5 Stocks With Recent Dividend Hike for a Stable Portfolio

Wall Street has been rangebound in the past month as market participants have remained indecisive regarding U.S. economic growth and the interest rate trajectory. In its recently concluded May FOMC meeting, the Fed raised the benchmark interest rate by 25 basis points to the range of 5-5.25%, marking the highest Fed Fund rate since August 2007.

In first-quarter 2023, U.S. GDP growth rate came in at a moderate 1.1% compared with the consensus estimate of 2% and the fourth-quarter 2022 growth rate of 2.6%. Moreover, the Conference Board’s Leading Economic Index, a gauge of future economic activity, dropped to 108.4 in March from February’s revised reading of 109.7, its 12th successive monthly drop and the lowest reading since November 2020.

A precipitous contraction in ISM manufacturing and services activities, a decline in orders of durable goods, a reduction in construction activities, and a freight slowdown are all signaling a recession later this year. The Fed Chair also acknowledged that the current banking turmoil in the United States has led to tighter credit conditions, and may impact economic activities.

The University of Michigan reported that U.S. consumer sentiment fell to a six-month low in its preliminary reading for May. The metric fell from April’s final reading of 63.5 to 57.7, marking its lowest since November 2022.

Stocks in Focus

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe that one should consider stocks that have recently raised their dividend payments. Five such companies are - Credicorp Ltd. BAP, Apollo Global Management Inc. APO, National Bank Holdings Corp. NBHC, Houlihan Lokey Inc. HLI and Tetra Tech Inc. TTEK.

Credicorp provides various financial, insurance, and health services and products primarily in Peru and internationally. BAP’s principal objective is to coordinate and manage the business plans of its subsidiaries to implement universal banking services in Peru, while diversifying regionally. Credicorp currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

On May 8, 2023, Credicorp declared that its shareholders would receive a dividend of $6.7385 per share on Jun 9, 2023. It has a dividend yield of 2.7%. Over the past five years, BAP has increased its dividend four times, and its payout ratio presently stays at 26% of earnings. Check BAP’s dividend history here.

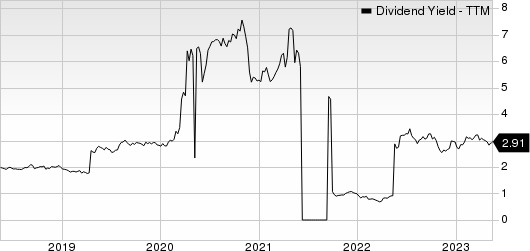

Credicorp Ltd. Dividend Yield (TTM)

Credicorp Ltd. dividend-yield-ttm | Credicorp Ltd. Quote

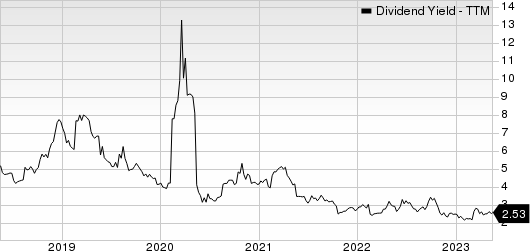

Apollo Global is a private equity firm specializing in investments in credit, private equity and real estate markets. APO’s private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions. APO currently carries a Zacks Rank #3 (Hold).

On May 9, 2023, Apollo Global declared that its shareholders would receive a dividend of $0.43 per share on May 31, 2023. It has a dividend yield of 2.8%. Over the past five years, APO has increased its dividend 10 times, and its payout ratio presently stays at 33% of earnings. Check APO’s dividend history here.

Apollo Global Management Inc. Dividend Yield (TTM)

Apollo Global Management Inc. dividend-yield-ttm | Apollo Global Management Inc. Quote

National Bank is a bank holding company operating full-service banking centers, with the majority of those banking centers located in Colorado and the greater Kansas City region. NBHC, through its subsidiaries, provides services through community banking franchises serving the needs of retail and business customers. NBHC currently carries a Zacks Rank #3.

On May 9, 2023, National Bank declared that its shareholders would receive a dividend of $0.26 per share on Jun 15, 2023. It has a dividend yield of 3.5%. Over the past five years, NBHC has increased its dividend nine times, and its payout ratio presently stays at 29% of earnings. Check NBHC’s dividend history here.

National Bank Holdings Corporation Dividend Yield (TTM)

National Bank Holdings Corporation dividend-yield-ttm | National Bank Holdings Corporation Quote

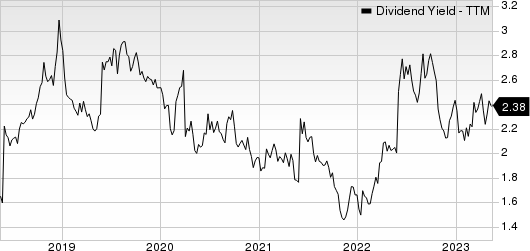

Houlihan Lokey is a global investment bank with expertise in mergers and acquisitions, capital markets, financial restructuring, and financial and valuation advisory. HLI serves corporations, institutions, and governments worldwide with offices in the United States, Europe, the Middle East, and the Asia-Pacific region. HLI currently carries a Zacks Rank #3.

On May 9, 2023, Houlihan Lokey declared that its shareholders would receive a dividend of $0.55 per share on Jun 15, 2023. It has a dividend yield of 2.4%. Over the past five years, HLI has increased its dividend six times, and its payout ratio presently stays at 47% of earnings. Check HLI’s dividend history here.

Houlihan Lokey, Inc. Dividend Yield (TTM)

Houlihan Lokey, Inc. dividend-yield-ttm | Houlihan Lokey, Inc. Quote

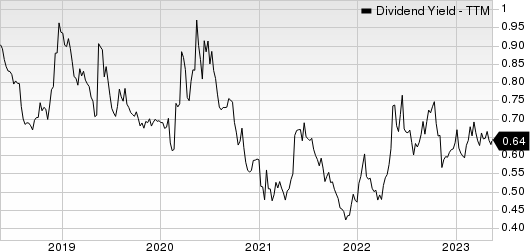

Tetra Tech is poised to benefit from a diversified business structure. TTEK’s focus on providing high-end consulting, design and engineering services is encouraging. TTEK’s Government Services Group segment is benefitting from growth in water and environmental programs. A strong backlog level should also be beneficial. The company expects adjusted earnings of $4.90 - $5.05 per share for fiscal 2023. TTEK currently carries a Zacks Rank #3.

On May 10, 2023, Tetra Tech declared that its shareholders would receive a dividend of $0.26 per share on Jun 6, 2023. It has a dividend yield of 0.7%. Over the past five years, TTEK has increased its dividend six times, and its payout ratio presently stays at 19% of earnings. Check TTEK’s dividend history here.

Tetra Tech, Inc. Dividend Yield (TTM)

Tetra Tech, Inc. dividend-yield-ttm | Tetra Tech, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

Apollo Global Management Inc. (APO) : Free Stock Analysis Report

Credicorp Ltd. (BAP) : Free Stock Analysis Report

National Bank Holdings Corporation (NBHC) : Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance