Advanced Energy (AEIS) Q2 Earnings Beat, Revenues Rise Y/Y

Advanced Energy Industries, Inc. AEIS reported second-quarter 2022 non-GAAP earnings of $1.44 per share, beating the Zacks Consensus Estimate by 26.3%. Further, the bottom line increased 15.2% from the year-ago quarter.

Revenues of $440.9 million surpassed the Zacks Consensus Estimate of $402 million. The top line improved 22% from the year-ago quarter.

Strong momentum across semiconductor equipment, telecom and networking, and industrial and medical end markets drove top-line growth.

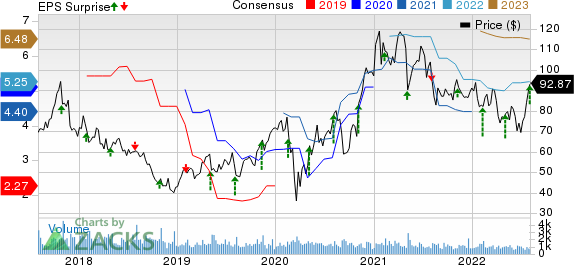

Advanced Energy Industries, Inc. Price, Consensus and EPS Surprise

Advanced Energy Industries, Inc. price-consensus-eps-surprise-chart | Advanced Energy Industries, Inc. Quote

End Market in Detail

Semiconductor Equipment: Revenues generated from the market grew 30% year over year to $228.8 million (51.9% of the total revenues), driven by the growing momentum across dielectric etch and RPS. Also, strong design wins, with high-voltage solutions, were positives.

Industrial & Medical: Revenues from the market grew 26% year over year to $104.9 million (23.8% of the total revenues) in the reported quarter. Top-line growth in the market was driven by growing design wins in medical, indoor farm lighting, factory automation and industrial printing.

Data Center Computing: Revenues from the market were $69.2 million (15.7% of the total revenues), down 0.4% from the year-ago quarter.

Telecom & Networking: Revenues generated from the market were $38.04 million (8.6% of the total revenues), up 19% from the prior-year quarter.

Operating Results

In the second quarter, the non-GAAP gross profit margin was 37.1%, which contracted 90 basis points (bps) from the year-ago quarter.

Non-GAAP operating expenses were $94.2 million, up 14.1% year over year. As a percentage of revenues, the figure contracted 150 bps year over year to 21.4% in the reported quarter.

The non-GAAP operating margin was 15.8%, contracting 70 bps from the prior-year quarter.

Balance Sheet & Cash Flow

As of Jun 30, 2022, cash and cash equivalents were $372.7 million compared with $521.2 million as of Mar 31, 2022.

Total debt was $383 million at the second-quarter end, down from $387.9 million at the first-quarter end.

For the second quarter, cash flow from operations was $37.6 million, which jumped from $9.9 million in the first quarter.

The company made dividend payments of $3.8 million and repurchased shares worth $17 million in the quarter.

Guidance

For third-quarter 2022, Advanced Energy expects non-GAAP earnings of $1.30 per share (+/- 30 cents). The Zacks Consensus Estimate is pegged at $1.37 per share.

The company anticipates revenues of $435 million (+/- $25 million). The Zacks Consensus Estimate for the same is pegged at $418.4 million.

Zacks Rank & Stocks to Consider

Currently, Advanced Energy has a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Keysight Technologies KEYS, ASE Technology ASX and Asure Software ASUR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Keysight Technologies has lost 19.9% in the year-to-date period. KEYS’ long-term earnings growth rate is currently projected at 9.1%.

ASE technology has lost 24.6% in the year-to-date period. The long-term earnings growth rate for ASX is currently projected at 23.1%.

Asure Software has lost 32.3% in the year-to-date period. The long-term earnings growth rate for ASUR is currently projected at 14%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Asure Software Inc (ASUR) : Free Stock Analysis Report

ASE Technology Holding Co., Ltd. (ASX) : Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance