5 Top Stocks to Buy as Consumer Confidence Picks Up

Despite apprehensions of a second wave of coronavirus in the United States, consumer confidence received a significant boost as the country continues to advance with its plans to reopen the economy by relaxing the “stay-at-home” restrictions across 50 states.

This is evident from a spike in the Conference Board’s Consumer Confidence Index. In June 2020, the index surged to 98.1 from 85.9 in May 2020, which reflected almost no change. This sequential rise was above the expected mark of 91 as reported by CNBC.

Trump’s strong stimulus plan worth $1 trillion, revamping economic activities driven by re-opening shops, restaurants, malls and other public places, improving labour market conditions are anticipated to accelerate the production and expenditure in the U.S. economy in the near term. This, in turn, is likely to boost consumer sentiments further.

We believe this optimism in consumer confidence is likely to bolster personal spending, which in turn bodes well for the consumer discretionary sector. Notably, the sector currently holds lucrative prospects.

Reportedly, this particular sector has witnessed a sequential gain of 32.6%in second-quarter 2020 driven by the abovementioned factors.

More on Unemployment, Consumer Expectations & Spending

The declining unemployment rate in the United States remains encouraging. Several businesses in the country are creating more jobs amid the ongoing pandemic situation.

According to the U.S. Bureau of Labour Statistics, the unemployment rate in May declined to 13.3% in May from 14.7% in April. Further, 2.5 million of jobs were created alone in May.

The organization expected a further dip in the unemployment rate to 12.2% in June and creation of another 3 million jobs.

This improving scenario is contributing to the overall consumer spending. Per the Bureau of Economic Analysis, the personal consumption expenditure in May reflected a solid rebound, improving 8.2% from April when it declined 12.6% sequentially.

Further, this momentum is likely to continue as the U.S. economy reopens.

The surge in the Conference Board’s Expectation Index, which is based on the short-term outlook of consumers for income, business and labor market condition, is testament to the same. Notably, the index rose 106 in June from 97.6 in May.

Our Picks

Per the Zacks’ proprietary methodology, stocks with the combination of a VGM Score of A or B and a Zacks Rank #1 (Strong Buy) or 2 (Buy) offer solid investment opportunities.

Based on this, here we pick fiveconsumer discretionary stocks that boast a perfect mix of elements and strong fundamentals. You can see the complete list of today’s Zacks #1 Rank stocks here.

BJ's Wholesale Club Holdings, Inc. BJ is riding on its robust digital business,which is progressing well with omni-channel transformation. Further, the launch of platforms such as BJ’s mobile app and BOPIC — buy online, pick up in-club— remains a major positive. Further, the introduction of same-day delivery and ship from club to cater to the rising member demands has been contributing to performance.

BJ currently has a Zacks Rank #1 and a VGM Score of A. The Zacks Consensus Estimate for its fiscal 2021 earnings has climbed 28.5% to $2.21 per share over the past 60 days, indicating year-over-year improvement of 51.4%.

BJs Wholesale Club Holdings, Inc. Price and Consensus

BJs Wholesale Club Holdings, Inc. price-consensus-chart | BJs Wholesale Club Holdings, Inc. Quote

American Outdoor Brands Corporation SWBI is gaining on the well-performing Firearm segment. Increasing orders from retailers and distributors driven by a heightened consumer demand for firearms is acting as a tailwind. Further, the company’s flexible manufacturing model, strong portfolio of Shield EZ pistols, and strengthening e-commerce platform remain major positives.

American Outdoor Brands currently has Zacks Rank #1 and a VGM Score of A. The consensus mark for its fiscal 2021 earnings has climbed 109.4% to $1.78 per share over the past 60 days, suggesting year-over-year improvement of 117.1%.

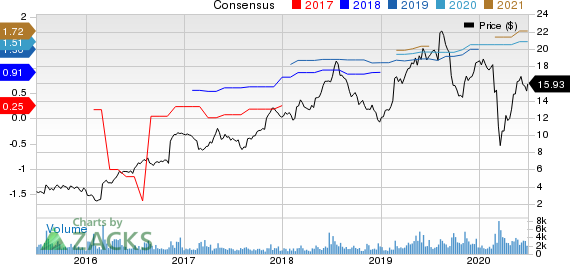

American Outdoor Brands Corporation Price and Consensus

American Outdoor Brands Corporation price-consensus-chart | American Outdoor Brands Corporation Quote

Career Education Corporation PRDO is benefiting from its continued focus on student retention, engagement and academic outcomes. Further, increasing use of technology is enabling the company in providing relevant support to students, which in turn is bolstering its student engagement process.

Career Education currently has a Zacks Rank #1 and a VGM Score of A. The Zacks Consensus Estimate for its 2020 earnings has climbed 4.1% to $1.51 per share over the past 60 days, indicating year-over-year improvement of 10.2%.

Career Education Corporation Price and Consensus

Career Education Corporation price-consensus-chart | Career Education Corporation Quote

TEGNA Inc. TGNA benefits from a stable subscriber base and higher rates. Solid contribution from acquisitions, a continued spike in subscription revenues and strong spending on political advertisements are key catalysts. TEGNA’s buyouts of local TV stations that comprise the Big Four affiliates and aggressive spending on political ads are major positives.

TEGNA currently has a Zacks Rank of 2 and a VGM Score of A. The consensus mark for its 2020 earnings has climbed 10.6% to $1.56 per share over the past 60 days. Further, the figure suggests growth of 13% on a year-over-year basis.

TEGNA Inc. Price and Consensus

TEGNA Inc. price-consensus-chart | TEGNA Inc. Quote

Nintendo Co. NTDOY is expected to gain from the popularity of its Switch video game console and Animal Crossing: New Horizons game. Moreover, the company’s partnership with Tencent allows the latter to publish Super Mario Odyssey and Mario Kart 8 Deluxe in China — the world’s largest gaming market.

Nintendo currently has a Zacks Rank of 2 and a VGM Score of B. The Zacks Consensus Estimate for its fiscal 2021 earnings has advanced 1.1% to $2.64 per share over the past 60 days. Further, the figure indicates an improvement of 6% on a year-over-year basis.

Nintendo Co. Price and Consensus

Nintendo Co. price-consensus-chart | Nintendo Co. Quote

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJs Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Nintendo Co. (NTDOY) : Free Stock Analysis Report

TEGNA Inc. (TGNA) : Free Stock Analysis Report

Career Education Corporation (PRDO) : Free Stock Analysis Report

American Outdoor Brands Corporation (SWBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance