ABB to Exit Remaining Stake in Hitachi Energy Joint Venture

ABB Ltd ABB has entered into an agreement to sell its remaining 19.9% equity stake in the Hitachi Energy joint venture to Hitachi, Ltd.

The Hitachi Energy joint venture (formerly Hitachi ABB Power Grids) was formed in 2020, following ABB’s divestment of 80.1% of its Power Grids business to Hitachi. ABB held a pre-defined option to exit the remaining stake by 2023. The call option has an exercise value of $1.679 billion.

Subject to regulatory approvals, the transaction is expected to close in the fourth quarter of 2022. Until full separation, ABB will continue to provide transition services to Hitachi Energy.

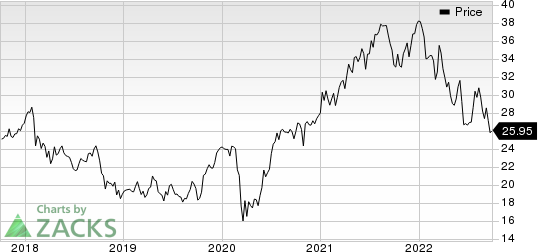

ABB Ltd Price

ABB Ltd price | ABB Ltd Quote

Upon completion of the sale, ABB expects net positive cash inflows of approximately $1.425 billion. It does not expect to record any material gain or loss from the sale.

With this divestment, ABB’s portfolio will be focused entirely on industrial customers. It will help the company focus more on key market trends and customer needs of electrification of transport and industry, automated manufacturing, digital solutions and increased sustainable productivity.

Timo Ihamuotila, chief financial officer of ABB, said, "We are delighted to have agreed on the final part of the transaction earlier than expected and on favorable terms. This will further strengthen our balance sheet and give us additional flexibility in our capital allocation decisions."

Zacks Rank & Key Picks

ABB currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Applied Industrial Technologies, Inc. AIT presently carries a Zacks Rank #2 (Buy). The company pulled off a trailing four-quarter earnings surprise of 22.8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Applied Industrial has an estimated earnings growth rate of 10.9% for the current year. Shares of the company have gained 5.1% in the past three months.

Eaton Corporation plc ETN currently carries a Zacks Rank of 2. The company delivered a trailing four-quarter earnings surprise of 1.4%, on average.

Eaton has an estimated earnings growth rate of 14.1% for the current year. The stock has rallied 5.3% in the past three months.

IDEX Corporation IEX presently carries a Zacks Rank #2. The company delivered a trailing four-quarter earnings surprise of 4.6%, on average.

IDEX has an estimated earnings growth rate of 26% for the current year. The stock has rallied 9% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

ABB Ltd (ABB) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance