Update: Acacia Communications (NASDAQ:ACIA) Stock Gained 98% In The Last Year

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Acacia Communications, Inc. (NASDAQ:ACIA) share price is up 98% in the last year, clearly besting than the market return of around 7.6% (not including dividends). So that should have shareholders smiling. We'll need to follow Acacia Communications for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Acacia Communications

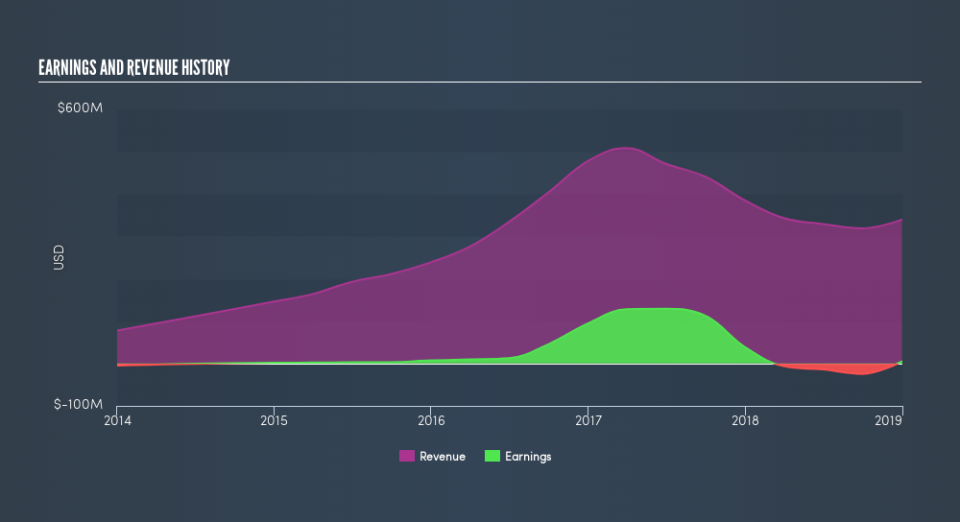

Given that Acacia Communications only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Acacia Communications actually shrunk its revenue over the last year, with a reduction of 12%. Despite the lack of revenue growth, the stock has returned a solid 98% the last twelve months. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Acacia Communications is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Acacia Communications will earn in the future (free analyst consensus estimates)

A Different Perspective

It's nice to see that Acacia Communications shareholders have gained 98% over the last year. And the share price momentum remains respectable, with a gain of 38% in the last three months. This suggests the company is continuing to win over new investors. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance