5G, Fiber Likely to Help 3 Wireless Stocks Tide Over the Storm

The Zacks Wireless National industry appears to be mired in a challenging macroeconomic environment and uncertain business conditions despite a gradual revival in post-pandemic market conditions. In addition, high capital expenditures for infrastructure upgrades, margin erosion, high inflationary pressures and supply-chain disruptions owing to chip shortage and tense geopolitical conditions have dented the industry’s profitability.

Nevertheless, T-Mobile US Inc. TMUS, AT&T Inc. T and Cambium Networks Corporation CMBM are likely to benefit in the long run from higher demand for scalable infrastructure for seamless connectivity with a wide proliferation of IoT and a faster pace of 5G rollout.

Industry Description

The Zacks Wireless National industry primarily comprises firms that provide a comprehensive range of communication services and business solutions. These include wireless, wireline, local exchange, long-distance calls, data/broadband and Internet, video, managed networking, messaging, wholesale and cloud-based services to retail consumers. The firms within the industry also offer IP-based voice and data services, targeted advertising, television, streaming content, cable networks and publishing operations, multiprotocol label switching networking, fiber optic long-haul networks, and hosting and communications systems to businesses and government agencies. In addition, the firms provide edge computing services that allow businesses to route application-specific traffic to where it is required and is most effective — whether in the cloud, the network, or on their premises.

What's Shaping the Future of the Wireless National Industry?

Demand Supply Imbalance: Increased infrastructure spending for network upgrades has largely compromised short-term margins. Unless the high investments generate healthy ROI in the long run, it is likely to weigh on the bottom line. In addition, the industry is continuously facing a shortage of chips, which are the building blocks for various equipment used by telecom carriers. Uncertainty regarding chip shortage and supply-chain disruptions leading to a dearth of essential fiber materials, shipping delays and shortages of other raw materials are likely to affect the expansion and rollout of new broadband networks. Extended lead times for basic components are also likely to adversely impact the delivery schedule and escalate production costs. Moreover, high raw material prices due to the prolonged Russia-Ukraine war and the consequent economic sanctions against the Putin regime have affected the operation schedule of various firms. Although various steps have been taken to address the global shortage of semiconductor chips and devise ways to increase domestic production, the demand-supply imbalance has crippled operations and largely affected profitability due to inflated equipment prices.

Fast-Tracked 5G & Fiber Optic Rollout: Most industry participants are deploying the latest 4G LTE Advanced technologies to deliver higher peak data speeds and capacity, driven by customer-focused planning, disciplined engineering and investments for infrastructure upgrades. The companies are also expanding their fiber optic networks to support 4G LTE and 5G wireless standards as well as wireline connections. The fiber-optic cable network is vital for backhaul and the last mile local loop, which are required by wireless service providers for 5G deployment. Fiber networks are also essential for the growing deployment of small cells that bring the network closer to the user and supplement macro networks to provide extensive coverage. Further, leading firms within the industry have been deploying the C-Band spectrum to gain additional coverage. These mid-band airwaves offer significant bandwidth with better propagation characteristics for optimum coverage in rural and urban areas compared with mmWave. As the 5G ecosystem evolves, customers are expected to experience significant enhancements in coverage and speed.

Profitability Woes: Aggressive promotional expenses, lucrative discounts and the adoption of several low-priced service plans to attract and retain customers amid a challenging macroeconomic environment are eroding profits. A steady decline in linear TV subscribers and legacy services due to a challenging macroeconomic environment and high inflation adds to the margin woes. Consequently, the firms within the industry are increasingly seeking diversification from legacy telecom services to more business, enterprise and wholesale opportunities. The companies are making significant investments to upgrade their network and product portfolio, including considerable advances in software-defined, wide-area network capabilities and a new Cloud Core architecture. This has realigned the companies’ wireless network toward a software-centric model to cater to increasing business demands and customer needs through remote facilities. The industry players are focused on bringing improved operational efficiencies through network simplification and rationalization, thereby boosting end-to-end provisioning time and driving standardization.

New Dimension to Business Model: The industry participants are taking a holistic approach to content delivery to help providers anticipate demand for more personalized, relevant and on-the-go experiences. Moreover, the firms are offering a variety of pathways for delivering services through a combination of network-based video transcoding, packaging, storage and compression technologies to offer new IP video formats, live TV, streaming services and home gateways to connected devices inside and outside the home. In addition, some sector firms are reinventing online advertising by pooling a unique set of assets — valuable consumer data and insights, advanced advertising capabilities and engaged, passionate fanbases. This has led to a faster turnaround of advertising campaigns, enabling marketers to access and understand the efficacy of these messages in weeks instead of months. These, in turn, are giving a new dimension to the business models.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Wireless National industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #204, which places it at the bottom 19% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates encouraging prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few wireless national stocks that are well-positioned to outperform the market based on a strong earnings outlook, let’s take a look at the industry’s recent stock market performance and valuation picture.

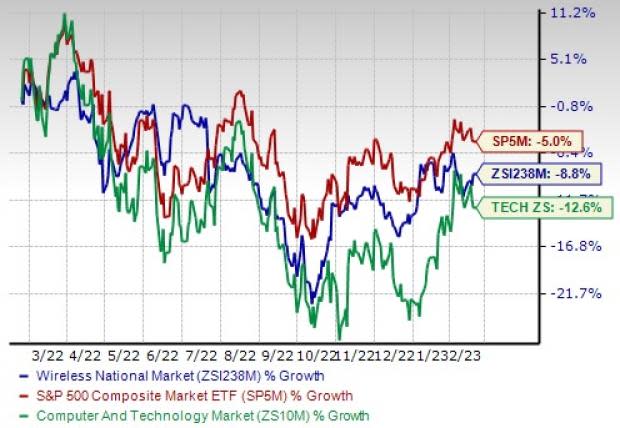

Industry Lags S&P 500, Outperforms Sector

The Zacks Wireless National industry has lagged the S&P 500 composite but outperformed the broader Zacks Computer and Technology sector over the past year.

The industry has lost 8.8% over this period compared with the S&P 500 and the sector’s decline of 5% and 12.6%, respectively.

One Year Price Performance

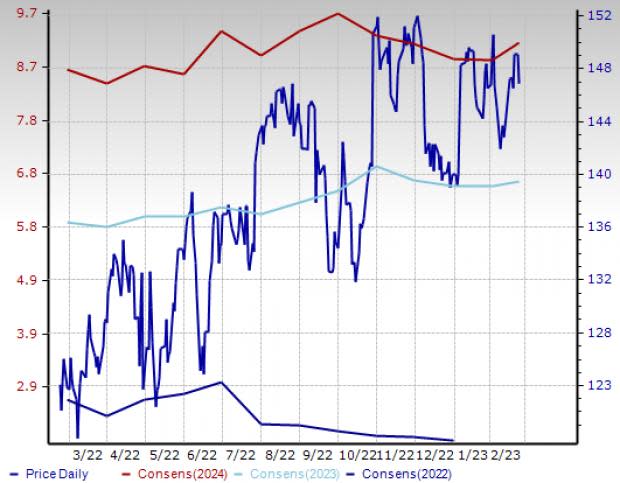

Industry's Current Valuation

On the basis of the trailing 12-month enterprise value-to-EBITDA (EV/EBITDA), which is the most appropriate multiple for valuing telecom stocks, the industry is currently trading at 7.85X compared with the S&P 500’s 11.99X. It is also below the sector’s trailing 12-month EV/EBITDA of 9.5X.

Over the past five years, the industry has traded as high as 12.02X and as low as 4.96X and at the median of 6.68X, as the chart below shows.

Trailing 12-Month enterprise value-to-EBITDA (EV/EBITDA) Ratio

3 Wireless National Stocks Likely to Move Ahead of the Pack

T-Mobile: Headquartered in Bellevue, WA, T-Mobile is a national wireless service provider. The company offers services under the T-Mobile, Metro by T-Mobile and Sprint brands. T-Mobile, through its subsidiaries, provides wireless services for branded postpaid and prepaid, and wholesale customers. The Zacks Consensus Estimate for current-year earnings has been revised 12.7% upward since February 2022, while that for the next year is up 5.5% over the same time frame. T-Mobile continues to deploy 5G with the mid-band 2.5 GHz spectrum from Sprint and is expected to provide 5G to 99% of the U.S. population. The combined company’s network has 14 times more capacity than on a standalone basis, which enables it to leapfrog the competition in network capability and customer experience. It has a long-term earnings growth expectation of 31.5% and delivered an earnings surprise of 67.6%, on average, in the trailing four quarters. The stock has a VGM Score of B. T-Mobile carries a Zacks Rank #2 (Buy).

Price and Consensus: TMUS (Chart 3)

AT&T: Based in Dallas, TX, AT&T is the second-largest wireless service provider in North America and one of the world’s leading communications service carriers. The company offers a wide range of communication and business solutions that include wireless, local exchange, long-distance, data/broadband and Internet, video, managed networking, wholesale and cloud-based services. AT&T has spun off its media assets and merged them with the complementary assets of Discovery to focus on core businesses. With a customer-centric business model, AT&T is witnessing healthy momentum in its postpaid wireless business with a lower churn rate and increased adoption of higher-tier unlimited plans. It has a long-term earnings growth expectation of 3.4% and delivered an earnings surprise of 5.5%, on average, in the trailing four quarters. The stock has a VGM Score of B. AT&T carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: T (Chart 4)

Cambium: Headquartered in Rolling Meadows, IL, Cambium operates as a wireless solutions provider, connecting people with a flexible network infrastructure with a broad portfolio of fixed wireless broadband and Wi-Fi networking solutions. The innovative offerings enable the creation of a unified wireless fabric that spans multiple frequencies of Wi-Fi, managed centrally via the cloud. Cambium is well-positioned to benefit from proprietary software and product ramp-up, likely facilitating it to deliver a compelling combination of price, performance and spectrum efficiency. One of its major advantages is its fixed wireless broadband networking infrastructure solutions, distinguished by embedded intelligence and scalability. It delivered an earnings surprise of 118.6%, on average, in the trailing four quarters and has a long-term earnings growth expectation of 16%. Cambium carries a Zacks Rank #3.

Price and Consensus: CMBM (Chart 5)

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

AT&T Inc. (T) : Free Stock Analysis Report

Cambium Networks Corporation (CMBM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance