7 Worst-Performing Bank Stocks of 2018 (So Far)

2018 has been a generally strong year in the financial sector. While it's been far from a smooth ride -- especially over the past few weeks -- the sector is up by 3.8% for the year, nearly double the S&P 500's 2% gain.

However, not all bank stocks have performed well in 2018. Here are the seven worst-performing North American banks so far this year, as well as one key trend and a discussion of the worst-performing U.S.-based bank.

Image Source: Getty Images.

Position | Company (Symbol) | Recent Stock Price | YTD Performance |

|---|---|---|---|

1 | Canadian Imperial Bank of Commerce (NYSE: CM) | $89.92 | (6.9%) |

2 | Bank of Montreal (NYSE: BMO) | $74.32 | (6.2%) |

3 | Wells Fargo (NYSE: WFC) | $56.29 | (5.9%) |

4 | Bank of Nova Scotia (NYSE: BNS) | $61.08 | (4.6%) |

5 | Towne Bank (NASDAQ: TOWN) | $29.30 | (4.6%) |

6 | Community Trust Bancorp (NASDAQ: CTBI) | $45.65 | (4.2%) |

7 | Royal Bank of Canada (NYSE: RY) | $77.49 | (4.1%) |

Data Source: TD Ameritrade. Performance as of 3/7/18. Only North American banks with market capitalizations of $500 million or more and listed on the Nasdaq or NYSE are considered.

What's the deal with the Canadian banks?

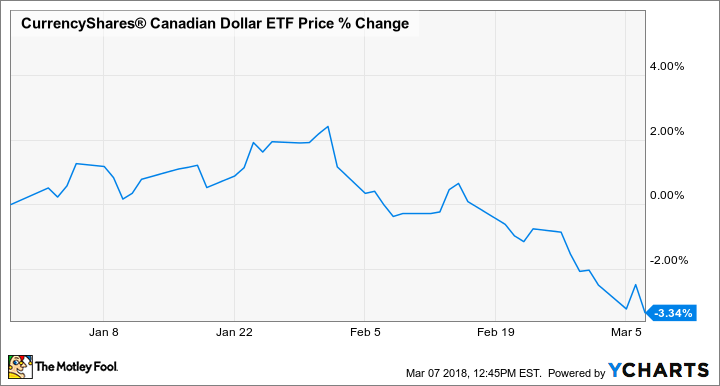

For one thing, Canadian banks are sensitive to currency fluctuations -- at least in terms of their stock prices quoted in U.S. dollars. So far in 2018, the Canadian Dollar has weakened by about 3.3% relative to the U.S. dollar, with a particularly large 5.6% drop since February 1.

In other words, because of this change in currency values, shares of Canadian banks declined more on U.S. exchanges than they did on the Toronto Stock Exchange, where they're listed in Canadian dollars.

Furthermore, some of the catalysts that have propelled U.S. bank stocks higher don't necessarily apply to Canadian banks. Tax reform is one big example. The reduction of the U.S. corporate tax rate from 35% to 21% obviously benefits U.S. banks over the long run, and the projected effects weren't fully understood until after January 1, in many cases. Canadian banks, on the other hand, don't get this benefit unless they have a significant U.S. presence, like Toronto-Dominion Bank (NYSE: TD) -- which notably is not on the list.

The prospect of deregulation is another example of a U.S. banking catalyst that doesn't have much of an effect on Canadian banks.

In a nutshell, the reason that four of the seven worst-performing banks this year are Canadian isn't because they've done poorly -- it just has been a great stock market environment for U.S. bank stocks. Combined with the exchange-rate fluctuation, Canadian banks have been at a disadvantage when it comes to strong stock performance.

Wells Fargo is the worst-performing U.S. bank of 2018

Wells Fargo has been a major laggard to the banking sector ever since news of its fake-accounts scandal broke in late 2016. In the time since then, we've learned that the scandal was worse than originally thought and there recently have been several other "mini-scandals" plaguing the bank.

However, in 2018, the bank's underperformance was kicked into high gear when the Federal Reserve decided to levy an uncharacteristically harsh punishment on the bank. Specifically, Wells Fargo is prohibited from growing larger than its total asset size as of the end of 2017 until it makes "sufficient improvements."

It's not clear what would constitute "sufficient improvements," but at a minimum, this punishment will remain in place for most of 2018. Even more significantly, Wells Fargo is now prohibited to grow, just as we're entering perhaps the best growth environment for banks in decades.

Are any of these smart buys?

Since the Fed's action against Wells Fargo, I've become much less optimistic on the stock's merits as a "value play." Until there's some clarity as to when the growth limitation is expected to end, I'd steer clear.

On the other hand, the Canadian banks could be some of the best values in banking right now. The big Canadian banks are well-run institutions with track records of solid performance, they generally pay higher dividends than their U.S. counterparts, and they're now on sale.

More From The Motley Fool

Matthew Frankel owns shares of The Toronto-Dominion Bank. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance