5 Insurers Set to Surpass Expectations This Earnings Season

Per the latest Earnings Preview, the Finance sector’s fourth-quarter earnings are expected to grow 8.1% while revenues are estimated to improve 3.2%. Insurance, one of the Finance sector industries, is likely to have benefited from improved pricing, exposure growth, prudent underwriting, product redesigning, and accelerated digitalization. Easy year-over-year comparisons are likely to have added to the upside. However, a still low-rate environment is likely to have weighed on the upside.

With the help of the Zacks Stock Screener, we have identified five insurers namely, Everest Re Group RE, American Equity Investment Life Insurance Company AEL, American International Group AIG, Aflac Incorporated AFL and Marsh and McLennan Company MMC poised to outshine the Zacks Consensus Estimate in fourth-quarter earnings. These stocks have the ideal combination of two ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy), #3 (Hold) — to surpass expectations. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Factors Likely to Impact Q4 Results

Insurers continued to witness improved pricing in the fourth quarter of 2021. An active catastrophe environment accelerated the policy renewal rate and aided in better pricing in the fourth quarter. Per Willis Towers Watson’s 2021 Insurance Marketplace Realities report, except for one, 29 lines should witness a price rise. Reinsurance programs, favorable reserve development and solid capital level are expected to drive underwriting profitability.

A still near-zero interest rate environment is likely to have weighed on investment income, which is an important component of an insurer’s top line. Though a larger investment asset base is expected to have limited the downside, yield is likely to have suffered. Thus, insurers continued directing funds into alternative investments like private equity, hedge funds, and real estate, among others.

Life insurers have been redesigning products by moving away from guaranteed savings products toward protection products of unit-linked savings products to weather a low-rate environment. Also, life insurers continue to roll out investment products that provide bundled covers of guaranteed retirement income, life and healthcare to cater to customers preferring policies with “living” benefits more than those with death benefits. Increasing demand for protection products is likely to have driven sales.

Accelerated digitalization not only ensured smoothing functioning of the insurers but is also likely to have saved costs, thus aiding margins.

Banking on solid capital position, insurers pursued strategic mergers and acquisitions to sharpen their competitive edge, build on a niche, expand globally, and diversify their portfolio. These apart, insurers continued to boost shareholders values via hiked dividends, special dividends as well as share buybacks.

The insurance industry gained 7.6% in the fourth quarter compared with the Finance sector’s increase of 5.8% and the S&P 500 Index’s rise of 10.2% in the said time frame.

Potential Q4 Outperformers

Everest Re Group writes property and casualty, reinsurance and insurance in the United States, Bermuda and international markets. While new business growth, strong renewal retention and continued favorable rate increases are likely to have favored Insurance performance, partnership with core clients and Everest Re’s position as a preferred reinsurance platform is expected to aid Reinsurance results.

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $9.23, indicating an increase of 924.1% from the year-ago reported figure. RE has an Earnings ESP of +3.15% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Everest Re Group, Ltd. Price and EPS Surprise

Everest Re Group, Ltd. price-eps-surprise | Everest Re Group, Ltd. Quote

American Equity Investment Life Insurance Company is a leader in the development and sale of fixed index and fixed rate annuity products. Its solid portfolio of fixed index and fixed rate annuity products guaranteeing principal protection, expansion into middle market credit, real estate, infrastructure debt, and agricultural loans is likely to aid quarterly results.

The Zacks Consensus Estimate for American Equity Investment’s fourth-quarter earnings is pegged at $1.05, indicating an increase of 36.4% from the year-ago reported figure. AEL has an Earnings ESP of +4.56% and a Zacks Rank #3.

American Equity Investment Life Holding Company Price and EPS Surprise

American Equity Investment Life Holding Company price-eps-surprise | American Equity Investment Life Holding Company Quote

American International Group provides a wide range of property casualty insurance, life insurance, retirement solutions, and other financial services. Its well-performing Commercial and Personal lines businesses and cost control measures are likely to aid quarterly results.

The Zacks Consensus Estimate for American International Group’s fourth-quarter earnings is pegged at $1.17, implying an increase of 24.5% from the year-ago reported figure. AIG has an Earnings ESP of +4.88% and a Zacks Rank #3.

American International Group, Inc. Price and EPS Surprise

American International Group, Inc. price-eps-surprise | American International Group, Inc. Quote

Aflac Incorporated is a general business holding company and oversees the operations of its subsidiaries by providing management services and making capital available. Higher sales and expense saving initiatives are likely to favor Aflac’s quarterly results

The Zacks Consensus Estimate for Aflac’s fourth-quarter earnings is pegged at $1.25, indicating an upside of 16.8% from the year-ago reported figure. AFL has an Earnings ESP of +4.74% and a Zacks Rank #3.

Aflac Incorporated Price and EPS Surprise

Aflac Incorporated price-eps-surprise | Aflac Incorporated Quote

Marsh and McLennan Company is a globally leading insurance broker, providing risk and insurance services, risk consulting, and employee benefits consulting services. Marsh and McLennan’s quarterly results are likely to benefit from diverse product offerings, a wide geographic footprint, improved rate across the commercial property and casualty insurance marketplace and strong client retention.

The Zacks Consensus Estimate for Marsh and McLennan’s fourth-quarter earnings is pegged at $1.34, suggesting an increase of 12.6% from the year-ago reported figure. MMC has an Earnings ESP of +2.76% and a Zacks Rank #2.

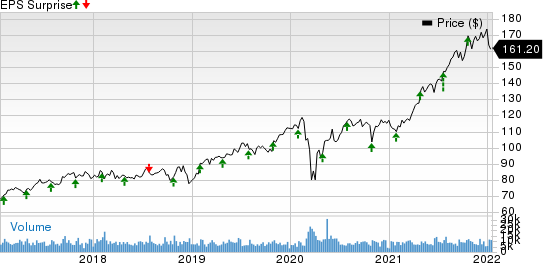

Marsh & McLennan Companies, Inc. Price and EPS Surprise

Marsh & McLennan Companies, Inc. price-eps-surprise | Marsh & McLennan Companies, Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance