9 Financial Stocks Oppenheimer Expects To Break Out

In a recent report, analysts at Oppenheimer took a technical look at the market and chose some of their favorite stocks in different sectors based on what they see in the charts.

Analysts like what they see in the financial space, and nine charts stood out to them as particularly bullish.

Financial Select Sector SPDR ETF (NYSEMKT: XLF)

In the chart of the XLF versus the S&P 500, analysts are looking for a bounce off of the lower boundary of the technical range that the ETF has been trading inside since the beginning of 2013.

The Blackstone Group PL (NYSE: BX)

Blackstone has broken out in early 2015 above the $35 resistance that had held three times in 2014. Analysts see the stock as a buy if the breakout holds.

Cowen Group, Inc (NASDAQ: COWN)

After forming a broad, multi-year base in the past five years, Cowen recently broke out above resistance dating back to early 2011.

Raymond James Financial Inc (NYSE: RJF)

After trading in a range between $47 and $57 for all of 2014, Raymond James finally broke out to new highs recently.

Stifel Financial Corp (NYSE: SF)

Analysts note healthy consolidation in Stifel's chart following a 2015 breakout through a resistance level that had previously held since 2011.

Related Link: What The World Thinks Of Lumber Liquidators In 6 Charts

E*TRADE Financial Corp (NASDAQ: ETFC)

After forming a broad base dating back to late-2008 and consolidating in a tight range throughout 2014, E*TRADE recently broke out to the upside.

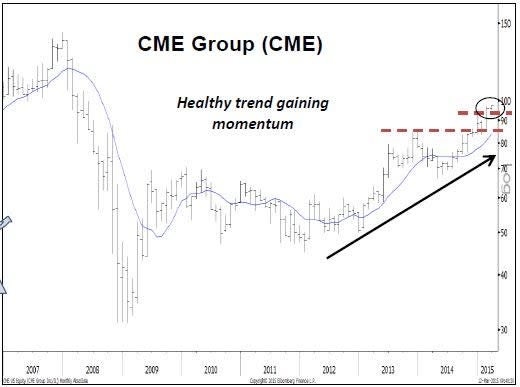

CME Group Inc (NASDAQ: CME)

CME has been on the rise since 2012, and analysts see the stock picking up momentum after recently breaking through multiple resistance levels.

Investment Technology Group Inc (NYSE: ITG)

Oppenheimer is sticking to its Buy rating on the stock after it aggressively broke above the $21 resistance level in recent weeks.

The Nasdaq OMX Group Inc (NASDAQ: NDAQ)

Analysts also mention The Nasdaq OMX Group as an imminent breakout candidate after the stock has recently approached the $50 resistance level that dates back to early 2008. The stock meets this level with several years of upward momentum behind it.

See more from Benzinga

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance