Fund managers cranked up their exposures to Europe before the Brexit vote

In their efforts to deliver clients above-average returns, active fund managers will tilt their portfolios in various ways to go overweight certain assets and underweight others. They differ from passive fund managers, who aim to track the returns of certain benchmarks like the S&P 500.

Unfortunately, many active fund managers were overweight Europe during the days ahead of the UK’s EU referendum, aka the Brexit vote, which unexpectedly ended with Britons voting to leave the EU.

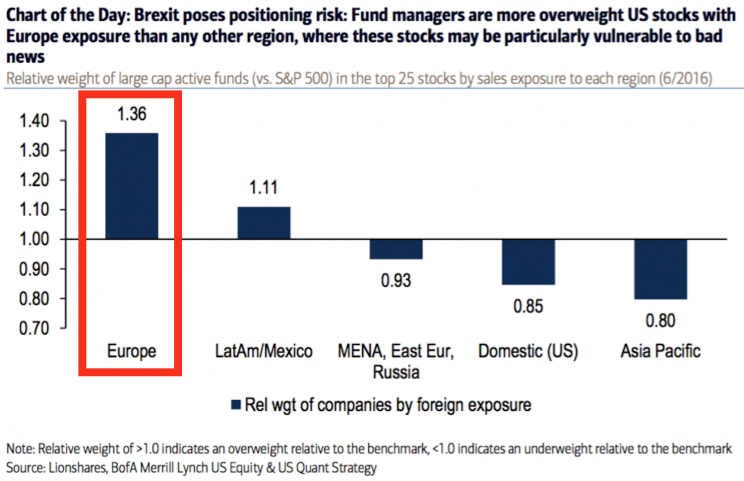

“Yes, Europe, the nexus of political discord and downward GDP revisions,” Bank of America Merrill Lynch’s Savita Subramanian said in a June 29 note to clients. “Our analysis of fund exposure by geographic region suggests that US companies exposed to Europe are more overweight by active managers than companies exposed to any other region, including pure US sales exposure.”

What followed the Brexit vote was a period of acute market volatility that had a more amplified effect on companies and stocks with more exposure to the UK and mainland Europe.

This was surely a very embarrassing position to be in for these active fund managers. And while stock markets later rebounded, it’s not hard to imagine that at least some of these fund managers bailed on these positions at lows while underwater.

Fund managers rarely beat their benchmarks

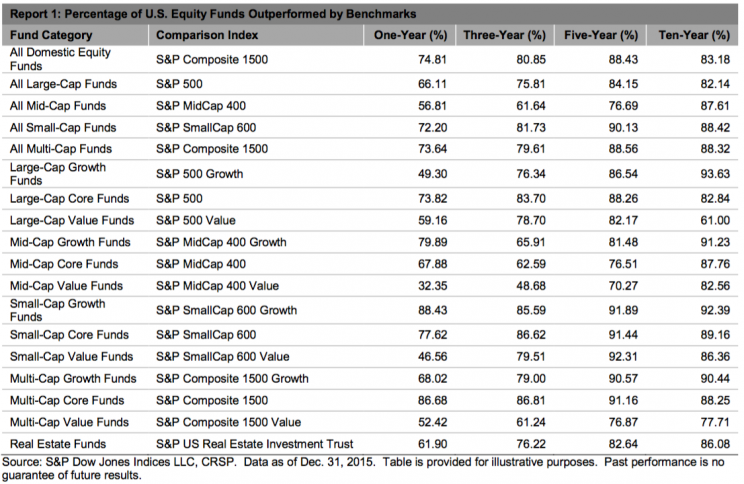

Indeed, there are countless studies and surveys that have captured the long history of active fund managers failing to deliver on what they were selling. According to S&P’s Aye Soe, 66.1% of large-cap equity funds lagged the S&P 500 (^GSPC) in 2015. Looking longer-term, 75.8% underperformed over three years, 84.1% underperformed over five years, and 82.1% underperformed over ten years. You can see how other categories of funds performed in the table below.

It’ll be some time before we exactly how the industry performed. Many fund investors will get a nice glimpse once the Q2 reports go out (the Brexit vote occurred during the end of Q2).

As far as the market is concerned, Subramanian warns that bad news during this earnings season out of individual companies regarding the Brexit vote could lead to sharp selling.

“Few corporates were seemingly worried about Brexit: we found just 29 mentions of the EU Referendum or Brexit in 1Q earnings transcripts,” she said on Wednesday. “Now Brexit has occurred, some companies with European/UK exposure may reduce earnings guidance on expectations of weaker European growth, a stronger US dollar and overall negative sentiment/uncertainty. US stocks with European exposure may be particularly vulnerable to bad news given how overweight fund managers had gotten in these stocks going into the Brexit vote.”

Some American companies like Carnival (CCL) and Delta Airlines (DAL) have already blamed Brexit for their woes. But we have yet to see a stock really get slammed on a Brexit-driven excuse. Then again, we are only a week into earnings season.

—

Sam Ro is managing editor at Yahoo Finance.

Read more:

The most important question in the stock market right now: Will earnings grow again?

A single word explains why financial markets everywhere will nosedive: Uncertainty

The dumbest math mistake investors make in the stock market

Now’s a great time to reread Warren Buffett’s op-ed he wrote after one of history’s worst sell-offs

Merrill Lynch chief economist nails the truth about risk in a perfect 3-word sentence

Yahoo Finance

Yahoo Finance