5 Top Tech Stocks Under $20 That Promise More Gains

Technology has been one of the best performing sectors so far this year and continues to be a profitable area of investment.

Notably, Technology Select Sector SPDR ETF XLK has returned 26.2% on a year-to-date basis, reflecting strong performance.

Although the ongoing trade war between the United States and China, a slowing China economy and Brexit-related uncertainty are potent challenges, the outperformance is expected to continue due to continuing adoption of IoT, cloud, AI, ML, AR/VR, blockchain, biometrics, and advanced data analytics.

Moreover, the accelerated deployment of 5G technology — the next wireless revolution — is likely to create further opportunities. Additionally, positive trends in overall IT spending and improving PC shipments are encouraging.

Strategy to Pick Potential Stocks

The big and small, all players alike are striving to deliver cutting-edge innovative technologies, which is delivering solid returns. Here we present five low-priced stocks that also possess strong fundamentals. Although these stocks are risky in nature, they do have the potential to offer high rewards.

Today with the help of our Zacks Stock Screener, we’ve highlighted five technology stocks that hold immense growth potential. Each of these stocks is currently trading for less than $20 a share and carries a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

To further narrow down the list, we have selected those that have Growth Score of A or B. Our research shows that stocks with a Growth Score of A or B when combined with a Zacks Rank #1 or 2 offer the best upside potential.

Our Picks

Digital Turbine, Inc. APPS offers products and solutions for mobile operators, device OEMs and third parties. The company outpaced the Zacks Consensus Estimate in the trailing four quarters, with an average positive earnings surprise of 125%.

It sports a Zacks Rank #1. The stock has Growth Score of A. The stock, currently priced at $7.32, has returned 300% on a year-to-date basis.

Digital Turbine, Inc. Price and Consensus

Digital Turbine, Inc. price-consensus-chart | Digital Turbine, Inc. Quote

PC-Tel PCTI designs, develops, and delivers wireless solutions. The company outpaced the Zacks Consensus Estimate in the trailing four quarters, with an average positive earnings surprise of 146.4%.

It sports a Zacks Rank #1. The stock has Growth Score of A. The stock, currently priced at $6.78, has returned 58% on a year-to-date basis.

PC-Tel, Inc. Price and Consensus

PC-Tel, Inc. price-consensus-chart | PC-Tel, Inc. Quote

Lattice Semiconductor LSCC designs, develops and markets high performance programmable logic devices and related development system software. The company outpaced the Zacks Consensus Estimate in three of the trailing four quarters, with an average positive earnings surprise of 14.3%.

It carries a Zacks Rank #2. The stock has Growth Score of A. The stock, currently priced at $19.25, has returned 178.2% on a year-to-date basis.

Lattice Semiconductor Corporation Price and Consensus

Lattice Semiconductor Corporation price-consensus-chart | Lattice Semiconductor Corporation Quote

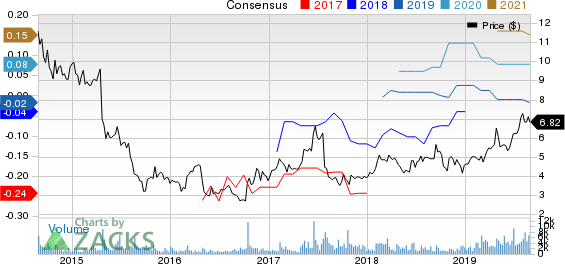

MobileIron MOBL is engaged in providing security and management solutions for mobile applications, content, and devices. The company outpaced the Zacks Consensus Estimate in one of the trailing four quarters, with an average positive earnings surprise of 45%.

It carries a Zacks Rank #2. The stock has Growth Score of B. The stock, currently priced at $6.82, has returned 48.6% on a year-to-date basis.

MobileIron, Inc. Price and Consensus

MobileIron, Inc. price-consensus-chart | MobileIron, Inc. Quote

Telenav TNAV is a provider of location-based services, or LBS, including voice guided navigation, on mobile phones. The company outpaced the Zacks Consensus Estimate in two of the trailing four quarters, with an average positive earnings surprise of 11.9%.

It carries a Zacks Rank #2. The stock has Growth Score of A. The stock, currently priced at $11.47, has returned 182.5% on a year-to-date basis.

Telenav, Inc. Price and Consensus

Telenav, Inc. price-consensus-chart | Telenav, Inc. Quote

To Conclude

Investors looking for lucrative options at lower prices should go for the aforementioned companies as these as these have encouraging financials and are reasonably good choices to start.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

MobileIron, Inc. (MOBL) : Free Stock Analysis Report

PC-Tel, Inc. (PCTI) : Free Stock Analysis Report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

Technology Select Sector SPDR Fund (XLK): ETF Research Reports

Telenav, Inc. (TNAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance