Some Aequus Pharmaceuticals (CVE:AQS) Shareholders Have Copped A Big 63% Share Price Drop

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Aequus Pharmaceuticals Inc. (CVE:AQS) shareholders. So they might be feeling emotional about the 63% share price collapse, in that time. And over the last year the share price fell 36%, so we doubt many shareholders are delighted. On top of that, the share price has dropped a further 12% in a month. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

See our latest analysis for Aequus Pharmaceuticals

Given that Aequus Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Aequus Pharmaceuticals grew revenue at 54% per year. That's well above most other pre-profit companies. In contrast, the share price is down 28% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

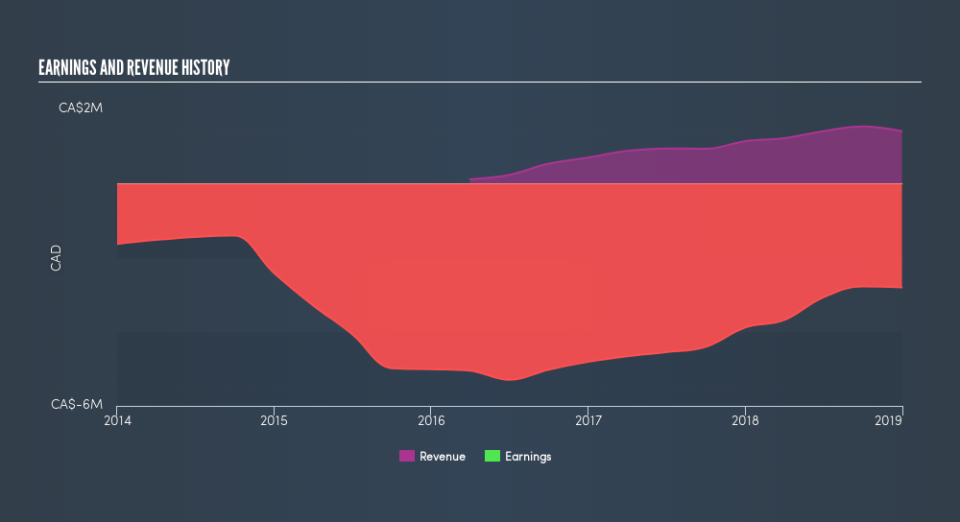

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

This free interactive report on Aequus Pharmaceuticals's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Over the last year, Aequus Pharmaceuticals shareholders took a loss of 36%. In contrast the market gained about 6.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 28% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. You could get a better understanding of Aequus Pharmaceuticals's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance