Affirm Adapts Its Checkout System for Greater Flexibility

Affirm, the payment network, has launched a new product that enables merchants to offer customers more choice and flexibility at checkout.

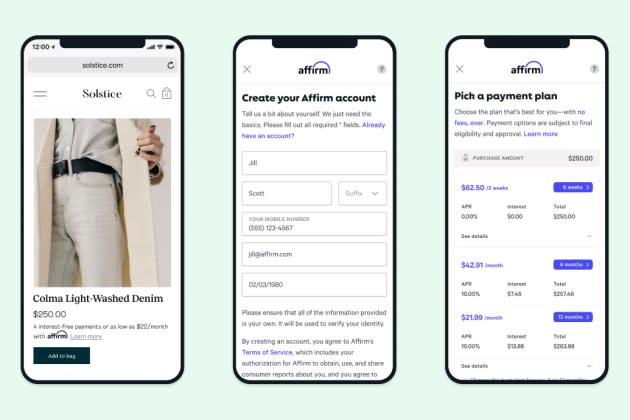

The product, called Adaptive Checkout, leverages Affirm’s proprietary technology, optimizes biweekly and monthly payment options for each transaction side-by-side in a single, integrated checkout solution, and increases transactions, according to Affirm.

More from WWD

The publicly held, San Francisco-based Affirm is a service enabling consumers to choose a payment schedule and know up front the total amount that needs to be paid, so there are no surprises with fees or hidden costs later. Affirm says it doesn’t charge late fees or penalties, and charges simple interest which does not compound. Affirm is considered an alternative to credit cards.

Thousands of retailers — including Amazon, Walmart, Adidas, Peloton, Audi, Expedia and Neiman Marcus — have partnered with Affirm. After shoppers fill their online carts with whatever they want to buy, they select Affirm at checkout and can split the total cost of any purchase over $50 into separate payments, with a range of term-length options for monthly payments depending on the cart size.

Affirm indicated that certain merchants given early access to Adaptive Checkout have seen, on average, a 26 percent increase in cart conversion, a 22 percent lift in approvals and a 20 percent increase in sales.

Adaptive Checkout gives personalized payment options based on the transaction size as well as a real-time underwriting decision.

Affirm is an alternative to traditional credit cards. Affirm never charges late or hidden fees, like compounded or deferred interest, and consumers know upfront what they will have to pay.

“Adaptive Checkout provides consumers with even more choice and flexibility at checkout,” said Geoff Kott, chief revenue officer at Affirm. “Providing an optimized set of payment options for consumers to choose from has resulted in our highest-converting checkout solution for merchants. Adaptive Checkout extends our ability to intelligently service a wide range of transactions, providing the option to select from four interest-free payments every two weeks to monthly payments spanning three to 36 months.”

New and existing Affirm merchant partners are now able to integrate Adaptive Checkout.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.

Yahoo Finance

Yahoo Finance