ABM Industries (ABM) Q2 Earnings Beat, Revenues Miss, View Up

ABM Industries Inc.ABM reported mixed second-quarter fiscal 2021 results, wherein earnings beat the Zacks Consensus Estimate while revenues missed the same.

Adjusted earnings from continuing operations came in at 82 cents per share, beating the consensus mark by 9.3% and improving 36.7% year over year. The bottom line benefited from higher margin improvement in Work Orders and EnhancedClean services as clients continue to incorporate disinfection into their operations. Persistent management of direct labor to align with the operating environment is also an added positive.

Additionally, the Technical Solutions segment gained from improved business mix and execution of higher margin projects. These were, however, partially offset by higher corporate expenses (owing to planned investments in information technology) and higher share based compensation expenses.

Total revenues of $1.49 billion missed the consensus estimate by 0.3% but improved 0.1% from the year-ago quarter. Despite ongoing COVID-19-related client disruptions, the year-over-year growth was due to huge demand for disinfection-related work orders and EnhancedClean services in the Business & Industry, Technology & Manufacturing, Education, and Technical Solutions segments. These were, however, partially offset by continued softness in the Aviation segment.

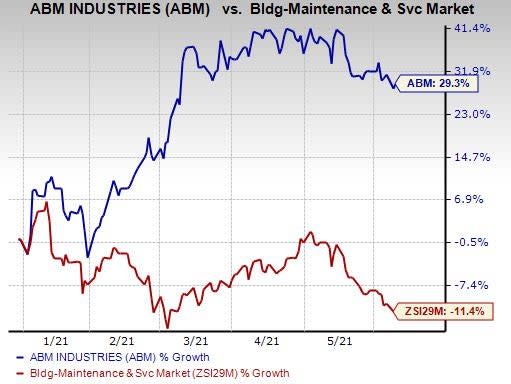

So far this year, shares of ABM Industries have gained 29.3% against with 11.4% decline of the industry it belongs to.

Image Source: Zacks Investment Research

Let’s check out the numbers in detail.

Segment-wise Revenues

Business & Industry revenues increased 1.4% year over year to $796.2 million. Technology & Manufacturing revenues improved 5.4% year over year to $246.3 million. Education revenues of $214.2 million increased 7% from the prior-year quarter. Technical Solutions revenues increased 2.6% year over year to $125.5 million.

Aviation revenues decreased 19.7% year over year to $148.3 million.

Operating Results

Adjusted EBITDA came in at $106.6 million, up 17.1% from the prior-year quarter. Adjusted EBITDA margin rose to 7.1% from 6.1% in the year-ago quarter.

Operating expenses decreased 2.4% from the year-ago quarter to $1.27 billion. Selling, general and administrative expenses increased 35.6% from the year-ago quarter to $161.9 million.

Balance Sheet & Cash Flow

ABM Industries exited second-quarter fiscal 2021 with cash and cash equivalents of $435.7 million compared with $378.3 million at the end of the prior quarter. Long-term debt was $524.2 million compared with $573.8 million at the end of the prior quarter.

Net cash generated from operating activities totaled $125.9 million in the reported quarter. Free-cash flow came in at $117.6 million.

ABM Industries Inc. Price, Consensus and EPS Surprise

ABM Industries Incorporated price-consensus-eps-surprise-chart | ABM Industries Incorporated Quote

Dividend Payout

ABM Industries paid out a quarterly cash dividend of 19 cents per share, leading to $12.7 million of total dividend payout in the reported quarter. Additionally, the company’s board of directors announced a quarterly cash dividend of 19 cents, payable on Aug 2, 2021, to its shareholders of record as of Jul 1, 2021. This marked the 221th consecutive quarterly cash dividend declared by the company.

Fiscal 2021 Guidance

For fiscal 2021, ABM Industries raised its guidance for adjusted income from continuing operations to the range of $3.30 to $3.50 per share from the prior guidance of $3.00 - $3.25. The Zacks Consensus Estimate of $3.23 lies within the updated guidance.

Currently, ABM Industries carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

Equifax’s EFX first-quarter 2021 adjusted earnings of $1.97 per share beat the Zacks Consensus Estimate by 29.6% and improved on a year-over-year basis. Revenues of $1.21 billion outpaced the consensus estimate by 7.9% and improved 26.6% year over year on a reported basis as well as on a local-currency basis.

Robert Half’s RHI first-quarter 2021 earnings of 98 cents per share beat the consensus mark by 22.5% and were up 24.1% year over year. Revenues of $1.4 billion surpassed the consensus mark by 3.3% but declined 7.2% year over year on a reported basis and 7.6% on an adjusted basis.

Omnicom’s OMC first-quarter 2021 adjusted earnings of $1.33 per share beat the consensus mark by 16.7% and increased 11.8% year over year. Total revenues of $3.4 billion surpassed the consensus estimate by 3.6% and marginally increased year over year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

ABM Industries Incorporated (ABM) : Free Stock Analysis Report

Robert Half International Inc. (RHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance