility as of Dec 31, 2017. This resulted in available credit lines of roughly $1.2 billion, excluding the uncommitted $300 million accordion feature.

Total capital expenditure in the fourth quarter was $236.6 million.

Outlook

Agnico Eagle expects total cash costs for full-year 2018 to be in the range of $625-$675 per ounce.

AISC is expected in the range of $890-$940 per ounce for 2018. AISC is expected to be higher this year than 2017 as a result of lower production and higher total cash costs.

The company increased production guidance for 2018 and now anticipates production to be 1.53 million ounces of gold, compared with the previous guidance of 1.5 million ounces.

Price Performance

Agnico Eagle’s shares have declined 3.7% over a year, outperforming the 9.9% fall recorded by its industry.

Zacks Rank & Stocks to Consider

Agnico Eagle currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Methanex Corporation MEOH, LyondellBasell Industries N.V. LYB and Cabot Corporation CBT.

Methanex has an expected long-term earnings growth rate of 15% and flaunts a Zacks Rank #1 (Strong Buy). Its shares have rallied 13.2% over a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

LyondellBasell has an expected long-term earnings growth rate of 9% and sports a Zacks Rank #1. The company’s shares have gained 18.4% in a year.

Cabot has an expected long-term earnings growth rate of 10% and carries a Zacks Rank #2 (Buy). Its shares have moved up 11.1% over a year.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance