5 Tech Stocks to Buy as Nasdaq Outperforms Dow Jones & S&P 500

The rally in Nasdaq Composite has continued, with the index closing up 0.29% on Tuesday, marking the seventh straight positive in last eight trading days. Additionally, the tech-laden Nasdaq crossed the 10,000 mark for the first time ever.

The index also outperformed the Dow Jones and the S&P 500, which closed down 1.09% and 0.78% yesterday, respectively. Year to date, Nasdaq has gained 10.9%, while the Dow Jones and the S&P 500 indices are down 4.44% and 0.73%, respectively.

The U.S. stock market has been in a recovery mode for the past two months, after crashing in March due to the pessimism surrounding the coronavirus crisis. However, it is the technology sector which has played a crucial role in Nasdaq’s faster recovery compared with the Dow Jones and the S&P 500.

Tech stocks constitute more than 50% of weightage in the Nasdaq Composite index. The Technology Select Sector SPDR XLK, the most important component of the broad market index, has a positive year-to-date return of 11.7%.

What’s Driving the Tech Stocks Rally?

The coronavirus outbreak has, surprisingly, opened up newer avenues of growth for tech companies. The pandemic-led global lockdown is fueling demand for PCs, notebooks and peripheral accessories, as more and more workers and students are now working and learning from home.

The work-and-learn-from-home necessity is also stoking demand for cloud storage. Furthermore, the lockdown has bolstered the usage of online and e-commerce services globally. Therefore, data-center operators are enhancing their capacities to accommodate the demand spike for cloud services.

Furthermore, the long-term growth prospects of tech companies look promising owing to the continuous digital transformations. Rapid adoption of cloud computing, along with the ongoing integration of AI and machine learning, has been a major growth driver.

The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to spur further growth. Moreover, blockchain, IoT, autonomous vehicles, AR/VR and wearables offer significant growth opportunities.

Investment in Tech Stocks Holds Promise

Considering the healthy growth prospects of tech companies, investing in this space for long-term gains holds promise. Amid this economic and financial instability, it is a prudent idea to pick solid growth companies as these are financially stable, reaping profits in established markets. These stocks, with their healthy fundamentals, help investors hedge their investments from any economic downturns.

Furthermore, the technology sector is likely to benefit the most from the reopening of the U.S. and global economies after two-three months of partial or full lockdowns that were imposed to prevent the spread of coronavirus.

Here we have zeroed in on five Nasdaq-traded tech stocks that are well poised to benefit from this space’s solid growth prospects.

These stocks also have favorable combinations of a Growth Score of A or B, and a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per the Zacks’ proprietary methodology, stocks with such favorable combinations offer solid investment opportunities.

Our Picks

Zoom Video Communications ZM is undoubtedly one of the biggest gainers of the coronavirus-induced remote working trend. Demand for this Zacks Rank #1 company’s cloud-native unified communications platform is anticipated to remain solid owing to extended work-from-home suggestions from companies. As schools remain closed, the online learning wave will also continue, much to the benefit of Zoom Video.

The stock has a Growth Score of B. The Zacks Consensus Estimate for fiscal 2021 earnings is pegged at $1.18 per share, suggesting more than 237% year-over-year growth.

Zoom Video Communications, Inc. Price and Consensus

Zoom Video Communications, Inc. price-consensus-chart | Zoom Video Communications, Inc. Quote

Chegg CHGG operates a direct-to-student learning platform. The company has been benefiting significantly from the coronavirus-induced online-learning wave. As schools and colleges are likely to remain shut for a prolonged time, the momentum is likely to continue for this Zacks #1 Ranked stock that has a Growth Score of A.

Chegg’s earnings are likely to jump 33% year on year to $1.21 per share in 2020.

Chegg, Inc. Price and Consensus

Chegg, Inc. price-consensus-chart | Chegg, Inc. Quote

Dropbox DBX is benefiting from the shift in demand trend owing to the coronavirus pandemic. The company offers a platform that enables users to store and share files, photos, videos, songs and spreadsheets.

Due to the global lockdown situation, workers now need to work from home, which is stoking demand for cloud storage. Moreover, the company is gaining from the evolving workspace demands for seamless enterprise communication tools. Further, integration with leading applications like Zoom Video, Slack and Atlassian will likely expand the Dropbox paying-user base over the long run.

Dropbox currently sports a Zacks Rank #1 and has a Growth Score of B. The company’s earnings are expected to jump 48% year over year to 74 cents per share in the ongoing year.

Dropbox, Inc. Price and Consensus

Dropbox, Inc. price-consensus-chart | Dropbox, Inc. Quote

Apple AAPL, undoubtedly, makes to our list due to its robust fundamentals. We consider that with its sustained focus on innovation and expanding the product portfolio, this tech giant is poised to thrive in the remote-work world.

Additionally, this Zacks #2 Rank company is well placed to benefit from the upcoming 5G upgrade cycle. The iPhone-maker will likely launch its first 5G-supported device later this year. Also, continued momentum in the Services segment, backed by stellar App Store sales and robust acceptance of Apple Music and Apple Pay, is anticipated to drive the company’s growth this year.

The stock has a Growth Score of B and the Zacks Consensus Estimate for fiscal 2020 earnings of $12.30 suggests year-over-year growth of 3.5%.

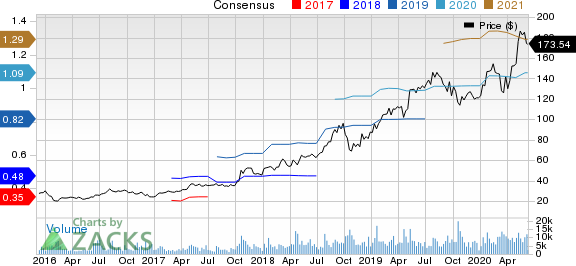

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

Atlassian Corporation Plc TEAM, which carries a Zacks Rank #2 at present, is poised to grow on the massive digitalization of work in organizations, big or small. Apart from this, integration with leading applications like Slack, Dropbox, and Adobe, along with partnerships with the likes of Amazon’s AWS and Microsoft, will likely expand the Atlassian paying user base.

The stock has a Growth Score of A and its earnings are likely to grow 26.7% in fiscal 2020.

Atlassian Corporation PLC Price and Consensus

Atlassian Corporation PLC price-consensus-chart | Atlassian Corporation PLC Quote

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

Chegg, Inc. (CHGG) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance