8 Stocks Viking Global Investors Continues to Buy

Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors bought shares of the following stocks in both the fourth quarter of 2019 and the first quarter of 2020.

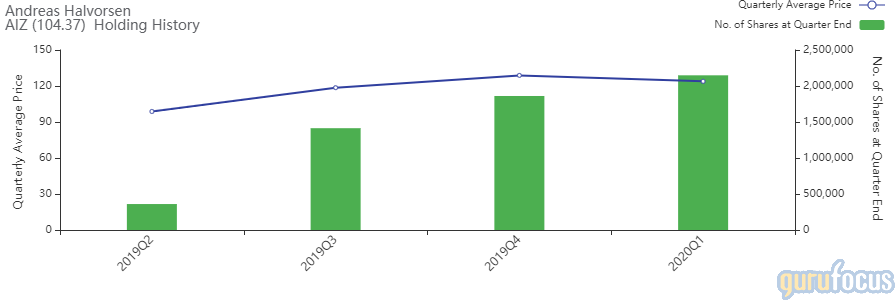

Assurant

The firm raised the Assurant Inc. (AIZ) position by 31.64% in the fourth quarter and then added 15.43% in the first quarter. The stock has a weight of 1.16% in the portfolio.

The company, which operates in the insurance industry, has a market cap of $6.23 billion. Its revenue of $10.20 billion has risen 0.90% over the last five years.

Halvorsen is the largest guru shareholder of the company with 3.60% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.49% and Pioneer Investments (Trades, Portfolio) with 0.25%.

Cigna

The firm boosted the Cigna Corp. (CI) in the fourth quarter and increased the stake again in the first quarter. The stock has a weight of 2.35% in the portfolio.

The provider of pharmacy benefit management services has a market cap of $73.60 billion. Its revenue of $154.22 billion has increased 20.80% over the last 12 months.

Dodge & Cox is the largest guru shareholder of the company with 4.07% of outstanding shares, followed by Larry Robbins (Trades, Portfolio)' Glenview Capital Management with 0.40% and Barrow, Hanley, Mewhinney & Strauss with 0.18%.

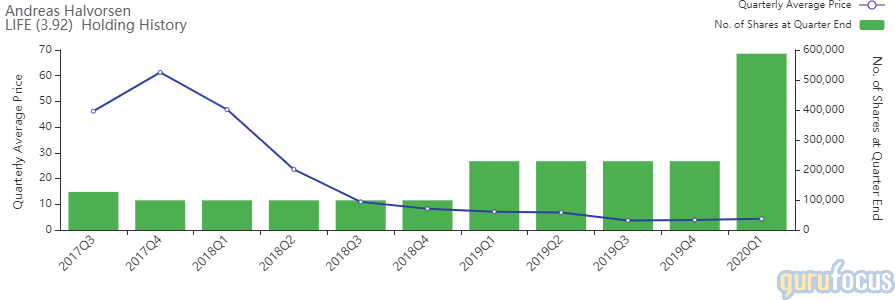

aTyr Pharma

The firm boosted the aTyr Pharma Inc. (LIEF) position by 256.21% in the fourth quarter and then added 156.21% in the first quarter. The stock has a weight of 0.01% in the portfolio.

The biotherapeutics company has a market cap of $36.69 billion.

The company's largest guru shareholder is Halvorsen with 6.28% of outstanding shares, followed by Simons with 2.24%.

Avantor

The investment firm raised the position in Avantor Inc. (AVTR) by 5.98% in the fourth quarter and added 20.45% in the first quarter. The stock has a total weight of 0.65% in the portfolio.

The company, which provides products and services to biopharma, healthcare, education and government companies, has a market cap of $10.75 billion.

Other notable guru shareholders of the company include Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 0.98% of outstanding shares, Daniel Loeb (Trades, Portfolio)'s Third Point with 0.87% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.08%.

Blueprint Medicines

In the fourth quarter, the guru increased the Blueprint Medicines Corp. (BPMC) position by 62.98%, then raised it another 22.5% in the first quarter. The stock has a total weight of 0.49% in the portfolio.

The biopharmaceutical company has a market cap of $3.48 billion.

Other notable guru shareholders of the company include Simons with 0.20% of outstanding shares, Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) with 0.12% and Caxton Associates (Trades, Portfolio) with 0.01%.

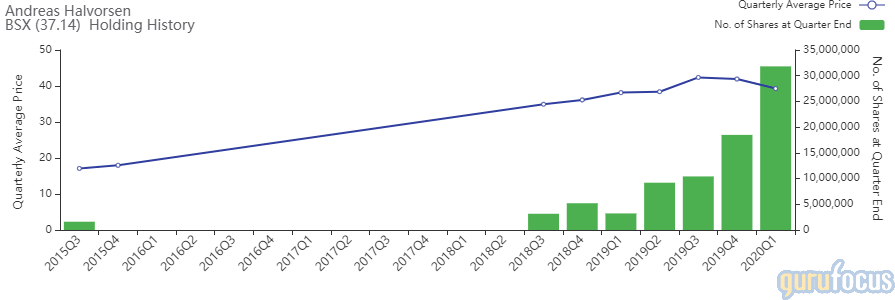

Boston Scientific

The investment firm bolstered the Boston Scientific Corp. (BSX) position by 77.53% in the fourth quarter and then raised it by 72.06% in the first quarter. The stock has a weight of 5.40% in the portfolio.

The company, which produces less-invasive medical devices, has a market cap of $51.97 billion. Its revenue of $10.78 billion has increased at an average annual rate of 6.80% over the last five years.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 3.02% of outstanding shares, followed by Vanguard Health Care Fund (Trades, Portfolio) with 2.31% and Spiros Segalas (Trades, Portfolio) with 0.25%.

Fortive

The guru raised the Fortive Corp. (FTV) position by 48% in the fourth quarter and then added 31.45% in the first quarter. The stock has a weight of 2.71% in the portfolio.

The company, which operates in the hardware industry, has a market cap of $21.44 billion. Its revenue of $7.44 billion has increased 2.70% over the last five years.

Other notable shareholders include Pioneer Investments (Trades, Portfolio) with 0.04% of outstanding shares and Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.03%.

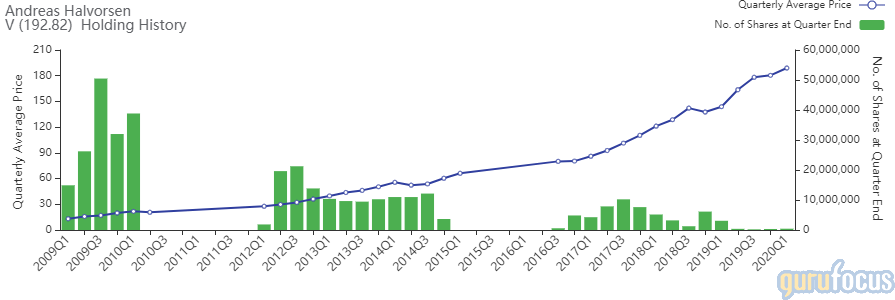

Visa

The firm increased the Visa Inc. (V) stake by 33.75% in the fourth quarter and 28.18% in the first quarter. The stock has a weight of 0.36% in the portfolio.

The payment processor has a market cap of $423.55 billion. Its revenue of $23.88 billion has increased at an average annual rate of 15.50% over the last ten years.

The largest guru shareholder is Fisher with 0.92% of outstanding shares, followed by Frank Sands (Trades, Portfolio) with 0.66%.

Disclosure: I do not own any stocks mentioned.

Read more here:

7 Stocks First Pacific Advisors Continues to Buy

8 Stocks Diamond Hill Capital Continues to Buy

Lone Pine Capital Exits Salesforce, Union Pacific

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance