5 Restaurant Stocks to Add to Your Portfolio on Strong Sales

The U.S. restaurant industry witnessed an impressive turnaround in 2022 after two pandemic-ridden years. This industry suffered major jolts during the coronavirus outbreak due to lockdowns and other restrictive norms to maintain social distancing. As we are out of pandemic-era restrictions, restaurant businesses are set to thrive in 2023.

At this stage, investment in restaurant stocks with a favorable Zacks Rank should be prudent. Five such stocks are — Dine Brands Global Inc. DIN, Darden Restaurants Inc. DRI, Arcos Dorados Holdings Inc. ARCO, Dave & Buster's Entertainment Inc. PLAY and Brinker International Inc. EAT.

Strong Restaurant Sales in January

The Department of Commerce reported that retail sales unexpectedly jumped 3% in January after declining 1.1% in December. The consensus estimate was an increase of 1.7%. Within retail sales, the major gains came from food services and drinking places, which rose 7.2% in January. This solid performance is more commendable in light of the fact that the consumer price index – a key inflation gauge – rose 0.5% in January compared with 0.1% in December.

The restaurant industry is gradually witnessing improving sales. The improvement can be attributed to the enhancement in fundamentals such as modifications in business processes, staffing, floor plans and technology.

Importantly, after the removal of pandemic-era restrictions, on-premises dining is gaining popularity. On Nov 30, 2022, the industry body, the National Restaurant Association (NRA) stated “Despite the booming popularity of off-premises restaurant meals and snacks in recent years, pent-up demand for in-restaurant experiences — socialization, celebration, and culinary exploration — is strong, with 70% of respondents noting customer desire to gather on-premises.”

Innovative Measures

Restaurant operators’ focus on digital innovation, their sales-building initiatives and cost- saving efforts have been acting as major catalysts. With the growing influence of the Internet, digital innovation has become the need of the hour. Big restaurant chains are constantly partnering with delivery channels and digital platforms to drive incremental sales.

The restaurant industry is consistently gaining from the spike in off-premise sales, which primarily include delivery, takeout, drive-thru, catering, meal kits and off-site options, such as kiosks and food trucks, owing to the coronavirus pandemic. Per the NRA, more than 60% of restaurant foods are consumed off-premise.

By 2025, off-premise is likely to account for approximately 80% of the industry's growth. The idea of providing off-premise offerings along with a connected curbside service is steadily garnering positive customer feedback.

Our Top Picks

We have narrowed our search to five restaurant stocks that have strong growth potential for 2023. These stocks have seen positive earnings estimate revision in the past 60 days. Each of our picks carries a Zacks Rank # 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

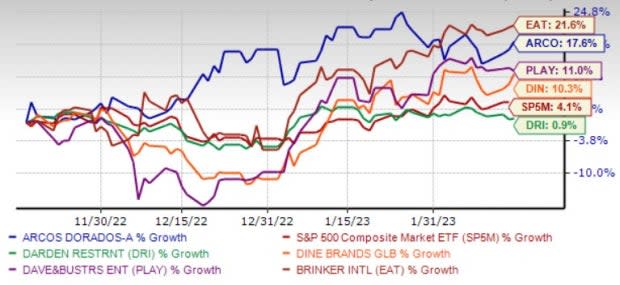

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Darden Restaurants is one of the largest casual dining restaurant operators worldwide. DRI is gaining from business-model enhancements and menu simplifications. This and a focus on technological enhancements in online ordering, the introduction of To Go capacity management and Curbside I'm Here notification bode well.

Darden Restaurants’ acquisition of the small restaurant chain, Cheddar's Scratch Kitchen (Cheddar's), in April 2017 added an undisputed casual dining value to the company’s portfolio of differentiated brands. It also helped DRI to further enhance its scale.

Darden Restaurants has an expected earnings growth rates of 5.4% for the current year (ending May 2023). The Zacks Consensus Estimate for current-year earnings has improved 10.4% over the past 60 days.

Dine Brands is a full-service dining company. DIN operates and franchises restaurants under both Applebee's Neighborhood Grill & Bar and IHOP brands. DIN’s Applebee's restaurants offer casual food, drinks, casual dining, and table services and IHOP restaurants provide full table services, and food and beverage.

Dine Brands has an expected earnings growth rates of 15.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the past 30 days.

Arcos Dorados operates as a franchisee of McDonald's with its operations divided in Brazil, North Latin America division, South Latin America and the Caribbean division. ARCO also runs quick-service restaurants in Latin America and the Caribbean.

Arcos Dorados has operations in territories in Latin America and the Caribbean, including Argentina, Aruba, Brazil, Chile, Colombia, Costa Rica, Curaçao, Ecuador, French Guiana, Guadeloupe, Martinique, Mexico, Panama, Peru, Puerto Rico, Uruguay, the U.S. Virgin Islands of St. Croix and St. Thomas, and Venezuela.

Arcos Dorados has an expected earnings growth rate of 4.2% for the current year. The Zacks Consensus Estimate for the current year has improved 7% over the past 30 days.

Dave & Buster's Entertainment is a leading owner and operator of high-volume venues in North America that combine dining and entertainment for both adults and families. PLAY has been benefitting from a higher mix of amusements and a leaner operating model.

PLAY expects the momentum to continue on the back of its strategic initiatives that include a new menu, optimized marketing and technology investments. Also, the expansion of entertainment options bodes well.

Dave & Buster's Entertainment has an expected earnings growth rate of 29.5% for the current year (ending January 2024). The Zacks Consensus Estimate for the current year has improved 0.1% over the past 30 days.

Brinker International primarily owns, operates, develops and franchises various restaurants under Chili’s Grill & Bar (Chili’s) and Maggiano’s Little Italy (Maggiano’s) brands. EAT believes that more focus on sales channel expansion and brand-building awareness is likely to drive growth in the upcoming periods.

EAT remains steadfast in its goal to drive traffic and revenues through a range of sales-building initiatives, including streamlining menu innovation, strengthening its value proposition, better food presentation, advertising campaigns and kitchen system optimization.

Brinker International has an expected earnings growth rate of 37.6% for next year (ending June 2024). The Zacks Consensus Estimate for the current year has improved 5.1% over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DINE BRANDS GLOBAL, INC. (DIN) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance