What Is Absolute Software's (TSE:ABT) P/E Ratio After Its Share Price Rocketed?

It's great to see Absolute Software (TSE:ABT) shareholders have their patience rewarded with a 38% share price pop in the last month. Looking back a bit further, we're also happy to report the stock is up 56% in the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that deep value investors might steer clear when expectations of a company are too high. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

Check out our latest analysis for Absolute Software

Does Absolute Software Have A Relatively High Or Low P/E For Its Industry?

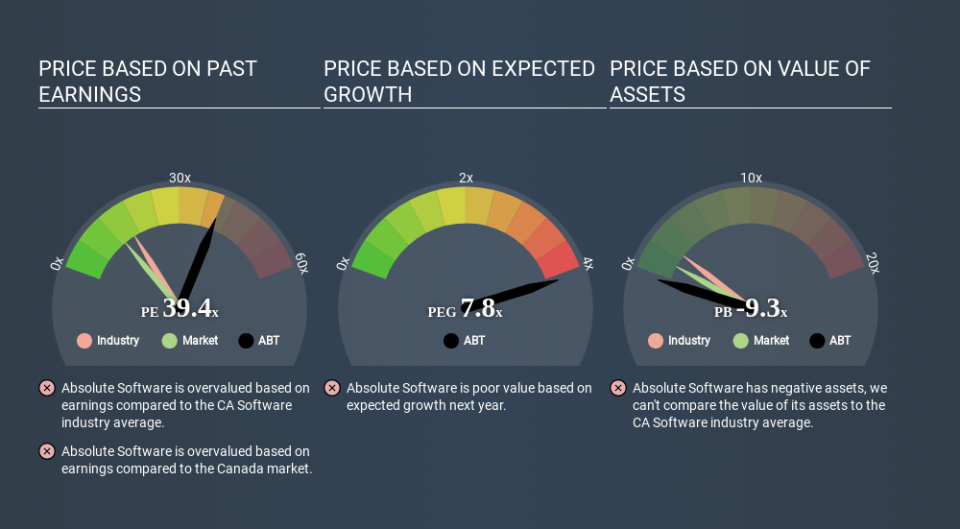

Absolute Software's P/E of 39.41 indicates some degree of optimism towards the stock. The image below shows that Absolute Software has a higher P/E than the average (16.3) P/E for companies in the software industry.

Its relatively high P/E ratio indicates that Absolute Software shareholders think it will perform better than other companies in its industry classification. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should always consider the P/E ratio alongside other factors, such as whether company directors have been buying shares.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Notably, Absolute Software grew EPS by a whopping 25% in the last year. And its annual EPS growth rate over 5 years is 12%. I'd therefore be a little surprised if its P/E ratio was not relatively high.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. That means it doesn't take debt or cash into account. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

How Does Absolute Software's Debt Impact Its P/E Ratio?

The extra options and safety that comes with Absolute Software's US$39m net cash position means that it deserves a higher P/E than it would if it had a lot of net debt.

The Verdict On Absolute Software's P/E Ratio

Absolute Software has a P/E of 39.4. That's significantly higher than the average in its market, which is 13.1. Its strong balance sheet gives the company plenty of resources for extra growth, and it has already proven it can grow. So it is not surprising the market is probably extrapolating recent growth well into the future, reflected in the relatively high P/E ratio. What we know for sure is that investors have become much more excited about Absolute Software recently, since they have pushed its P/E ratio from 28.6 to 39.4 over the last month. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

Investors have an opportunity when market expectations about a stock are wrong. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

Of course you might be able to find a better stock than Absolute Software. So you may wish to see this free collection of other companies that have grown earnings strongly.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance