5 Stocks to Buy as S&P 500 Reshuffles Technology Sector

It is difficult for any prudent investor to overlook technology stocks. Notably, the technology sector has fared impressively on a year-to-date basis. The Technology Select Sector SPDR ETF XLK has returned 16.3% so far this year compared with the Zacks categorized S&P 500’s gain of 9.2%.

The rapid adoption of cloud, Internet of Things (IoT), autonomous cars, advanced driver assisted systems (ADAS), gaming, wearables, drones, virtual reality/ augmented reality (VR/AR) devices, artificial intelligence (AI), cryptocurrencies and other emerging technologies are fueling huge growth for the sector.

However, when we are discussing the tech sector, we cannot undermine the special status enjoyed by a majority of FANG stocks namely, Facebook FB, Apple AAPL, Netflix NFLX and Google-parent Alphabet GOOGL.

In fact, First Trust Dow Jones Internet Index Fund FDN ETF, which allocates a combined 30% share in FANG stocks has returned 27.5% year to date. Further, ERSHARES Entrepreneur 30 ETF ENTR ETF with 24.3% allocation in FANG has returned 19.8% year to date.

Major Restructuring in the S&P 500 Classification

We need to change our habits of quoting Facebook and Google-parent Alphabet as tech stocks soon because of the major reshuffle of S&P 500 companies due Sep 24. While Amazon and Netflix remain under “consumer discretionary”, Facebook and Alphabet are set to leave the S&P 500 categorized “Information Technology” (IT) sector.

Per the new guidelines of Global Industry Classification Standard (GICS), the weight of technology sector in S&P 500 will be downgraded from 25% to 20%.

As part of the realignment, “Telecommunications” will be dissolved into the new “Communications Services” to include Facebook, Alphabet, Twitter, Paypal and gaming companies such as, Electronic Arts and Activision Blizzard. The media companies including The Walt Disney Company and Comcast will also come under the newly devised sector’s umbrella.

Are Better Prospects in Store for Tech Stocks Post Reshuffle?

Factors like volatility with respect to higher weight of the tech sector in S&P 500 have persisted to be major concerns.

Facebook seems to be struggling following the Cambridge Analytica blow. A glimpse of the company’s price trend shows that the stock hasn’t been able to deliver an impressive run on the bourse year to date.

In fact, shares of the company have shed 7.9% of value on a year-to-date basis. The stock has a Zacks Rank #4 (Sell).

Meanwhile, Alphabet’s top line is benefiting from robust mobile growth, strong network advertising revenues, cloud, hardware and Play revenues. The company's focus on innovation, AI, cloud, home automation space, strategic acquisitions and Android OS should continue to aid its top line.

The stock has rallied 12.4% year to date and carries a Zacks Rank #3 (Hold).

Although two dominating entities like Facebook and Alphabet are leaving the S&P categorized IT sector, there is still no reason to worry about displeasing the tech fraternity.

Apple to Maintain Luster in the S&P Tech Sector

Apple will continue to be integral to the S&P categorized tech sector post the reshuffling. The company is gaining from robust iPhone sales, driven by higher average selling price (ASP) and a loyal customer base. Moreover, sturdy demand for wearables is expected to aid results.

Shares of Apple have surged 33.4% on a year-to-date basis. The stock carries a Zacks Rank #2 (Buy). Notably, it was the first stock to ace the $1-trillion market capitalization and continues to be an investor favorite.

Although Apple is expected to be at the forefront of tech’s in the near term, there are few other stocks in the S&P 500 that are well-poised to hog the limelight post the reshuffling. These stocks are worth buying given their solid fundamentals and compelling prospects.

Moreover, all of them either sport a Zacks Rank #1 (Strong Buy) or a Rank #2 (Buy).

5 Stocks Poised to Hog the Limelight

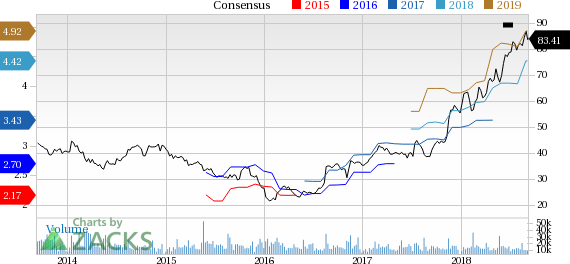

NetApp NTAP is benefiting from strong product adoption, increasing deal wins and expanding customer base across varied geographies. Moreover, the company’s transition into data fabric strategy is spurring business opportunities.

NetApp, Inc. Price and Consensus

NetApp, Inc. Price and Consensus | NetApp, Inc. Quote

The stock has soared 52.6% on a year-to-date basis and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

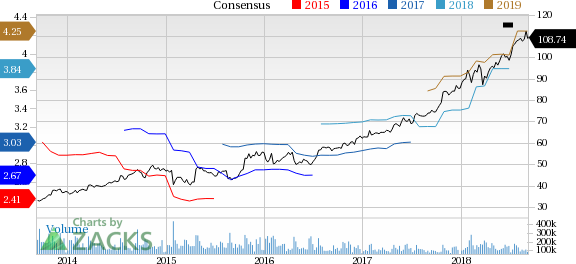

Salesforce.com’s CRM diverse cloud offerings and a strong spending on digital marketing remain key growth catalysts. Management is extremely optimistic about its enhancement of customer experience that has aided growth of the cloud segment. Additionally, strategic acquisitions and the resultant synergies are anticipated to prove conducive to growth over the long run.

Salesforce.com Inc Price and Consensus

Salesforce.com Inc Price and Consensus | Salesforce.com Inc Quote

The stock has jumped 45.6% on a year-to-date basis and carries a Zacks Rank of 1.

Garmin GRMN is riding on a solid performance in its fitness, marine, outdoor and aviation segments. The company's strategy involves a constantly evolving product line supported by a platform that increases engagement with its products and focuses on building a community of users. A solid portfolio across segments and acquisition synergies are other positives.

Garmin Ltd. Price and Consensus

Garmin Ltd. Price and Consensus | Garmin Ltd. Quote

The stock has returned 17.9% on a year-to-date basis and carries a Zacks Rank of 1.

Microsoft MSFT is expected to garner more popularity after the reorganization. The company has a dominant position in the desktop PC market. Increasing use of its different applications like Office 365 commercial, Dynamics, Outlook mobile and Teams are positives for the company. Moreover, Azure’s expanding customer base is a key growth catalyst.

Microsoft Corporation Price and Consensus

Microsoft Corporation Price and Consensus | Microsoft Corporation Quote

The stock has gained 28.8% on a year-to-date basis and carries a Zacks Rank of 2.

VeriSign VRSN continues to benefit from increased domain name registrations and renewal rates. The renewal of the .com contract and price hikes for the .com and .net domain names will also consistently drive VeriSign’s revenue base.

VeriSign, Inc. Price and Consensus

VeriSign, Inc. Price and Consensus | VeriSign, Inc. Quote

The stock has returned 38.2% on a year-to-date basis and is a Zacks #2 Ranked player.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Salesforce.com Inc (CRM) : Free Stock Analysis Report

ENTRPNR-30 FD (ENTR): ETF Research Reports

Garmin Ltd. (GRMN) : Free Stock Analysis Report

FT-DJ INTRNT IX (FDN): ETF Research Reports

SPDR-TECH SELS (XLK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance