5 Top Healthcare REITs You Can Buy Right Now

There are real estate investment trusts, or REITs, that specialize in virtually any kind of commercial real estate you can think of. Healthcare is one of the more defensive types of real estate, and also has some pretty impressive growth catalysts, so the right healthcare REIT can be a smart long-term growth investment for your portfolio.

With that in mind, here's a rundown of what REITs are, what investors should know before buying their first REIT, why healthcare real estate looks like such a compelling investment, and five healthcare REITs that could be worth a look.

Image source: Getty Images.

What is a REIT?

A real estate investment trust is essentially a pool of investor money that is used to acquire real estate assets. Most REITs acquire properties, and these are known as equity REITs, while others acquire mortgages and mortgage-related assets, and these are appropriately labeled as mortgage REITs.

Generally speaking, when you hear the word REIT, it is in reference to equity REITs. For the remainder of this article, if I use the term REIT, you can assume I'm referring to property-owning REITs. If I am referring to mortgage REITs, I'll make the distinction clear (as do most other REIT writers).

The main purpose of REITs is to give investors access to assets that they otherwise wouldn't be able to buy. For example, not too many retail investors could buy a large office building, and before REITs existed, this was an asset class for the wealthy. REITs allow investors to get exposure to apartment buildings, offices, industrial properties, healthcare facilities, and retail properties, just to name some of the most common property types.

To qualify as a REIT, a company must have at least three-fourths of its assets invested in real estate assets and must derive at least three-fourths of its income from rental income and similar sources. It also must agree to pay at least 90% of its taxable income as distributions to its shareholders, which is why REITs tend to pay higher-than-average dividends.

Important metrics for REIT investors to know

Even if you have a basic understanding of how to evaluate stocks, you may not be well-prepared to evaluate REITs effectively. Simply put, some of the most basic metrics (such as earnings) don't translate well to REITs. So, there are a few metrics REIT investors should definitely be familiar with:

Funds from operations (FFO): FFO is the "earnings" metric of the REIT world, and is the most important metric new REIT investors need to learn. It takes a REIT's net income and makes a few real estate-specific modifications to give a clearer picture of how much money a REIT is actually making. Because of an accounting concept known as depreciation, traditional earnings figures give a poor representation of how much money a REIT is actually making. When a business buys a large asset, like real estate, it is allowed to depreciate, or write off, that asset over a number of years, making it look like a big, ongoing expense on the income statement, even though it's not actually costing anything. Quite the opposite actually -- as we all know, real estate tends to increase in value over time. FFO adds depreciation back in, and also makes a few other REIT-specific tweaks to give a better picture of REIT earnings.

Adjusted/core/normalized FFO: These generally provide the most accurate picture of a particular REIT's profitability. FFO isn't a perfect metric, so many REITs use certain variations to try to give a great company-specific picture of a REIT's sustainable earnings. For example, normalized FFO may back out one-time items that won't produce recurring earnings, such as a property sale. Different companies have slightly different ways of calculating these, as they aren't standardized metrics, but the key takeaway is that they are often the most accurate picture of how much a specific REIT is actually earning.

Capitalization rate, or "cap rate": Cap rate expresses a property's annual income relative to its acquisition cost and is a metric that shows how profitable new properties are. REITs often use this to describe recently acquired properties. For example, you might hear that a certain REIT acquired $100 million worth of properties at an average cap rate of 6.5%.

Why invest in REITs?

In exchange for meeting the definition of a REIT, as I discussed in the first section, these companies enjoy a special tax structure. Specifically, REITs aren't taxed on the corporate level.

When most companies earn profits, they pay corporate income tax on their profits, and can choose to pay shareholders a dividend, which will then be taxed on the personal level. REITs avoid this sort of double taxation, as their distributions are generally taxed only after they are paid out. To be fair, REIT dividends typically don't qualify for the preferential tax treatment of most dividends, but this is still a very favorable arrangement for shareholders. It also makes REITs an especially smart choice for tax-deferred accounts like IRAs.

REITs can also be used to add diversification, which essentially means spreading your assets over a variety of different investments. Real estate can help diversify a portfolio of stock and bond investments.

Finally, in addition to the high dividends most REITs pay, REITs can also benefit from the appreciation of their properties over time. For example, if a REIT pays a 5% dividend and the value of its properties increases by 5% in 2018, you'll have a total return of 10%. REITs can be excellent total return investments over long periods of time, as I'll discuss more with some of the example REITs below.

Why invest in healthcare real estate?

Healthcare is one of the more defensive property types you can invest in. For one thing, it's something people will always need, whether the economy is strong, in recession, or in between. People can stop going on vacation and staying at hotels, stop shopping at the mall, and move their stuff out of a self-storage facility if they need to cut back. However, they'll still need to go to the doctor if they're sick.

In addition, healthcare tenants generally sign long-term leases, and moving locations is often prohibitively difficult. Turnover is minimized, and rental income tends to be steady and predictable.

Finally, there are some extremely favorable demographic conditions for healthcare. In simple terms, the U.S. population is aging fast. The 65-and-older age group is expected to roughly double in size by 2050, and the oldest segments of the population are growing even faster. Older people use healthcare services more frequently, and generally spend more money when they do. So there should be steady demand growth for healthcare facilities over the next several decades, and REIT investors could be a big beneficiary.

Image source: Welltower.

The risks of REIT investing

Before getting into any investment, it's important to be aware of the risks involved. So, just to name a few that apply here:

REITs tend to be very vulnerable to interest rate fluctuations. To make a long story short, income investors generally demand a "risk premium," or a certain yield in excess of what they could get with a risk-free investment like Treasury bonds. So, when Treasury yields rise (the 10-year Treasury is a good REIT indicator), REIT yields tend to rise accordingly, which pushes share prices down.

Like any real estate investment, REITs can get hit if the value of the properties they own falls.

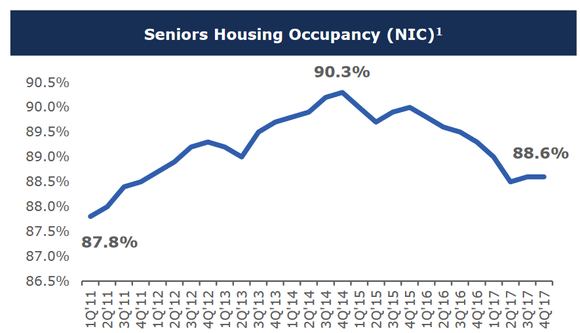

In promising areas of real estate (like healthcare) oversupply can be a concern. This is especially true when borrowing money is cheap, but property values are high, as we've seen over the past few years. In short, it sometimes becomes cheaper for companies to build new properties than to acquire existing ones, and we're seeing a bit of this in senior housing now. This is the main reason occupancy has fallen off a bit in recent years.

Image source: Ventas.

Finally, healthcare (especially senior housing) is subject to a lot of regulatory risk. With the uncertain future of the U.S. healthcare system, it's possible that new regulations could weigh on certain types of healthcare real estate.

5 top healthcare REITs to consider

Company (Symbol) | Market Capitalization | Dividend Yield | Price-to-FFO (2018 Midpoint) |

|---|---|---|---|

Welltower (NYSE: WELL) | $23.3 billion | 5.5% | 14.5 |

Ventas (NYSE: VTR) | $20.9 billion | 5.4% | 13.6 |

HCP (NYSE: HCP) | $12.3 billion | 5.7% | 13.4 |

Physicians Realty Trust (NYSE: DOC) | $2.9 billion | 5.8% | 14.9 |

Senior Housing Properties Trust (NASDAQ: SNH) | $4.3 billion | 8.5% | 9.8 |

Data source: TD Ameritrade. Share prices, dividend yields, and P/FFO metrics as of 7/13/18. Instead of 2018 midpoint (guidance unavailable), Physicians Realty Trust's and Senior Housing Properties Trust's P/FFO is based on Q1 2018 normalized FFO extrapolated on an annualized basis.

The "big three" healthcare REITs

When it comes to healthcare REITs, there are three big players -- Welltower, Ventas, and HCP. And all three have similar (but not identical) business models. So let's take a look at these three first, and explore some of the differences between them.

Welltower is the largest and most senior-oriented of the big three

Welltower is the largest of all, in terms of market cap, and specializes heavily in senior-specific property types. The company has a portfolio of nearly 1,300 healthcare properties, with 71% of the portfolio's income from senior housing properties and another 11% from long-term and post-acute properties. The remainder is composed of outpatient medical facilities.

Approximately 95% of Welltower's portfolio's facility revenue is derived from private-pay revenue sources. Generally speaking, private-pay healthcare revenue (paid by patients or insurance providers) is far more stable than revenue dependent on government reimbursements like Medicare.

Welltower's basic strategy is to amass a portfolio of properties that are located in affluent, high-barrier markets, and that are newer and nicer than those offered by the competition. The company partners with some of the top senior housing operators in the business, such as Sunrise Senior Living, Revera, and Benchmark Senior Living. There's a clear trend toward urban seniors desiring to age in place, and many of these markets are currently underserved by senior housing. For example, in Manhattan, where Welltower is currently developing a property, availability of assisted living is five times less than the national average.

One unique feature to senior housing real estate that most of the companies discussed here implement is that these properties are often not simply leased to tenants. Instead, they are operated as partnerships, meaning that the REIT's income is derived from the performance of the property, giving them some skin in the game beyond just collecting a rent check.

In a nutshell, Welltower is the most direct play on senior housing out of these five stocks. Senior housing demand is expected to soar over the coming decades, and by 2025, demand for senior housing units is expected to grow by 92,000 units per year. As the largest and one of the most financially flexible healthcare REITs, Welltower is in an excellent position to capitalize as the market grows.

Image source: Welltower.

A bit more diversification

Ventas is almost as large as Welltower and has a more diversified portfolio. Specifically, senior housing makes up only 54% of the total, with 19% coming from medical offices and smaller portions of the portfolio invested in life science facilities (7%), health systems (6%), and other types of healthcare real estate investments.

Like Welltower, Ventas' senior housing portfolio is set up partially as net-leased real estate and partially as operating partnerships with companies like Sunrise and Altria Senior Living (Ventas' biggest operating partner). And the portfolio is concentrated in high-barrier, affluent coastal markets.

Another forward catalyst for all healthcare REITs, but particularly the largest and most financially flexible, is industry consolidation. The company estimates that only about 12% to 15% of all healthcare real estate is currently REIT-owned, and some of Ventas' property types like medical offices, in particular, are still in the very early stages of REIT consolidation. There are some big advantages to scale, and as these large healthcare REITs get even larger, they'll (theoretically) benefit from increased efficiency.

In fact, expanding the medical office and life science portfolio is a key component of Ventas' strategy. The company invests in on-campus medical offices affiliated with leading health systems and university-based life science properties, and Ventas sees tons of room for growth in both of these areas.

If you want to invest in one of the largest and most financially flexible healthcare REITs, but the concentration of Welltower's portfolio concerns you, Ventas could be worth a look.

A well-rounded healthcare REIT with three core property types

In full disclosure, HCP is the healthcare REIT I own in my personal stock portfolio. While I'm certainly a fan of the other two large healthcare REITs and don't think investors can go wrong with either one, I like HCP's portfolio composition best.

HCP owns 833 properties and focuses on three core property types -- senior housing, medical office, and life science. And it doesn't have a particularly high concentration in any one of them. Senior housing makes up 34% of the portfolio, medical offices account for 27%, and life science properties make up 25%. The remainder is composed of hospital properties and other types of real estate investments. This diversification makes HCP the least vulnerable of the big three to the oversupply concerns in the senior housing market, while still positioning the company to take advantage of the long-term growth potential.

Over the past couple of years, HCP has undergone quite a transformation. It spun off its skilled nursing assets into a new REIT (which ironically is in the process of being acquired by Welltower), reduced its concentration in its largest tenant, Brookdale Senior Living, from 34% of portfolio income to 16% pro forma, reduced its debt load, and made a few other strategic changes. Now, HCP is a solid private-pay oriented REIT with a strong balance sheet and a well-rounded portfolio.

Why did HCP choose its three areas of concentration? Life science investment has really ramped up in recent years and is showing no signs of slowing down. With rising life expectancies increasing the number of U.S. adults who live with chronic conditions, there's a growing need for medical research and development. To illustrate this, HCP currently has 1.3 million square feet in life science developments in progress and another 972,000 square feet in the planning stages.

Furthermore, medical offices benefit from favorable demographic trends and also have lots of room for REIT consolidation, as I mentioned earlier. And HCP has the key advantage of strong relationships with leading health systems such as HCA, the largest for-profit hospital operator. And just like the other big healthcare REITs, HCP sees senior housing as an amazing long-tailed growth opportunity.

A different approach to healthcare real estate

I've mentioned that medical offices benefit from the same demographic tailwinds as senior housing, but without the oversupply problems and with significantly less regulatory concern.

Physicians Realty Trust is an almost pure play on medical offices, with 265 properties in its portfolio, the vast majority of which (93%) are medical office properties. The majority of the company's properties are leased to health systems on a triple-net basis, which generally translates to stable and predictable income.

Although it is relatively young (IPO in 2013), Physicians Realty Trust has grown impressively, with about $4 billion in gross real estate investments to date.

Physicians Realty Trust's current strategy involves strategically disposing of noncore assets and recycling that capital in ways that maximize shareholder value. For example, the company is recognizing the value in off-campus healthcare properties, demand for which is growing due to their convenience and efficiency, but which command significantly lower prices than on-campus healthcare properties.

The company's portfolio is well-diversified both geographically and in terms of tenant concentration, with the top 10 tenants making up just over one-fourth of the total rental income. More than half of the tenants have investment-grade credit, and the company's portfolio occupancy is significantly higher than its peer group average.

Can that yield possibly be safe?

Investors often look at Senior Housing Properties Trust with a cautious eye, as its nearly 9% dividend yield may sound too good to be true. And to be clear, you should be skeptical of a dividend yield like this.

However, in this case, the high payout makes a lot of sense and appears to be sustainable. For starters, it represents a payout ratio of just 86% of the company's FFO from the last 12 months, a completely reasonable payout for a REIT. And with 97% of its properties' revenue coming from private-pay sources, Senior Housing Properties Trust has the highest concentration of any company discussed here.

Despite the company's name, senior housing makes up just over half (52%) of the portfolio. About 42% is composed of medical office and life science properties, with smaller investments in skilled nursing facilities and wellness centers. In fact, although the senior housing concentration is a bit higher, the company's portfolio strategy isn't that different from HCP's.

To be thorough, when you're looking at a REIT with a higher dividend yield from a portfolio of assets similar to other, lower-paying companies, it generally indicates that the REIT is taking on a bit more risk, and that definitely seems to be the case here. Senior Housing Property Trust's credit ratings of BBB-/Baa3, while still investment-grade, are lower than those of the other REITs discussed. In other words, Senior Housing Property Trust has a significantly higher -- yet still small -- chance of defaulting on its debt obligations.

And the company's largest senior housing tenant (by far), Five Star Senior Living, doesn't exactly have impressive rent coverage, with operating cash flow of just 115% of the rent due. For comparison, the 18 Brookdale-leased properties have rent coverage of 2.3 times, double that of Five Star, which leases 185 of Senior Housing Properties Trust's 305 communities.

The bottom line is that Senior Housing Property Trust's high dividend is certainly sustainable for the time being, but there are some additional risk factors that you take on in exchange for such a high payout.

More From The Motley Fool

Matthew Frankel, CFP® owns shares of HCP. The Motley Fool recommends HCA Healthcare. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance