How Advanced Micro Devices Inc. Stock Fell 41% Last Month

What happened

Shares of Advanced Micro Devices (NASDAQ: AMD) fell 41% in October of 2018, according to data from S&P Global Market Intelligence. What started as a slow decline amid general market weakness turned into an all-out rout when the microchip designer reported unimpressive third-quarter results.

So what

AMD's third quarter was a mixed bag at best. Revenues rose 4% year over year to $1.65 billion, while adjusted earnings jumped 44% higher, landing at $0.13 per diluted share. Analysts had been looking for earnings near $0.12 per share on sales in the neighborhood of $1.70 billion.

So far, so blah. The real damage was done by AMD's guidance for the fourth quarter. There, management sees top-line sales rising 8% year over year to stop at roughly $1.45 billion. Your average analyst had been looking for something more like $1.6 billion.

`

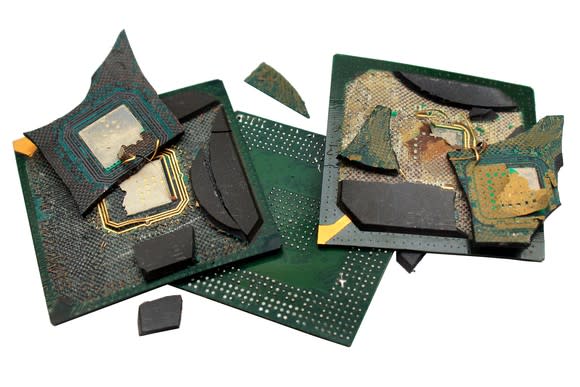

Image source: Getty Images.

Now what

AMD is squandering a rare chance to take advantage of larger rival Intel's (NASDAQ: INTC) missteps. That semiconductor giant is patching up the holes in its manufacturing technology plans and getting back on the right track again. Whatever chance AMD had to steal market share from Intel's dominant data center portfolio is vanishing quickly. At the same time, the cryptocurrency mining boom of 2017 did not create a sustainable business opportunity for AMD's crypto-friendly graphics processors.

October's drop may have been a little bit too steep, but AMD's stock was ripe for some sort of a correction. And the stock is still expensive at 84 times free cash flows and 33 times forward earnings.

More From The Motley Fool

Anders Bylund owns shares of Intel. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance