A new Aurora CEO would face Toronto Maple Leafs-like turnaround challenge: analyst

An update on new leadership at Aurora Cannabis (ACB.TO)(ACB) could be in the cards as the company reports its latest financial results on Thursday. However, analysts warn attracting a splashy new CEO to boost investor confidence will be tough given concerns about the pot producer’s debt-heavy balance sheet.

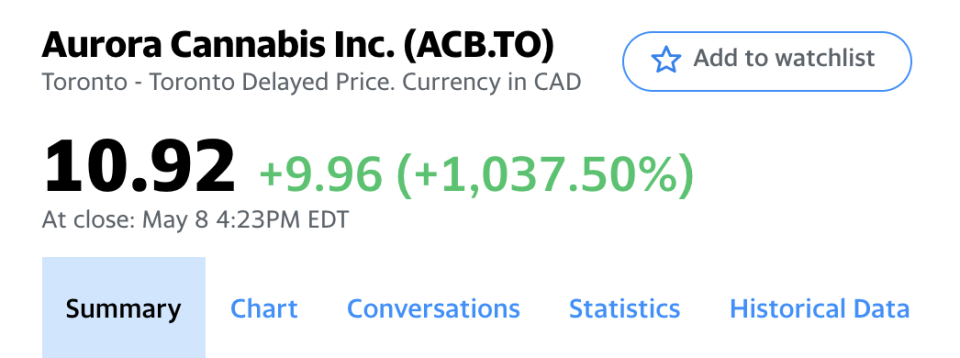

Shares of Edmonton-based Aurora started Monday’s trading session up more than 1,000 per cent, the result of a 12:1 reverse stock split done to keep shares from being dropped by the New York Stock Exchange. The NYSE told Aurora in April that its shares fell below an average price of US$1 over a 30 trading-day period, a breach of its continued listing standards.

The stock has been slammed over the past year as the company fell short of promised profitability targets, risked breaking debt covenants, and diluted its share count by turning to the market for equity financing. Toronto-listed shares have plunged more than 90 per cent in the past 12 months.

The top ranks of the company have been equally unstable. On the Saturday before the start of the Christmas holidays, Aurora announced its highest-profile executive was stepping down. Chief corporate officer Cam Battley’s abrupt departure was then followed in February by founder and chief executive officer Terry Booth’s retirement, though he maintains a seat on the board.

Aurora chairman Michael Singer is replacing Booth on an interim basis. The announcement was coupled with news that Aurora would lay off about 500 staff, write down nearly $1 billion in assets, and restructure debt arrangements with lenders. Singer has said he is not interested in becoming permanent CEO.

While Aurora has been quiet about successors, PI Financial analyst Jason Zandberg raised the issue in a research note last week.

“This is something to watch for when they release their earnings,” he told Yahoo Finance Canada.

Zandberg expects Aurora would give preference to someone from the consumer packaged goods sector able to make inroads on the company’s plan to strike partnerships with well-known brands. However, he notes a newcomer would have to accept Aurora’s tarnished reputation, and take on a litany of company-specific issues in an already challenging sector.

“There’s a lot of heavy lifting to do right off the bat. It’s not an ideal situation. But if you can turn it around, it definitely has rewards,” Zandberg said. “It’s kind of like coming in as the head coach of the Toronto Maple Leafs. You know, there is a lot of glory if you can do it. But you’re going into a long dry spell.”

Another cannabis sector analyst who spoke to Yahoo Finance Canada on background said finding an ideal person will be difficult to do quickly, and there are multiple executive-level openings in the cannabis sector right now. Like Zandberg, he believes consumer packaged goods experience is preferred, along with pharmaceutical and global business credentials.

Aurora shares climbed last year when the company announced a strategic partnership with billionaire activist investor Nelson Peltz, whose resume includes The Procter & Gamble Company (PG), the Snapple Beverage Corporation, Heinz, and many others. The announcement was seen by some as a signal that Aurora would soon land a big investment from a major food or beverage partner. No such deals have materialized.

“There was a lot of initial excitement,” Zandberg said. “There is only so much you can expect from someone who comes on as a board member or in a non-direct role.”

Peltz was granted options to purchase 19,961,754 common shares in the company at a price of $10.34 per share. Aurora’s stock has not traded above $10 since March 2019.

Both analysts expect the pot producer’s balance sheet will be the major focus for investors when the company reports financial results after markets close on Thursday.

Aurora said it had about $205 million in cash as of March 31. The company has filed a short form prospectus to raise up to US$250 million in a renewed at-the-market program, and has $100 million remaining on its outstanding base shelf prospectus.

While Aurora has said it’s on track to hit cost-cutting targets, concerns persist about its ability to right the ship.

“If you take their spending over the last few quarters, and you project it forward, and look at their cash positions, those numbers don’t add up,” Zandberg said. “I don’t believe that they will run out of cash, but there definitely is that thought out there that they won’t survive the year... a new CEO will have a lot of fires to put out.”

Jeff Lagerquist is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jefflagerquist.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance