Adyton Resources Announces Corporate Changes and Financing Update

About Adyton

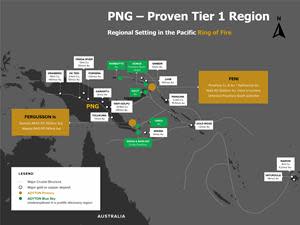

Map showing the location of Adyton’s Papua New Guinea exploration projects relative to significant PNG gold projects.

BRISBANE, Australia, Dec. 22, 2021 (GLOBE NEWSWIRE) -- Adyton Resources Corporation (TSX Venture: ADY) (“Adyton” or the “Company”) today announces that the Company’s Chairman, President and CEO, Mr Frank Terranova, has been terminated without cause and has also resigned as a director of the Company, all effective 9:00 am ET on December 24, 2021. In addition, independent directors Mr Jason Kosec, Mr Nick Tintor, Mr Fred Leigh and Mr Peter DuPlessis, as well as Mr Rod Watt, a director and Chief Geologist of the Company (collectively, the “Resigning Directors”), have each tendered their resignation as a director effective at 9:00 am ET on December 31, 2021. Mr. Watt has also resigned as Chief Geologist effective at the same time.

Mr Terranova’s termination and resignation as a director and the resignations of the Resigning Directors are attributable to what Mr Terranova and the Resigning Directors consider to be irreconcilable differences with Mayur Resources Limited (“Mayur”), Adyton’s largest shareholder owning approximately 43% of the Company’s shares, regarding the Company’s proposed C$4 million brokered private placement led by Eight Capital announced on December 3, 2021 (the “Private Placement”) and the business strategy for the Company, including the approach to the exploration and development of its exploration projects in Papua New Guinea, and demands made by Mayur for governance changes.

Following the announcement of the Private Placement by the Company on December 3, 2021, Mayur objected to the terms of the Private Placement, expressing the view that the amount sought to be raised exceeded Adyton’s requirements, was overly dilutive and was being conducted in a rushed manner, all to the detriment of Adyton and its shareholders. Mayur proposed certain potential financing alternatives to Adyton, all of which were conditional on the termination of Mr Terranova from all positions he holds with Adyton, but ultimately without being able to conclude any agreement on financing with the Board of Directors. Mayur has indicated that it intends to requisition a meeting of the shareholders of the Company to implement changes to the Company’s Board of Directors and remove Mr Terranova as Chairman, President and CEO and, accordingly, Mr Terranova and the Resigning Directors are taking these actions to enable Mayur to proceed with such changes as it wishes to implement without the need for a shareholders meeting.

Mr Terranova and the Resigning Directors share the frustration of all of Adyton’s shareholders, including Mayur, about the Company’s share price. However, in their view, this does not detract from the fact that Adyton has successfully completed the programs it set out to conduct when it initially listed on the TSX Venture Exchange in February 2021. Since that time, Adyton has achieved considerable operational success with the completion of its stated exploration programs on the Fergusson Island and Feni Island projects, which resulted in significant increases in total mineral resources across the projects, the declaration of a maiden indicated resource on the Fergusson Island project, and most recently, the reporting of a significant copper intercept from one of the five holes drilled as part of the Feni Island project drilling program.

Based on their significant experience with junior exploration companies and taking into consideration feedback received from market participants, Mr Terranova and the Resigning Directors believe the most likely means of achieving share price appreciation for all Adyton shareholders is by undertaking further exploration activities on one or more of the Company’s projects targeted at progressing them through milestones that substantively de-risk them, making them more attractive to potential equity investors, purchasers of the projects, joint venture partners and other similar parties. If the Company is unable to undertake these further exploration activities due to insufficient funding, it is the view of Mr Terranova and the Resigning Directors that this will result in a lack of potential developments for Adyton which is likely to lead to reduced investor interest, further downward pressure on the Adyton share price and reduced investor appetite to participate in financings Adyton may need to undertake.

Following the release of the Feni Island project exploration results on December 1, 2021, Adyton was advised by Eight Capital that those results had generated some investor interest in Adyton, creating the potential for it to undertake a financing provided it could be completed quickly and was appropriately priced in the context of the market to make it attractive to investors. Taking into consideration the matters described above, their experience that the availability of equity financing for junior exploration companies is highly volatile, and that it is necessary to move quickly to take advantage of financing windows when they appear, it was, and remains, the view of Mr Terranova and the Resigning Directors that it is in the best interests of Adyton and all its stakeholders for Adyton to seek to take advantage of the financing window created by the Feni Island exploration results to secure as much financing as possible and necessary for the next phase of Adyton’s exploration programs. Mr Terranova and the Resigning Directors consider the previously proposed Private Placement to have been an acceptable financing alternative available to Adyton given current market conditions.

Following Mayur’s objections to the Private Placement, representatives of the Resigning Directors held discussions with representatives of Mayur’s Board of Directors with the objective of reaching a mutually agreed financing and business strategy for Adyton. Those discussions were not successful. While Mayur proposed potential alternative financing proposals which would be less dilutive to Adyton’s shareholders, they were considered by Mr Terranova and the Resigning Directors to be inferior to the Private Placement as they would not provide Adyton with sufficient financing to attempt to progress the Company’s projects to potential milestones that might be sufficient to result in share price appreciation. It is the view of Mr Terranova and the Resigning Directors that further discussions with Mayur will not achieve a mutually agreeable business strategy and consequently an adequate financing transaction.

Moreover, based on these events, management and the Board understand and believe that the probability of successfully completing the Private Placement has substantially diminished.

Taking into account the fundamental differences of opinion between Mayur and Mr Terranova and the Resigning Directors regarding the business and financing strategy for Adyton and the demands made by Mayur for governance changes, the Resigning Directors consider their position to be untenable and have therefore reluctantly taken the decision to terminate Mr Terranova as demanded by Mayur and resign their positions in order for Mayur to implement such governance changes as it wishes in the quickest manner possible. The period through to December 31, 2021 will be utilised to effect an orderly transition to Mr Tim Crossley, also a director of Mayur, and Mr Sinton Spence, as the continuing directors of the Company and to allow them and Mayur time to consider the appointment of additional directors to replace some or all of the Resigning Directors.

ON BEHALF OF ADYTON RESOURCES CORPORATION

Frank Terranova, Chairman, President and Chief Executive Officer

For further information please contact:

Frank Terranova, Chairman, President and Chief Executive Officer

E-mail: fterranova@adytonresources.com

Phone: +61 7 3854 2389

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

ABOUT ADYTON RESOURCES CORPORATION

Adyton Resources Corporation is focused on the development of gold and copper resources in world class mineral jurisdictions. It currently has a portfolio of highly prospective mineral exploration projects in Papua New Guinea on which it is exploring for copper and gold. The Company’s mineral exploration projects are located on the Pacific Ring of Fire which hosts several world class copper and gold deposits.

Adyton was formed by a reverse takeover transaction completed with XIB I Capital Corporation on February 17, 2021 and commenced trading on the TSX Venture Exchange under the symbol “ADY” on February 24, 2021.

Adyton is also quoted on the OTCQB under the code ADYRF the Frankfurt Stock Exchange under the code 701:GR

For more information about Adyton and its projects, visit www.adytonresources.com.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/295c409b-646f-4c2d-9319-727f7d578039

Yahoo Finance

Yahoo Finance