5 Stocks to Watch on Dividend Hikes Amid Economic Turmoil

Wall Street is going through a torrid time due to various economic concerns. Major events to look out for are the Federal Reserve’s decision over short-term interest rates and the consumer price index data for the month of May. Meanwhile, the S&P 500 and the Nasdaq have posted positive returns of 8.9% and 23.6%, respectively, and the Dow has reported a negative return of 0.7% so far this year.

The question remains whether the Fed will adopt a dovish stance and stop its aggressive interest rate hikes. After 10 hikes, currently, the interest rate is in the range of 5.00-5.25%. The unemployment rate is the lowest in a decade at 3.4%, and inflation recorded for the month of April was 4.9% year over year. In its upcoming policy meeting between Jun 13-14, it will be necessary for the Fed to strike the right balance between a higher interest rate and inflation to make a soft landing for the economy.

However, strength in the labor market raised concerns that the Fed may continue to hike rates — something that doesn’t bode well for the economy and, in turn, the stock market. Inflation is currently following a downtrend as the full impact of the Fed's aggressive rate hikes is still making its way through the economy. However, the degree of interest rate tightening due to the sudden failures of Silicon Valley Bank, Signature Bank, and First Republic Bank is difficult to gauge.

Challenges continue in the other part of the world as well. China which is considered a global manufacturing hub shows shrinking economic activity. Official data for the month of May suggest that factory activity shrank at its fastest rate in five months, and service sector activity has expanded at the slowest pace in four months.

Thus, investors looking for regular income and capital preservation can invest in mature businesses, which pay out regular dividends. Amid adverse economic conditions, these stocks remain profitable due to their proven business models. Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks during market volatility. Investors can expect a regular flow of income in volatile market conditions.

On that note, let us look at companies like Lowe's Companies LOW, NetEase NTES, Canadian Imperial Bank of Commerce CM, Hamilton Lane HLNE and IDEX (IEX) which have lately hiked their dividend payouts.

Lowe's Companies is a home improvement retailer. This Zacks Rank #3 (Hold) company has evolved as one of the world’s leading home improvement retailers, offering services to homeowners, renters and commercial business customers. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

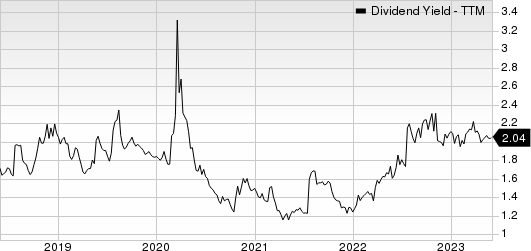

On May 26, LOW declared that its shareholders would receive a dividend of $1.10 a share on Aug 9, 2023. LOW has a dividend yield of 2.09%.

Over the past five years, LOW has increased its dividend six times, and its payout ratio presently sits at 30% of earnings. Check Lowe’s Companies dividend history here.

Lowe's Companies, Inc. Dividend Yield (TTM)

Lowe's Companies, Inc. dividend-yield-ttm | Lowe's Companies, Inc. Quote

NetEase is an Internet technology company. This Zacks Rank #3 company is engaged in the development of applications, services, and other technologies for the Internet in China.

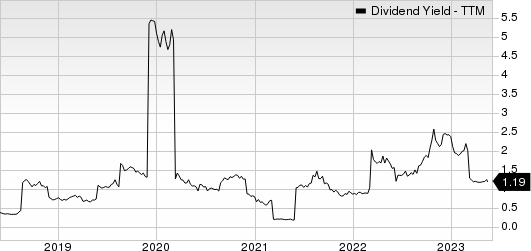

On May 25, NTES announced that its shareholders would receive a dividend of 46 cents a share on Jun 26, 2023. NTES has a dividend yield of 1.26%.

Over the past five years, NTES has increased its dividend 12 times. Its payout ratio now sits at 22% of earnings. Check NetEase’s dividend history here.

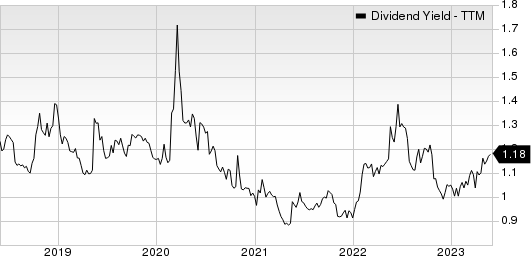

NetEase, Inc. Dividend Yield (TTM)

NetEase, Inc. dividend-yield-ttm | NetEase, Inc. Quote

Canadian Imperial Bank of Commerce is a leading North American financial institution. This Zacks Rank #3 company offers a full range of products and services through its comprehensive electronic banking network, branches, and offices across Canada, in the United States and around the world.

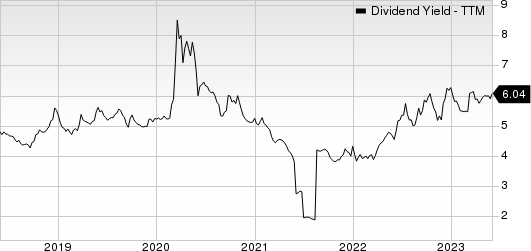

On May 25, CM declared that its shareholders would receive a dividend of 64 cents a share on Jul 28, 2023. CM has a dividend yield of 6.05%.

In the past five-year period, CM has increased its dividend 15 times. Its payout ratio at present sits at 48% of earnings. Check Canadian Imperial Bank of Commerce’s dividend history here.

Canadian Imperial Bank of Commerce Dividend Yield (TTM)

Canadian Imperial Bank of Commerce dividend-yield-ttm | Canadian Imperial Bank of Commerce Quote

Hamilton Lane is an investment management firm. This Zacks Rank #3 company provides private market solutions and operates primarily in the United States, Europe, Asia, Latin America, and the Middle East.

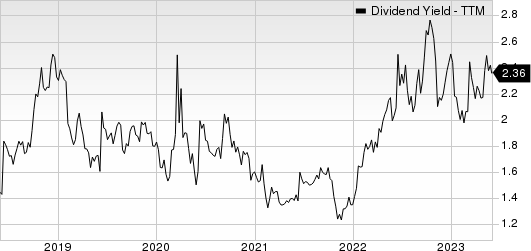

On May 25, HLNE declared that its shareholders would receive a dividend of 45 cents a share on Jul 7, 2023. HLNE has a dividend yield of 2.36%.

In the past five years, Zacks Rank #3 HLNE has increased its dividend six times. Its payout ratio at present sits at 48% of earnings. Check Hamilton Lane’s dividend history here.

Hamilton Lane Inc. Dividend Yield (TTM)

Hamilton Lane Inc. dividend-yield-ttm | Hamilton Lane Inc. Quote

IDEX is an applied solutions company. This Zacks Rank #3 company specializes in a diverse range of applications such as fluid and metering technologies; health and science technologies; and fire, safety, and other products built to customer specifications.

On May 25, IEX declared that its shareholders would receive a dividend of 64 cents a share on Jun 23, 2023. IEX has a dividend yield of 1.21%.

In the past five years, Zacks Rank #3 IEX has increased its dividend four times. Its payout ratio at present sits at 29% of earnings. Check IDEX’s dividend history here.

IDEX Corporation Dividend Yield (TTM)

IDEX Corporation dividend-yield-ttm | IDEX Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM) : Free Stock Analysis Report

Hamilton Lane Inc. (HLNE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance